Jack Bogle led an investing revolution when he introduced index funds.

He believed the average investor couldn’t beat the market over time. All he or she could hope to do was match the market’s performance as closely as possible.

While we laud the change he brought to financial markets…

…we believe he is dead wrong.

In fact, we can PROVE that the average investor can beat the market with a simple options strategy…

…a strategy Bryan Perry employs in his latest project, The Eight-Month Millionaire.

Options Two Ways

Options come in two flavors: puts and calls.

We have the choice of either buying or selling either type.

Today, we’re going to focus on selling put contracts.

Quite simply, when you sell a put contract, you give someone the right to sell shares to you at a given price until the expiration date.

You’re essentially acting like their insurance in case a stock goes lower.

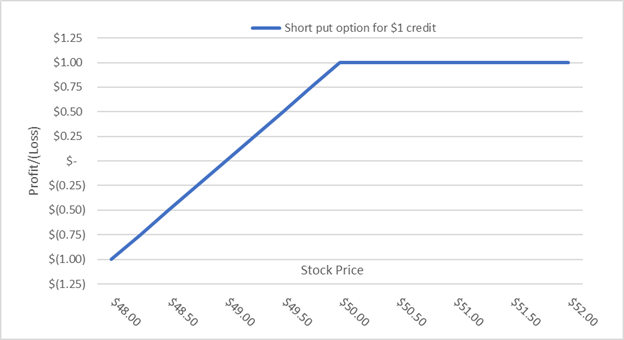

That’s why the payout diagram for selling a put option looks like this:

Why would anyone do this?

Because when you sell someone a put contract, you make them pay for that right.

The amount they pay is what’s known as the option’s premium (A.K.A. an option’s price).

You get to keep this NO MATTER WHAT — remember this because we’ll bring it up later.

An option’s premium is made up of two components: intrinsic and extrinsic value.

Intrinsic value is what you get if the option is immediately exercised in the open market.

Extrinsic value is the remainder of the option price that goes to zero at expiration.

Here’s an example.

- AAPL trades at $130.

- I sell someone a put option with a $135 strike price.

- That put option costs them $7.00.

Since the person could sell AAPL shares to me at $135, per the contract, they could buy shares of AAPL on the open market for $130, immediately turn around and sell them to me for $135, and gain $5.00.

That leaves the $7.00 – $5.00 = $2.00 as extrinsic value.

We’re going to focus on extrinsic value.

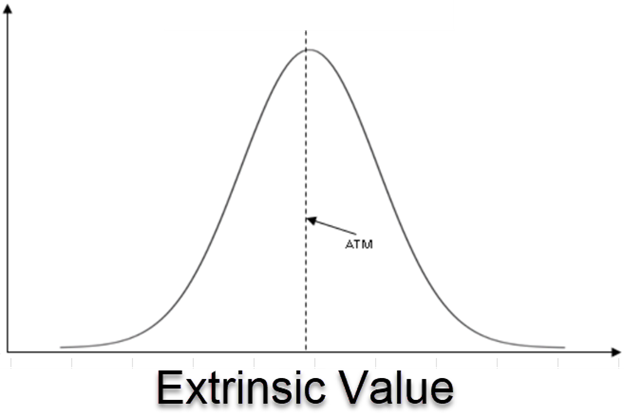

The extrinsic value of an option changes based on how far away the stock’s current price is from the strike price and forms a bell curve:

Here are the key points:

- When a put option’s strike price is below or equal to a stock’s current price, the option has no intrinsic value. It only has extrinsic value.

- Extrinsic value is at its highest when the stock’s current price equals the strike price.

While this may be a bit of rehashing for some of you, and maybe a bit wonky for others, it’s critical you understand the “why.”

Otherwise, it would be like teaching a driver that a car’s accelerator makes the car move forward without explaining that it does that by using gas. While you’d have fun for a while, you’d quickly find yourself on an empty tank stuck on the highway.

The Simple Options Strategy

Here’s where the rubber meets the road.

The Chicago Board of Exchange (CBOE) publishes an index called the ‘Put Write’ index.

Quite simply, this index measures the gains of selling an at-the-money put — where the price of the S&P 500 is equal to the strike price of the put.

Here’s how it works:

- Sell an at-the-money put each month.

- You set aside cash to cover the cost of that put (the cash is invested in T-bills)

- At expiration, you accept any losses or gains.

- You then repeat the process and sell a new at-the-money put.

Here’s an example:

- On Jan. 1, the S&P 500 trades at $4,400.

- I sell a put for $100 that expires on Jan. 31 with a $4,400 strike price.

Since you get to keep that option premium, as long as the S&P 500 doesn’t fall by more than the amount you sell the put for, you make money.

In the example, that means that as long as the S&P 500 stays above $4,400 – $100 = $4,300, you make money.

Anything below $4,300 and you incur losses.

Why might someone do this?

For starters, you’re setting aside money that you might otherwise use to purchase the same number of shares of the S&P 500, which is 100 shares per options contract.

Note: You can do this on the SPY ETF or the XSP Index, which are one-tenth the size of the S&P 500.

But more importantly, the odds of making money by selling options in general are statistically higher than buying them.

And as promised, the graph below shows the strategy itself does beat the S&P 500 over time:

Source: TradingView

The green line shows the percent return for this strategy, while the orange line is the S&P 500.

Now, we know what you’re thinking.

Yes, if you change when you start, this can change which outperforms the other. Nor does this assume reinvested dividends.

However, the PutWrite Index also has less volatility.

Taking It a Step Further

If you wanted to make things simple for yourself, there are exchange-traded funds (ETFs) and mutual funds that track the PutWrite Index.

But what should be abundantly clear is that even a strategy as simple as this can be remarkably powerful.

So, imagine what happens when you layer on the knowledge of a multi-decade options trader…

…who understands not only how to invest in stocks…

…but exploit inefficiencies in the options market.

At that point, you’re only limited by how active you want to be.

If this sounds like a path worth exploring, then we encourage you to CLICK HERE to explore Bryan Perry’s 8-month Millionaire Program.