Four business development companies to purchase in pursuit of potent profits also offer inroads to income.

The four business development companies to purchase span various industries to offer diversification to protect against economic weakness and sector slumps. With a recession considered a genuine possibility in 2024, investors may like the idea of aligning with business development company (DBC) cash cows.

In the Sept. 26 Cash Machine investment newsletter’s hotline, its leader Bryan Perry highlighted “hawkish communication” by the Fed that contributes to rising bond yields and many stocks slipping amid a market dip. The U.S. Treasury’s heavy issuance of federal debt and a “looming” partial government shutdown have been weighing on bond pricing, inducing reduced valuation in certain equities. As the third quarter comes to an end this week, fund managers are inclined to show cash on the books to give the impression they have reduced equity exposure and will avoid any sharp pullback in the stock averages, Perry added.

This Friday, the Personal Consumption Expenditures (PCE) index — the Fed’s preferred inflation indicator — will provide fresh data that includes the latest rise in oil and food prices. Investors have plenty to consider, in light of ongoing food and energy inflation headwinds, an expanding auto strike and “glaring diplomatic failures” in China and Iran, Perry added.

Four Business Development Companies to Purchase in Pursuit of 10%-Plus Yields

“The Cash Machine model portfolio is paying out a blended yield of 10.8%, two times that of the highest Treasury securities, and doesn’t factor in current and potential capital gains,” Perry recently wrote to his Cash Machine subscribers. “To this end, I’m confident our portfolio will deliver strong third-quarter results and set up well for a solid fourth-quarter performance.”

The economy is poised to see gross domestic product (GDP) grow at 5% or higher for the third quarter, Perry opined. If so, the Cash Machine portfolio is in a good place, Perry added.

Paul Dykewicz interviews Bryan Perry at a MoneyShow.

Four Business Development Companies to Purchase: OBDC

One of four BDC stocks that Perry especially likes is New York-based Blue Owl Capital Corporation (NYSE: OBDC), a global alternative asset manager. He recommended the stock last April and it already is up 16.47% in less than six months. OBDC also offers a current dividend yield of 9.48%.

Blue Owl Capital Corp. gained its name on July 6, when Owl Rock Capital Corp. (NYSE: ORCC) changed its name to and its stock ticker to OBDC. So, make note of this name and symbol change. This BDC is doing just about everything right, Perry commented.

Blue Owl Capital and Dallas-based Capital Southwest Co. (NASDAQ: CSWC) are BDCs that own senior secured floating rate loans. In this rising rate environment, those BDCs are akin to a “license to print money,” Perry wrote to his Cash Machine subscribers.

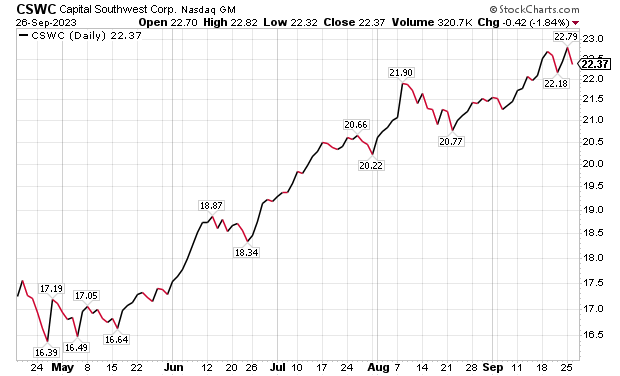

Four Business Development Companies to Purchase: CSWC

Capital Southwest Co. (CSWC) seems poised for further gains. Perry recommended the BDC on March 7 and is up 24.97% through Tuesday, Sept. 26. The company offers a forward dividend payout of $2.36 and a current yield of 10.44%.

“One sector of the economy that is enjoying some genuine prosperity is the business-to-business lending industry, where issuing floating rate loans well above historical averages is affording business development companies to pay out double-digit-percentage dividend yields,” Perry wrote.

Chart Courtesy of www.stockcharts.com

Four Business Development Companies to Purchase: Thriving Lender

Perry described CSWC as “thriving” in its financing niche. Capital Southwest became a recommendation in the Extreme Income Portfolio of Perry’s April 2023 issue of the Cash Machine investment newsletter. The BDC specializes in lead financing of $5 to $70 million that regularly has the company as an equity partner with an active network of co-investors.

Capital Southwest targets companies generating minimum earnings before interest taxes, depreciation and amortization (EBITDA) of $3 million, where the typical borrower has $3 to $20 million in EBITDA. Plus, 96% of its loans are first lien in structure, with total balance sheet assets standing at $1.2 billion as of the end of 2022.

The company will only make non-control investments. Its lending criteria is aimed at industrial manufacturing and services, value-added distribution, health care products and services, business services, specialty chemicals, tech-enabled services and software as a service (SaaS) models and food and beverage. Analysts are bullish on the company’s prospects for 2023 and 2024, Perry indicated.

Four Business Development Companies to Purchase: Special Meeting

Capital Southwest announced in August that it would hold a special meeting of its shareholders virtually on Oct. 11 about proposals of “utmost importance” that relate to a proposed amendment to the company’s charter to increase the number of authorized shares of common stock from 40,000,000 to 75,000,000. The additional authorized shares of common stock will allow the company to continue to grow its asset base by pursuing attractive investment opportunities consistent with its investment strategy. If the company cannot access the equity capital markets by issuing additional common shares, the capacity to grow its balance sheet could be adversely affected.

Capital Southwest has roughly $1.3 billion in investments at fair value, and the company is a middle market lending firm focused on supporting the acquisition and growth of businesses with $5 million to $35 million investments across the capital structure, including first lien, second lien and non-control equity co-investments. As a public company, Capital Southwest has the flexibility to be creative in its financing and to invest to support the growth of its portfolio companies over long periods of time, its management announced.

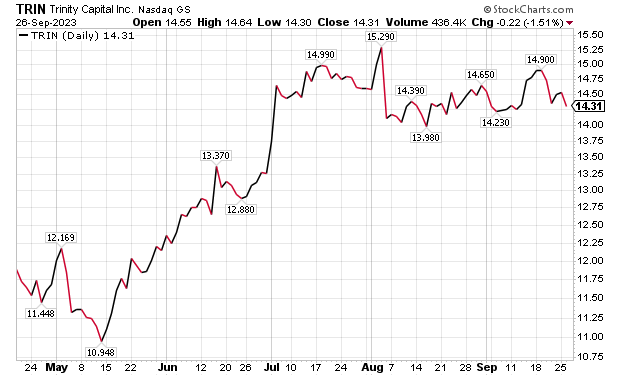

Four Business Development Companies to Purchase: Trinity Capital

Trinity Capital Inc. (NASDAQ: TRIN), a Phoenix, Arizona-based provider of diversified financial solutions for growth-stage companies, is up 1.99% since its recommendation on Aug. 9 and provides a current annual yield of 15.04%. Perry placed TRIN in Trinity Capital in his Extreme Income Portfolio after the company posted exceptional second-quarter results and conducted a $75 million secondary stock offering at $14.45 that was priced just above where the stock currently trades.

Trinity intends to use the net proceeds from the offering to pay down part of its existing debt outstanding under its KeyBank Credit Facility, to make investments in concert with its investment objective and investment strategy, and for general corporate purposes. UBS Investment Bank, Morgan Stanley, Keefe, Bruyette & Woods, a Stifel Company, RBC Capital Markets and Wells Fargo Securities served as joint-lead book-running managers for the offering. Compass Point, Ladenburg Thalmann and Oppenheimer & Co. acted as the offering’s co-managers.

Chart Courtesy of www.stockcharts.com

Four Business Development Companies to Purchase: Dividend Update

On Sept. 13, Trinity Capital announced its Board of Directors declared a cash dividend of $0.54 per share for the quarter ending September 30, 2023. The payout consists of a regular quarterly dividend of $0.49 per share and a supplemental cash dividend of $0.05 per share. The dividend marks a boost of 2.1% over the regular dividend declared in the prior quarter and is the 10th consecutive boost in payout.

The company’s performance also is gaining attention from Perry, who noted that Trinity Capital recorded second-quarter total investment income of $46 million, a 37.6% jump from the same period in 2022. That $0.61 per share beat estimates by $0.06. This increase was attributable to interest earned on the higher average loan balances in Trinity’s debt investment portfolio.

The effective yield on the portfolio for Q2 was 16.2%, compared to 15% in the first quarter. The core yield, which excludes non-recurring fee income, jumped to 14.8% from 14.3% in the prior quarter. The debt portfolio remains well positioned against recent interest rate heights with 72% of debt investments at floating rates.

The company’s objective is to distribute four quarterly dividends in an amount that approximates 90% to 100% of its taxable quarterly income or potential annual income for a particular year to qualify for tax treatment as a regulated investment company under the Internal Revenue Code of 1986. In addition, the company may pay additional supplemental dividends, so that it distributes approximately all its annual taxable income in the year it was earned, or it may spill over the excess taxable income into the coming year for future dividend payments.

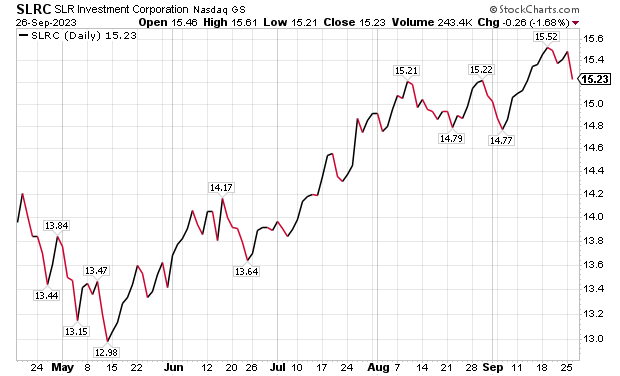

Four Business Development Companies to Purchase: SLRC

New York’s SLR Investment Corp. (NASDAQ: SLRC) is a yield-oriented BDC that invests directly and indirectly in senior secured loans of private middle market companies to generate current income that is distributed to shareholders monthly. SLRC collaborates with U.S. middle market businesses across a diversity of industries to deliver customized debt financing solutions.

On April 1, 2022, SLR Investment Corp. acquired its affiliate BDC, SLR Senior Investment Corp. The combined company trades under SLR Investment Corp.’s NASDAQ symbol, SLRC. The company’s forward dividend is $1.64, while its yield is 10.67%.

Income investors will like that SLRC declared a distribution of $0.136667 per share for the month of September 2023. The distribution is payable on Sept. 28, to stockholders of record as of Sept 20, so anyone who did not own the stock by then needs to wait for the next payout.

Four Business Development Companies to Purchase: Perry’s Perspective

In Perry’s analysis, BDCs have performed well against a rising rate environment, delivering double-digit-percentage yields and share price appreciation. For income investors, BDCs have been good places to position capital.

The BDC sector continues to see rising demand for quick and easy loans from small- to midsized privately owned businesses. The shakeout in the regional bank sector earlier this year spurred tighter lending standards at the banks, thereby diverting loan customers to the BDC market, Perry wrote. SLRC provides a diversified array of commercial finance solutions, encompassing cash flow-lending, asset-based lending and specialty finance investment strategies. Its main target is U.S. middle market businesses and intermediaries with debt financing solutions to fund working capital, acquisition, refinancing and growth capital requirements.

The fund’s investments generally range between $5 million and $100 million. SLRC invests in companies with revenues between $50 million and $1 billion and earnings before interest, taxes, depreciation and amortization (EBITDA) between $15 million and $100 million.

SLRC also invests by offering senior secured loans, mezzanine loans and equity securities. It may seek investments in thinly traded public companies and provide secondary investments. The fund further makes non-control equity investments, while primarily exiting within three years of the initial capital commitment.

Chart Courtesy of www.stockcharts.com

Four Business Development Companies to Purchase: Political Risk

The four business development companies to purchase feature recommendations from the Cash Machine investment newsletter. The picks by seasoned Wall Street Trader Bryan Perry could appeal to investors seeking income and capital appreciation, especially with rising political risk due to Russia’s invasion of Ukraine triggering a counteroffensive that lately has launched strikes against positions in the Crimea section of Ukraine that Russia has held since its assault and seizure of that land in 2014.

Paul Dykewicz, www.pauldykewicz.com, is an award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Crain Communications, Seeking Alpha, Guru Focus and other publications and websites. Paul can be followed on Twitter @PaulDykewicz, and is the editor and a columnist at StockInvestor.com and DividendInvestor.com. He also serves as editorial director of Eagle Financial Publications in Washington, D.C. In that role, he edits monthly investment newsletters, time-sensitive trading alerts, free weekly e-letters and other reports. Previously, Paul served as business editor and a columnist at Baltimore’s Daily Record newspaper and as a reporter at the Baltimore Business Journal. Plus, Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many other sports figures. To buy signed and specially dedicated copies, call 202-677-4457.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)