“And renouncing illusions, find peace and content,

In that simplest, sublimest of truths — six percent!”

—Nicholas Biddle (“Maxims of Wall Street,” p. 186)

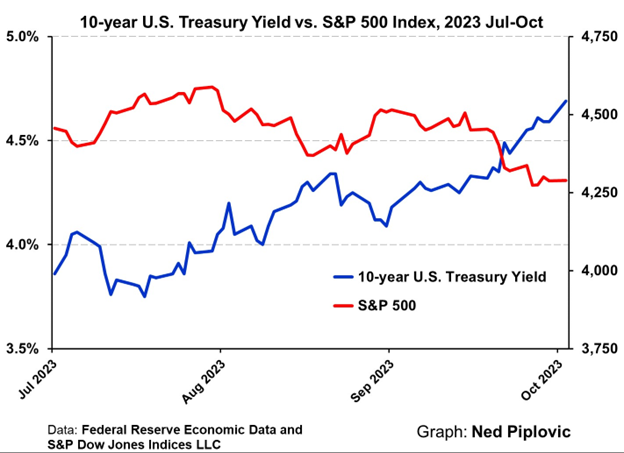

The first half of 2023 showed a strong recovery in the stock market, especially in technology.

But since July, it’s been a different story. Wall Street has struggled, and may even have entered a new bear market that might continue into the holiday season and 2024, an important election year.

Analysts blame higher energy prices, a strong dollar and persistently high inflation.

But the real culprit is the bond market and sharply rising bond yields, as this singular chart demonstrates.

Long-term bonds are now yielding 4-5% and may go higher, and 30-year mortgage rates are over 7%.

You can earn 4% on tax-free municipal bonds right now.

Or to be completely safe, you can buy three-month Treasury bills or a money market fund and earn over 5% risk-free.

All of these relatively low-risk investments are now competing with growth stocks that pay little or no dividends (such as tech stocks). And very few income stocks pay more than 5-6%. (Fortunately, we recommend several in Forecasts & Strategies.)

Washington is in Big Trouble

Moreover, higher interest rates eventually take their toll in business activity and consumer spending — and most importantly, the government budget, which is already out of control.

In fact, by 2030, 3.2% of the budget will be solely to pay the national debt, more than the cost of national defense!

The Federal Reserve, under Jay Powell, is determined to fight inflation to the death (or 2%, which ever comes first), which means a long slugfest that could come to an ugly conclusion in 2024 — an election year. Normally, this would be good news for the Republicans, but unfortunately, they have their own internal problems. See my “You Blew it” column below.

My strategy at Forecasts & Strategies is to stay invested in secure high-dividend-paying stocks that will weather the financial storm of high interest rates, and build a strong cash position to take advantage of bargains along the way.

Know the signs of the times!

The Man Who Changed my Life

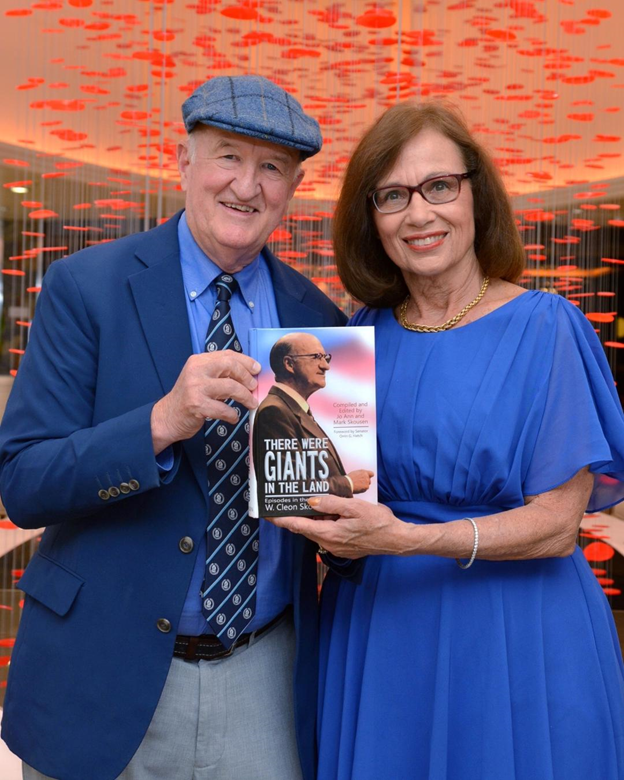

Last month, I announced publishing the inside story of my wise uncle, W. Cleon Skousen, in the new book “There Were Giants in the Land.”

Uncle Cleon (1913-2006) was a former FBI agent, chief of police of Salt Lake City, BYU professor of religion and author of over 25 books on communism, the Constitution and the Bible. He sold millions of copies, and gave over 10,000 speeches in his lifetime. He was like a father figure to me, since my own father passed away when I was only 16 years old.

The story is told in his own words, which my wife and I compiled over a three-year period, and includes many events that have never been published before, including the day FBI director J. Edgar Hoover shouted, “Where’s Skousen?” (p. 68) and Cleon’s encounter with “Gone with the Wind” actress Olivia de Havilland to try to convince her to break away from her Communist Party affiliation (pp. 85-87). For full details, go to Our New Book is Banned in Beijing! – Mark Skousen.

You can order a copy of the 540-page hardback (with plenty of photos) at www.skousenbooks.com.

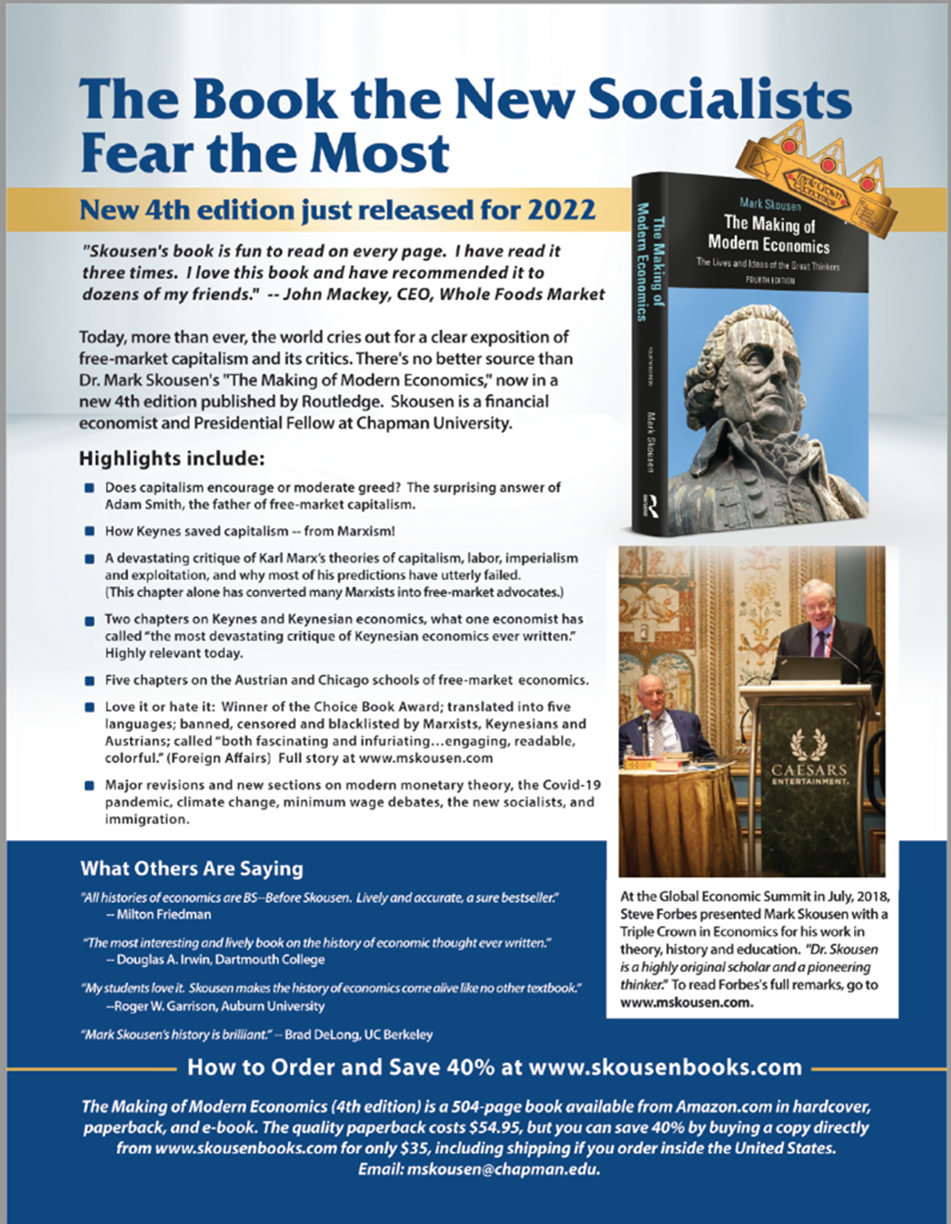

Telling the Story of the Great Economic Thinkers

Uncle Cleon made a huge difference in my writing the book “The Making of Modern Economics,” the history of the great economic thinkers, including Adam Smith, Karl Marx, John Maynard Keynes and Milton Friedman. Many of you have ordered copies, and know that it has received high praise from scholars and laymen alike.

But it could have been a disaster.

My first chapter was entitled “It All Started With Adam” (Adam Smith, that is, the father of economics who favored free trade and a “system of natural liberty.”)

As I started writing the book, I was still heavily under the influence of economist Murray Rothbard, who turned out to be highly critical of Adam Smith.

Rothbard held the unconventional view that Smith’s contributions were “dubious” at best, that “he originated nothing that was true, and that whatever he originated was wrong” and that “The Wealth of Nations” was “rife with vagueness, ambiguity and deep inner contradictions.”

At the time, my assessment of Adam Smith followed similar lines. I was critical of the founder of economics. However, I didn’t feel completely comfortable with this disagreeable chapter. Even so, I was on my way.

‘Inspired of God’

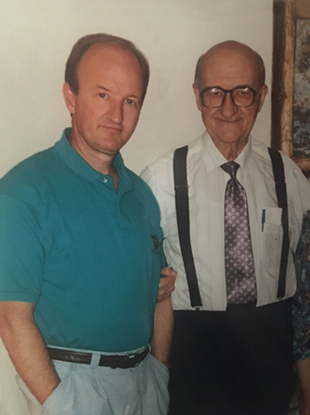

I printed out the chapter, and took it with me on a trip to Utah and Uncle Cleon to review it.

Uncle Cleon and me in the late 1980s.

I considered him as a wise old man I respected and as a towering figure in law, politics and religion.

When I handed him the first chapter, he did something that changed my life.

He put his hand on my shoulder, and, without looking at the pages, said with considerable feeling, “You know, Mark, the Adam Smith doctrine of the invisible hand is inspired of God.”

Those three words “inspired of God” shocked me. I thought to myself, “If my uncle is right, I may need to rewrite this chapter and start over.”

‘Who’s Right, Murray Rothbard or Cleon Skousen?’

So, I struggled with the question, “Who’s right? Murray Rothbard, the professional economist and my mentor, or my wise old Uncle Cleon, who is not an economist by training but is somebody I admire?”

There was only one way to find out. I decided to read Adam Smith’s magnum opus, “The Wealth of Nations”, cover to cover, and decide for myself. Day after day, I read all 975 pages of “The Wealth of Nations”. (I still have that well-marked Modern Library Edition on my bookshelf.)

Two months later, I finished the book and had made up my mind: Murray Rothbard was wrong and my Uncle Cleon was right!

Adam Smith’s “system of natural liberty,” despite his occasional significant errors, is an inspiring and profound classic that deserves to be the central message of the book.

That decision changed my entire outlook regarding the book.

For the first time, the history of economics could be told as a bona fide story, a bold plot with Adam Smith and his “system of natural liberty” as the heroic figure, and all economists could be judged as either for or against the invisible hand doctrine of Adam Smith. Smith was often attacked viciously by the Marxists, Keynesians and socialists, and sometimes left for dead… Only to be resuscitated by his followers, the French Laissez-Faire School, the Austrians and the Chicagoans.

It even had a good ending, with the collapse of the socialist central planning model in the early 1990s and the triumph of free-market capitalism.

The Rest of the Story

The first edition turned out to be published on March 9, 2001 — the exact anniversary of the date (March 9, 1776) that Adam Smith’s first edition of “The Wealth of Nations” was published in London!

It was with pleasure that I dedicated the book, “The Making of Modern Economics,” to W. Cleon Skousen.

I sent him a copy of the first edition with the inscription, “You changed my mind on Adam Smith, and that made all the difference. Lux in tenebris!”

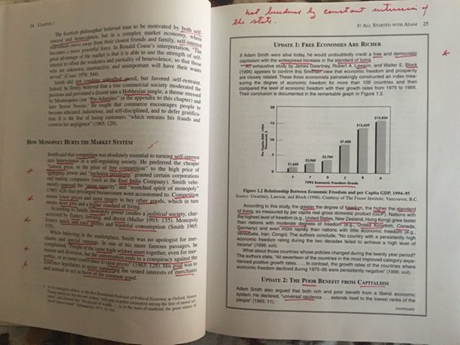

After my uncle passed away in January 2006, his family returned Cleon’s copy to me. My uncle had marked up the entire book in red.

Cleon’s marked-up copy of “Making of Modern Economics”.

‘The Making of Modern Economics’ Makes a Difference

“The Making of Modern Economics” is now in its 4th edition and published by the prestigious publisher Routledge (the same publisher of the works of Friedrich Hayek).

It is now one of the most popular textbooks of the great economic thinkers used in the classroom. Move over, Heilbroner!

As Roger Garrison, a professor at Auburn University, states, “My students love it. Skousen makes the history of economics come alive like no other textbook.”

I wrote the book to be both entertaining and educational.

It includes over 100 illustrations, portraits, photographs and “tell all” biographies.

The book is award-winning. It has won the Choice Book Award for Academic Excellence, and it was ranked #2 Best Libertarian Books in Economics by the Ayn Rand Institute (behind Henry Hazlitt’s “Economics in One Lesson”).

‘Single Best Book in Economics’

Over the years, I’ve received numerous testimonials of the book. Here’s the latest by columnist Richard Rahn in the Washington Times:

“Mark Skousen has produced the single best book on virtually all of those who have had a significant impact in economics — for good or bad — regardless of their political leanings. Despite being an economist with a definite political viewpoint, he treats the many figures he covers with considerable fairness — even the bad actors. It’s a delight to read cover-to-cover.”

Of course, not everyone agrees. My book has been banned, censored and blacklisted by Marxists, Keynesians and even some Austrians. It was also called “both fascinating and infuriating” by Foreign Affairs magazine.

Order the book and decide for yourself.

Get 50% Off by Ordering it from the Author

Routledge charges $54.95 plus shipping, but you can buy it directly from the author for only $35. Each copy is autographed, dated and mailed for no extra charge if mailed inside the United States.

And why not buy both books, “There Were Giants in the Land” and “The Making of Modern Economics?” Go to www.skousenbooks.com.

Upcoming Appearance

On my birthday, Thursday, Oct. 19, my wife Jo Ann and I will be headed to The Villages, the huge retirement community in Central Florida, where I will be speaking on “My Favorite Way to Choose Winning Stocks.” The meeting will take place from 8:30 — 10:00 am in the morning at The Villages on Oct. 19. It is co-sponsored by Raymond James, the brokerage firm. After my talk, I will be autographing copies of “The Maxims of Wall Street” and “There Were Giants in the Land” (available at www.skousenbooks.com). To learn more about my appearance, including the location of the meeting, contact Vince Czajkoski at vincentcz@hotmail.com. See you there!

IMPORTANT ANNOUNCEMENT: We are hosting Eagle’s Live Event on Wednesday, October 18. If you haven’t signed up for this yet, there’s still time. Just click here now to sign up for free. Believe me, you won’t want to miss this online event — as we bring together all of Eagle’s investment experts for our LIVE event titled Profit in the 4th Quarter With the World’s Most Trusted Experts… Reserve your seat now by clicking here.

Good investing, AEIOU,

![]()

Mark Skousen

You Blew It!

Why Kevin McCarthy Had to Go

By Mark Skousen

When Senator Orrin Hatch retired from the Senate in 2019, he had only one regret in terms of passing historic bills through Congress. According to a recent study, Hatch was the most successful senator in history for pushing through legislation. Yet, he complained he was unable to pass a balanced budget amendment.

And yet, a balanced budget law is already in place on Capitol Hill. It’s called the Debt Limit Statute. It’s not in the Constitution, or any of the amendments. Rather, it’s a law that was enacted to issue bonds to finance the United States’ involvement in World War I in 1917.

The debt ceiling statute can be a successful way to cut back government spending and get it back on the path to sound fiscal policy.

In 1995, when the Republicans took control of the House, Newt Gingrich, the speaker, refused to raise the debt ceiling in a fight with President Bill Clinton. His “Contract with America” included a provision for a balanced budget amendment. The fight continued when the federal government was forced to shut down for a few weeks. Eventually, Gingrich gave in, and passed the Clinton budget and raised the debt ceiling, but his defiance set the tone for balancing the budget, which was achieved briefly in 1999-2000.

But Kevin McCarthy, the controversial Speaker of the House who was just deposed, is no Newt Gingrich, and he showed little guts in fighting big government.

Moreover, former Congressman Justin Amash gives a strong reason why McCarthy was not a good speaker:

“Kevin McCarthy promised to open up the House, but he never made good on that promise. In this entire term, there has been only ONE legislative item that had an open amendment process — a very narrow, relatively inconsequential bill passed in January. Spending bills, by rule and tradition going back over 200 years, are supposed to be freely amendable from the floor by any member of the House able to garner the votes, yet ZERO of the spending bills McCarthy has brought to the floor have been considered under an open rule.”

Let’s hope the Republicans can get their act together by next November.