“Income inequality is the challenge of our times.” — Barack Obama (2013)

“When you include all transfer payments and taxes and look at changes in income inequality over time, you find that income inequality is not rising.” — Senator Paul Gramm, Robert Ekelund and John Early, “The Myth of American Inequality,” p. 4.

One of the biggest worries among students, the media and critics of 21st century capitalism (such as French economist Thomas Piketty) is growing income inequality. We hear it all the time: “The rich are getting richer at the expense of the middle class and the poor.”

According to Piketty, “Market forces and capitalism by themselves aren’t sufficient to ensure the common good and to limit the concentration of wealth at levels that are compatible with democratic ideals.” What’s needed, they say, is a massive tax on the wealth, capital gains and income of the super wealthy.

I warned about this new trend in 2020 in Skousen CAFÉ:

Danger Ahead: Democrats’ Massive Attack on Your Wealth! – Mark Skousen

This week, I met up with former Senator Phil Gramm, who gave me a copy of his new co-authored book, “The Myth of American Inequality: How Government Biases Policy Debate.” You can buy it on Amazon. His basic thesis is that the studies by Thomas Piketty and Emmanuel Saez, among others, leave out the welfare payments and taxes in determined usable income. When you include these changes, inequality has not been that serious. He provides evidence that the “ratio of the income for the top 20 percent of households to the bottom 20 percent is 4.9 to 1 rather than 16.7 to 1 ratio.”

Wealth and Income May Have Grown Unequal…

Nevertheless, the evidence is still strong that in the private sector — without the impact of government assistance and taxation — wealth and income inequality has grown.

That’s because wealthy people have been able to take advantage of the bull market in stocks, real estate and other assets in the 21st century more than the middle class and the poor.

They (the banks and financial institutions on Wall Street) were also bailed out during the financial crisis of 2008-09.

They have been able to afford high-priced real estate. Very few young people can afford to buy a house anymore.

Not surprisingly, a greater percentage of young adults are living with their parents. One-in-three adults in the United States aged 18 to 34 live in their parents’ home, according to U.S. Census Bureau data from 2021.

There’s no question in today’s inflationary environments, wages of ordinary Americans have not caught up with price inflation. Young people continue to struggle.

…But Goods and Services Have Not.

However, if you look at the quantity, quality and variety of goods and services, you see a different story. You see how everyone has benefited, not just the rich.

For example, today, everyone has a smartphone, they can email or text anyone and draw upon information and knowledge from anywhere in the world. It’s the great equalizer.

While it may be true that the super-rich class is earning more, if you look at actual goods and services, the middle class and the poor are gaining ground in terms of food, housing, transportation and entertainment.

As Andrew Carnegie stated, “Capitalism is about turning luxuries into necessities.”

Upcoming Conferences

I will be at the New Orleans Investment Conference, Nov. 2-5. Please email me if you are coming: mskousen@chapman.edu, and we can get together for lunch.

Hillsdale College, “Great Economists” Series, Nov. 5-8: I’ve lectured many times at Hillsdale College, the foremost free-market college in the country. This time I’ll be speaking on “The Genius of Adam Smith” on Sunday, Nov. 5, at 4 p.m. Other speakers include Bruce Caldwell on Friedrich Hayek, Ben Powell on Karl Marx, Jeff Tucker on Ludwig von Mises, Randy Holcombe on James Buchanan and Nicholas Wapshott on Milton Friedman and Paul Samuelson. For more information, email cca@hillsdale.edu, or call 517-607-2381. This series is open to the public.

Afterwards, I’ll be giving guest lectures to students on investment, gross output, Marxism and the theory of taxation. It’s always a pleasure talking to college students. It renews my faith in America.

Good investing, AEIOU,

![]()

Mark Skousen

You Blew It!

Green Energy Stocks Collapse After $400 Billion Subsidy

Here’s a good question: “How does the United States government manage to divert $400 billion of taxpayers’ money to green energy subsidies and, somehow, the solar and wind companies still manage to lose money and see their stocks collapse?”

Answer: “The same way the government pays people $7,500 to buy an electric vehicle and car buyers still won’t buy them.”

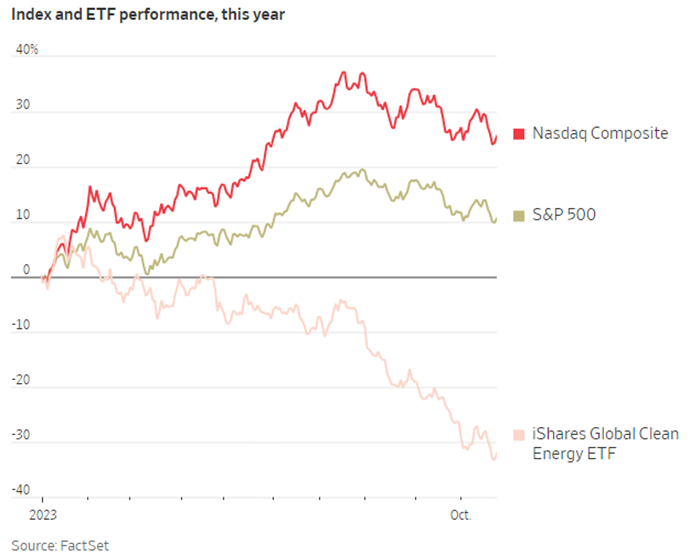

According to the Wall Street Journal, iShares Global Clean Energy ETF, which invests in renewable energy companies and utilities, is now selling at its lowest level since July 2020. It has plunged 33% this year, while the S&P 500 Index is up for the year.

In the S&P 500, SolarEdge ranks as the index’s worst performer this year.

See the chart below.