No one believes a financial disaster can strike… until it’s too late.

That’s bizarre, considering the average investor has lived through two financial crises.

Yet, few chose to protect themselves from outlier events like the Great Recession or the pandemic.

People take action only once they’re in a panic, buying protection when it costs more than ever.

Why does this happen?

Everyone thinks they can forecast the next financial collapse, like some modern-day Nostradamus. They assume magical insights are buried somewhere in the market-moving headlines of the day.

But as renowned economist Dr. Mark Skousen explains in this interview posted on YouTube, the real danger is found in slow-burning problems — the ones you need to sift through the data to locate.

Mark has spent years of his life researching and analyzing economic data.

And long before our recent tussle with inflation, he discovered our entire monetary system was far more fragile than anyone realized.

That’s why Mark is a huge proponent of gold.

Everyone knows gold is a traditional safety play.

But rarely do they actually understand why.

So, they oblige their financial advisors by holding 10% or less of their portfolio in gold-related stocks, figuring they’ve done their part.

And it’s leaving them totally defenseless to the real problems snowballing down the mountain.

However, you can prepare yourself with a few easy changes to how you approach the markets, just as Mark describes in this recent interview.

Unlearning the Gold Nonsense

People typically refer to gold as a safety asset because:

- It’s tangible

- It’s been a currency for thousands of years

- It transcends borders

They lump it in with Treasuries, because those are supposedly safe.

So, investors segment their portfolios into risk on (stocks) and risk off (gold).

The idea behind this is that when risk on assets do well, risk off should underperform and vice versa.

Ergo, if stocks go up, gold should go down.

Except that’s not how it works.

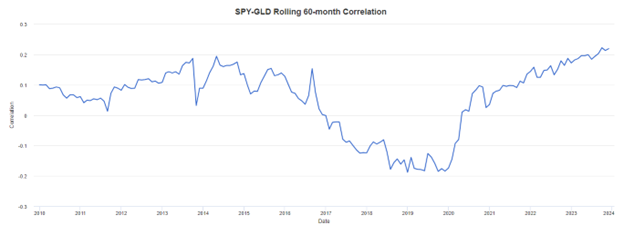

The correlation between gold and equities is slightly (emphasis on slightly) positive.

People misunderstand why they should include gold in their portfolio because they don’t know how it protects them.

Here’s the real reason gold must be a core holding for any investor.

The Golden Truth

Over the years, the Federal Reserve increased the supply of money to maintain its 2% inflation target and finance our growing deficits.

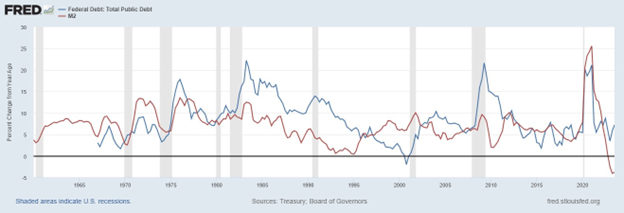

The graphic below shows the percentage change year-over-year for the Federal Debt (blue line) and the M2 Money Supply (red line).

While the two gyrate together, the magnitude of the changes are different.

Federal debt grew at a faster pace than the money supply throughout most of our history, with the exception of the late ‘90s, when we started to pay down the debt.

This means we have more debt than we have money to pay that debt. The only way to solve this conundrum, as Mark highlighted in his earlier videos, is to print more money.

So long as we refuse to pay down our debt, the money supply needs to increase to match the debt.

And that pushes up the price of gold.

But why?

Gold is a store of wealth. It’s also a (largely) finite resource.

Currency is also a store of wealth. However, central banks can change the amount of money available. The Treasury also influences this when it sells government debt.

So, if you have a finite resource, as well as one that isn’t, all things being equal, an increase of the non-finite currency will increase the price of finite gold.

This shouldn’t come as a shock to anyone. After all, this tug-of-war between currencies and gold has been going on longer than any of us have been alive.

So, what’s changed that makes gold more valuable than ever?

The Real Cost

The U.S. and global economies are debt-fueled spiral.

It’s not just the United States, but also emerging markets that continue to borrow without plans to repay their debt.

In a recent issue of Wealth Whisperer, we detailed the math that says either inflation hits 20% or government spending gets cut by a third.

So far, Congress isn’t interested in limiting its open-ended checkbook.

Modern Monetary Theorists like Alexandria Ocasio-Cortez believe we can borrow into perpetuity.

However, history says otherwise.

In the last decade, we watched as Greece’s debt burden nearly sank the Eurozone and the global economy.

Going further back, you can read about the post-WWII United Kingdom, which lost a huge chunk of its global influence because of its enormous debt load.

Before that, the Weimar Republic collapsed under the weight of its post-World War I obligations.

In fact, there are theories that the fall of the Roman Empire was precipitated by heavy inflation and budgetary shortfalls.

Nations, no matter how big and powerful, can fall apart when public debt crosses a point of no return.

Are we at that point?

Listen to the points Mark Skousen makes in THIS VIDEO and then decide for yourselves.