Five gold investments to consider buying for profits and protection offer a useful market hedge.

The five gold investments to consider buying for profits and protection may be gaining appeal as geopolitical risks mount due to Russia’s intensified invasion of Ukraine and the Oct. 7 attack and murder of 1,200 civilian in Israeli at the hands of Hamas militants that began a war in the Middle East. Gold traditionally performs well during geopolitical upheaval, inflation and U.S. dollar depreciation, so the precious yellow metal often is purchased as insurance during tumultuous times.

Gold also is regarded in many parts of the world as a way to shield savings from a possible bank crisis or even government confiscation of traceable personal assets in certain countries. Plus, a new report by BMO Capital Markets suggests that the price of gold is no longer driven by real interest rates.

Five Gold Investments to Consider Buying Amid Bullish Forecasts

That view may seem counterintuitive, especially with rates still above 5% and the stock market at an all-time high, but analysts at JPMorgan forecast that the metal will benefit this year from rate cuts and heightened demand for the shiny asset.

Several investment firms are recommending the purchase of gold, wrote Frank Holmes, the chief executive officer and chief investment officer of U.S. Global Investors (NASDAQ: GROW), a provider of eight no-load funds and two exchange-traded funds that feature precious metals, natural resources and emerging markets. One example is XIB Asset Management, a Canadian hedge fund that soared over 200% in the first two years of the pandemic, and now expects that gold and uranium will outperform if rates are cut.

Mark Skousen, PhD, a Presidential Fellow and scholar at Chapman University, wrote in his February 2024 Forecasts & Strategies investment newsletter that gold remains $2,030 an ounce. Skousen continued that he expects gold and GLD to rise in the next year.

Mark Skousen, head of Forecasts & Strategies and scion of Ben Franklin, talks to Paul Dykewicz.

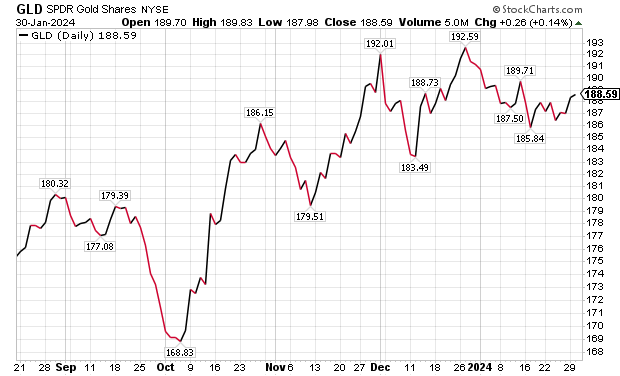

Five Gold Investments to Consider Buying: GLD

Skousen counseled his Forecasts & Strategies investment newsletter subscribers in the latest issue that he continues to recommend GLD, especially if the Fed cuts interest rates this year. Unlike many technology stocks that surged in 2023 after a dismal 2022, GLD gained a modest 5.08% during the past 12 months, 1.17% in the last three months and 0.59% in the past week.

SPDR Gold Shares is the largest physically backed gold exchange traded fund (ETF) in the world. Initially listed on the New York Stock Exchange in November of 2004, it has traded on NYSE Arca since December 13, 2007.

GLD operates as a trust that mainly holds gold bars. The investment objective of the trust is for the shares to reflect the performance of the price of gold bullion, less expenses. For many investors, the shares represent a cost-effective investment in gold. Skousen’s recommendation in his Forecasts & Strategies investment newsletter has jumped more than 25% since he advised his subscribers to purchase it in March 2020.

Chart courtesy of www.stockcharts.com

Aside from recommending SPDR Gold Shares (GLD), Skousen added that an alternative would be to purchase gold and silver coins from a reliable dealer, such as Van Simmons of David Hall Rare Coins, of Santa Ana, California.

Another fan of GLD is Jim Woods, who recommends it in his Successful Investing investment newsletter. That position is profitable, and Woods is encouraging his Successful Investing subscribers to hold onto it for further potential gains.

Jim Woods, a former U.S. Army paratrooper, co-heads Fast Money Alert.

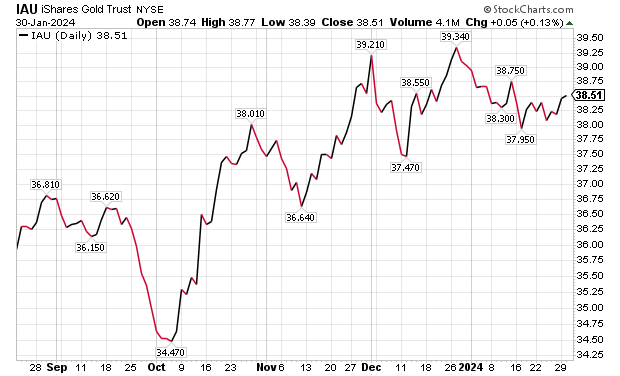

Five Gold Investments to Consider Buying: IAU

Bob Carlson, a former pension fund chairman who now heads the Retirement Watch investment newsletter, also is recommending gold though a trust. In the February 2024 issue of Retirement Watch, Carlson advised his subscribers that gold continues to deliver “solid returns,” even though it had a slow start in the initial weeks of 2024.

Carlson currently recommends the iShares Gold Trust (IAU), probably the “cheapest and most liquid” way to own the precious metal, he told me. The fund is up 5.68% in the past 12 months, 1.91% in the last three months and 0.31% in the past week.

“I believe gold’s recent strength is due largely to international tensions and not economic fundamentals, Carlson wrote.

Bob Carlson, who heads Retirement Watch, answers questions from Paul Dykewicz.

IAU is intended to constitute a simple and cost-effective way to perform like a direct investment in gold.

Chart courtesy of www.stockcharts.com

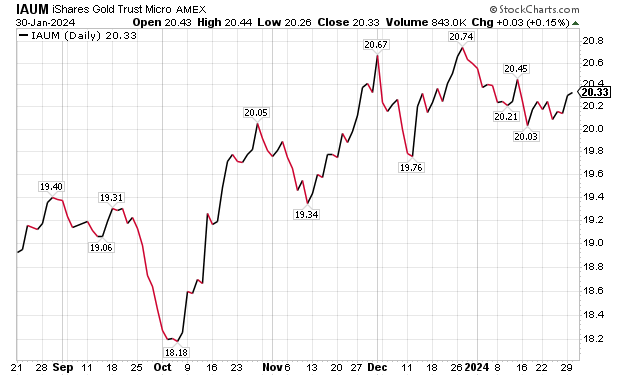

Five Gold Investments to Consider Buying: IAUM

“If I’m going to own a gold fund, it is going to be a fund that’s 100% backed by the physical metal,” said Michelle Connell, president and owner of Dallas-based Portia Capital Management, LLC.

Despite the availability of investing directly in gold mining companies that are publicly traded, they can be “very volatile,” Connell counseled. Such gold mining stocks can fall with the whims of the stock market, as well as face the ill effects of geopolitical threats that can disrupt gold production in certain countries, she added.

Michelle Connell leads Dallas-based Portia Capital Management.

“If someone is an investor who wants access to physical gold, they’re going to pay in excess of $2,000 an ounce,” Connell said. “That is not convenient for most individual investors.”

An exchange-traded fund (ETF) would make more sense since it is “economically accessible,” Connell continued. Her preferred fund is iShares Gold Trust Micro (IAUM). That ETF seeks to reflect the performance of the price of gold. The fund closed at $20.33 on Monday, Jan. 30.

IAUM is the lowest-cost physical gold ETF, with an expense ratio of 0.09%, and it does not require physical storage costs, Connell explained. Finally, if an investor needs to get in and out of gold quickly, an ETF allows purchases and sales inter-day, she added.

Compared to its ETF brethren, iShares Gold Trust Micro ETF has less downside risk, Connell continued. As for performance, IAUM has climbed 5.94% during the past 12 months, 2.06% in the last three months and 0.40% in the past week.

Chart courtesy of www.stockcharts.com

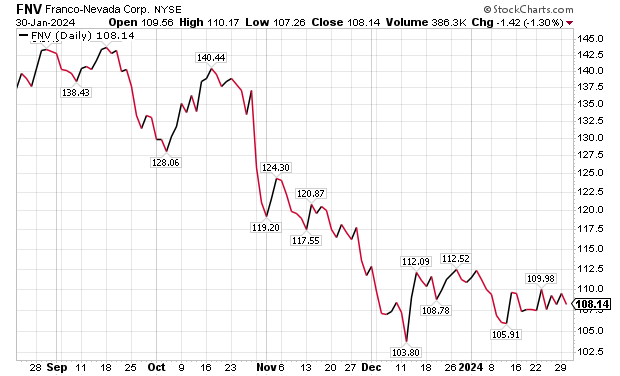

Five Gold Investments to Consider Buying: Franco-Nevada (FNV)

A gold royalty company that Skousen has recommended profitably twice in the past is Franco-Nevada Corp. (NYSE: FNV), of Toronto. His most recent profitable trade occurred in the Fast Money Alert trading service that he partners with Woods to lead. That recommendation between December 2022 and May 2023 produced a return of 5.68%.

FNV offers a large and diversified portfolio of cash-flow producing assets. Its business model provides investors with gold price and exploration optionality while limiting exposure to cost inflation.

Franco-Nevada is navigating a problem with its mine in Panama that it operates with a partner, First Quantum Minerals Ltd. The Cobre Panama mine currently remains in a phase of preservation and safe maintenance with production halted. As a result of the current suspension of operations, Franco-Nevada is conducting an impairment analysis and plans to disclose the findings in its 2023 year-end financial statements.

First Quantum has provided an update about its position regarding the next steps required for the responsible environmental stewardship of the Cobre Panama mine site. In addition, First Quantum announced it intends to pursue all appropriate legal avenues to protect its investment and rights. In turn, Franco-Nevada plans to pursue all appropriate legal avenues to enforce its rights and protect its investment in Panama.

The uncertainty is a drag on Franco-Nevada’s share price. However, Franco-Nevada announced on Tuesday, Jan. 30, that its Board of Directors raised its quarterly dividend to US$0.36 per share payable on March 28, 2024, to shareholders of record on March 14, 2024. The increased dividend will be effective for the full 2024 fiscal year. The 5.88% increase from the previous US$0.34 per share quarterly dividend marks the 17th consecutive annual increase for Franco-Nevada shareholders.

Gold royalty companies have less risk than mining companies. The bulk of its revenue comes from gold, silver and platinum. The company does not directly develop mining projects or conduct exploration and drilling. Partly due to the shutdown of the mine in Panama, Franco-Nevada’s share price has fallen 24.48% in the past year, 14.09% in the last three months and 1.67% in the past week.

There is no rush to buy the shares before Franco-Nevada provides an update in its 2023 10-k about the status of the mine in Panama. If the mine is restored to operation, the financial prospects of Franco-Nevada should be much improved.

Chart courtesy of www.stockcharts.com

Five Gold Investments to Consider Buying: Perth Mint/Asset Strategies

Another way to invest in gold is through Rich Checkan, president and chief operating officer of Asset Strategies International, a full-service, tangible asset dealer in Rockville, Maryland, close to where I live. Asset Strategies International offers precious metals, pre-1933 U.S. gold and silver coins, as well as world and ancient coins.

For investors who seek to buy precious metals, Checkan said “one of the safest” ways to do so is through the Perth Mint Depository Distributor Online (PMDDO) program. This program enables investors to buy and sell gold, silver and platinum securely and directly online seven days a week and 24 hours a day at some of the lowest premiums in the industry, Checkan added. The precious metals also can be stored, in some cases, for free at the Perth Mint.

“Just like investors can log into their brokerage account and buy and sell ETFs, investors can do the same with their PMDDO account,” Checkan said.

Once logged into an account, investors see both their live cash and bullion balance, and have the option to purchase, sell, or withdraw their metals. When clients make a purchase or a liquidation through the program, the metals are automatically added to or withdrawn from their account. Clients who want to take delivery of their metals should receive their shipment within 10 business days.

“Looking at the worst case for the PMDDO, there is a 1% premium to gold or silver when buying and a 1% discount to gold or silver when selling at the minimum transaction of $50,” Checkan said.

Aside from a straight price comparison, the Perth Mint program helps to mitigate the risks of liability, security and delivery, Checkan continued. The world’s only government guarantee provides Perth Mint clients a uniquely safe storage option, Checkan added.

“All in all, PMDDO is the clear winner when compared to other forms of physical precious metals ownership,” Checkan said. “When compared to ETFs, it compares quite well, but delivers so much more aside from premium.”

Rich Checkan, president and chief operating officer of Asset Strategies International.

Geopolitical Risks Worsen

In the Middle East, the Israeli army continues to try to take out Hama leaders who are hiding in tunnels beneath neighboring Gaza after orchestrating the Oct. 7 attack against civilians in Israel that killed 1,200 people. A potential hostage exchange between Israel and Hamas is under discussion but remains elusive.

Gaza’s Hamas-run Health Ministry reported at least 26,751 people have died there since the Israeli Defense Force (IDF) began a military response to the Oct. 7 murder of men, women and children living there, along with the kidnapping of around 250 people from Israel to the Gaza Strip. In addition, the Hamas Health Ministry reported about 65,000 people have been wounded in Gaza since the Oct. 7 invasion of Israel. The IDF successfully carried out a raid at a hospital in Gaza on Monday, Jan. 30, where a Hamas leader was located. That leader and two other Hamas militants at the hospital were killed by Israeli forces.

With world leaders expressing concern about the deaths and escalating violence in the region, the International Court of Justice ordered Israel on Friday, Jan. 26, to limit deaths and damage but did not demand a cease-fire in the Palestinian territory.

A lasting peace remains uncertain in the Middle East where militant groups like Hamas in Gaza have a goal of annihilating Israel and killing its people. Based on reports from the Hamas-run Health Ministry and other sources, more than 90,000 people have been killed or injured since Hamas militants sparked the latest war in the Middle East with its Oct. 7 attack. The Hamas infiltration of Israel caused the IDF to respond militarily to try to eliminate the threat rather than await the next one without attempting to stop further incursions.

The five gold investments to consider buying give investors a chance to gain financial refuge from geopolitical risk with wars erupting in different regions of the world.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Attention Holiday Gift Buyers! Consider purchasing Paul’s inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases or autographed copies! Follow Paul on Twitter @PaulDykewicz. He is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper, after writing for the Baltimore Business Journal and Crain Communications.