Three ways to benefit from shipping transportation stocks are worth exploring amid rising tensions in the Red Sea.

The stock markets are reacting to the turmoil in the Red Sea, a vital global shipping artery. With reduced container availability resulting in higher freight costs, the prices of shipping stocks, particularly oil and container shipping companies, have increased.

On November 19, 2023, a significant hostile event unfolded when Houthi rebels, an Iran-backed group situated in Yemen, hijacked a commercial ship in the Red Sea. There is no indication of these attacks slowing down, as evidenced by the targeting of 23 commercial vessels as of January 2024. The regional attacks in the Middle East have multiplied since the initial incident and the security situation has further deteriorated. The Houthi group has perpetrated over a dozen attacks, employing various means such as missiles, drones and speed boats.

The spike in attacks is linked to the Israeli-Hamas conflict, as the Houthis target boats with Israeli interests. However, the latest attacks involve vessels with no direct connection to Israeli ownership or trade.

Three Ways to Benefit from Shipping Transportation Stocks: Military Implications

Despite increased naval involvement by the United States and its allies in response to the attacks, the Houthis persisted, prompting many international shipping companies to reroute vessels, avoiding the Suez Canal and the Red Sea. Disruption of this strategic waterway, which handles approximately one-third of global trade, has big implications with around 8% dedicated to energy transit alone. Following a drone attack on a U.S.-owned vessel, the United States. and the United Kingdom launched a series of strikes on Houthi positions in Yemen on Jan. 11, 2024. This escalation is already having a ripple effect on the global supply chain.

The marine shipping sector, meanwhile, represents a substantial industry transporting freight, cargo and passenger services and boasts a market capitalization of $27.948 billion among the significant 35 companies, employing over 29,000 people. According to Yahoo Finance, year-to-date returns of the industry stand at +5.97% despite the challenges.

“Our energy shipping stocks are benefiting from higher spot market prices to get oil and LNG to their foreign markets,” seasoned investment professional Bryan Perry wrote in the March 2024 issue of his Cash Machine investment newsletter.

Bryan Perry leads the Cash Machine investment newsletter.

Freightos reported a continuous increase in freight rates between Asia and Europe, spiking by 173% since mid-December 2023. When it comes to the tensions in the Red Sea, a passage used for over 12% of global trade, these disruptions result in longer voyages, contributing to extended lead times for importers and the potential for port congestion. Despite rising freight costs, there is increasing demand for shipping services, meaning that some stock shares have increased sharply.

Here are three ways to invest in the shipping industry amid the escalating conflict in the Red Sea.

Three Ways to Benefit from Shipping Transportation Stocks: Dorian LPG Ltd.

The first way of investing in the shipping industry is through Dorian LPG traded on the New York Stock Exchange since 2014.

Dorian LPG Ltd. (NYSE: LPG), founded in 2013 and headquartered in Stamford, Connecticut, is a shipping company engaging in the transportation of liquified petroleum gas (LPG) through its fleet of 21 very large gas carrier (VLGCs) tankers. It operates worldwide with 35 large gas carriers. The company has offices in the United States, United Kingdom, Greece and Denmark.

Apart from shipping, the company also provides in-house commercial and technical services for their vessels, which employ 559 onboard and off-board staff, according to a 2022 corporate report. The ships transport over 13 metric tonnes (MT) of LPG annually.

LPG, often called the world’s most multi-purpose energy, has over 1,000 applications and is used by hundreds of millions globally at home, on the go, at the farm and at work. Among the most popular applications are cooking, heating, alternative transportation fuel, marine fuel, industry, commercial business, farming and recreational purposes.

There are other reasons why investing in Dorian LPG and the shipping industry should be highly considered, as worldwide use of LPG continues to grow. Between 2015 and 2022, the global seaborne trade increased by 32.1 MMT (a million metric tonnes, or 1,000 kg.), with a 31.7 MMT increase in U.S. exports in the same period. Moreover, there was a 9% increase in LPG imports in India in 2022, and plans are being made to build new plants in China. The expansion is thus genuinely global. International seaborne LPG transportation like Dorian LPG plays a key role in distributing this commodity.

The third quarter fiscal year 2024 financial results indicate key developments in the company, including a declared and paid irregular cash dividend totaling $ 40.6 million to be paid on or about February 27, 2024. Moreover, the financial results for this quarter show revenues of $163.1 million, with a net income of $100 million.

Given these financial results, Dorian LPG is listed as one of the recommendations by Dr. Mark Skousen in the latest issue of Five Star Trader from January 3, 2024. He indicated that he sees commodities, including energy-related stocks like Dorian LPG, expected to make a profitable return in 2024. In August 2023, Skousen recommended Dorian in his Five Star Trader service, then advised his subscribers to sell in November 2023 to produce a profit of 48.60% in the stock and an average gain in related call options of 36.81%.

Mark Skousen leads the Five Star Trader advisory service.

Since Dorian hit its 52-week high, the stock has slid 27.8% from $48.50 to $35.01 per share. For bargain hunters who like to buy at reduced prices, Dorian could attract their interest.

As a result, LPG is an undervalued stock with a market capitalization of $1.468 billion and a price-to-earnings ratio of 4.80 as of February 14, 2024. As of February 2024, three analysts recommend buying this stock and five advise holding it.

Compared to its peers, the stock receives a rating of 90 out of 100 on Stock Rover. Furthermore, it also ranks well on growth (98), efficiency (91), and dividends (37) when compared to peers. However, this shipping stock lags in its ratings for momentum (46) and financial strategy (47).

Other energy-related shipping stocks like Cyprus-based Frontline (NYSE: FRO), U.S.-based International Seaways, Inc. (NYSE: INSW), Bermuda-based Teekay Tankers Ltd. (NYSE: TNK) and U.K.-based TORM plc (NASDAQ: TRMD) have also been gaining momentum.

Source: StockCharts.com

Three Ways to Benefit from Shipping Transportation Stocks: Star Bulk Carriers

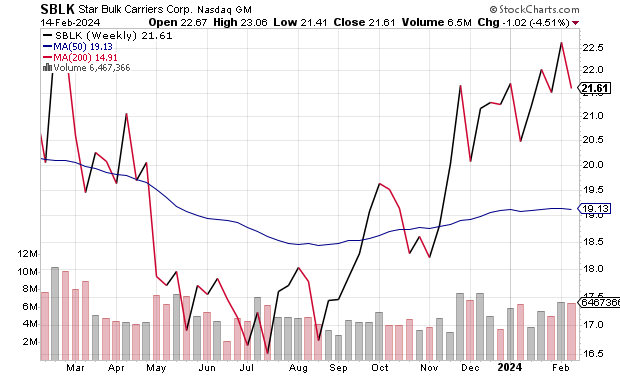

The second way of investing in the shipping industry is by looking at international stocks, such as Greece-based Star Bulk Carriers Corp., traded on the NASDAQ Global Select Market.

Star Bulk Carriers Corp. (NASDAQ: SBLK) is an Athens-based global shipping company incorporated in 2006 in the Marshall Islands that provides high-quality seaborne transportation solutions for dry bulk cargo. It generates revenues through the voyages it carries out. The company’s fleet comprises 124 vessels with an average age of 10.7 years and a total capacity of approximately 13.8 million deadweight tonnage (DWT). Start Bulk Carriers Corp. transports mainly bulk such as iron ore, minerals, grains, bauxite, fertilizers and steel products.

The fleet of vessels, including Newcastlemax, Capesize, Post Panamaz, Kamsarmax, Panamax and Supramax, ships around 70 million metric tons of cargo annually worldwide.

Star Bulk also owns Star Bulk (Singapore) Pte. Ltd., a Singapore-based company that facilitates the connection between the origination and destination of dry bulk commodities for the end user. Additionally, SBLK management expressed commitment to environmental, social and governance policies, issuing annual reports on the progress toward becoming a global leader in sustainable dry bulk shipping.

As of February 2024, the company’s market capitalization stands at $1.816 billion, with a PE ratio of 12.28, according to Yahoo Finance. The stock is undervalued, with 10 out of 11 analysts recommending it as a buy or a strong buy. SBLK has a forward dividend and yield of 6.50%.

Comparing Star Bulk to its peers, the stock receives a rating of 83 out of 100 on Stock Rover. It also performs well in terms of efficiency (87), growth (70) and momentum rating (74) when compared to peers. However, this shipping stock does not rate as well for dividends (65), valuation (52) and financial strategy (55).

The main competitors, which are also currently doing relatively well, include Golden Ocean Group (NASDAQ: GOGL), Costamare (NYSE: CMRE) and Navios Maritime Partners (NYSE: NMM).

Source: StockCharts.com

Three Ways to Benefit from Shipping Transportation Stocks: Hapag-Lloyd Aktiengesellschaft

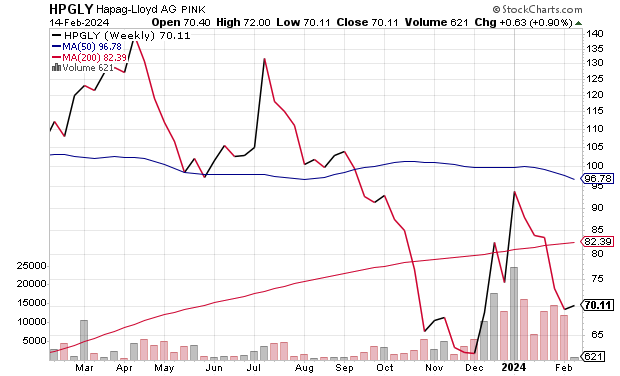

The third way of investing in the shipping industry is by looking at another international stock, German-based Hapag-Lloyd, traded on the Frankfurt and Hamburg Stock Exchanges.

Hapag-Lloyd Aktiengesellschaft (HLAG.DE) is a global liner shipping company founded in 1847 and headquartered in Hamburg, Germany.

The company’s vessel and container fleet, counting 264 ships, transports about 11.8 million TEU (Twenty-foot Equivalent Units) of dry, special, dangerous goods, coffee and refrigerated cargo per year on 113 routes. Hapag-Lloyd operates in 135 countries with over 398 offices and around 14,200 employees as of January 2024.

Additionally, the company offers bilateral EDI (electronic data interchange) and API (Application Programming Interface) Developer portals. Also, it operates a portal managing customers’ supply chain data to connect them with the interface. Besides focusing on seamless communication, Hapag-Lloyd provides inland container transportation using trucks and trains in Europe, North America, Latin America, the Middle East and Asia.

Having a market capitalization of approximately $26.44 billion (€24.65 billion), the company has a trailing PE ratio of 3.56. Furthermore, the forward dividend and yield stand at 48.20% as of February 14, 2024, according to Yahoo Finance.

Other top-performing shipping stocks traded on international stock exchanges include Denmark-based A.P. Møller – Mærsk A/S (OTC: AMKBY), China-based Cosco Shipping Holdings Co. (OTC: CICOY) and Japan-based Nippon Yusen Kabushiki Kaisha (OTC: NPNYY).

Recently, another shipping company, Maersk, announced the formation of a new vessel-sharing agreement with Hapag-Lloyd, known as Gemini Cooperation, to be launched in February 2025 after the current 2M alliance with the Mediterranean Shipping Company (MSC) is dissolved.

Source: StockCharts.com

Despite ongoing Houthi attacks in the Red Sea, which persist despite U.S. and U.K. strikes in Yemen, concerns are growing about disruptions in ocean freights. This includes rerouting shipping routes, increasing rates and other logistical challenges leading to delayed departures, impacted schedules and equipment shortages. Some carriers are adding capacity to Asia-Europe sailing routes and freight rates were anticipated to rise significantly in the coming months leading up to the Lunar New Year on Saturday, Feb. 10.

Beyond the transportation of goods, the Suez Canal and the Red Sea hold strategic importance as routes for a large volume of oil transportation. With companies rerouting their vessels, there is a further push in demand for shipping. These developments present a unique opportunity for investors as increasing tensions reshape the global shipping industry. Therefore, investing in shipping stocks now might be prudent to capitalize on these geopolitical developments.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)