“The power to tax involves the power to destroy.” —Chief Justice John Marshall

Recently, Tesla and Space X CEO Elon Musk was asked about the movement to tax the super rich, who are not paying their “fair share.”

Here was his astonishing reply: “It does not make sense to take the job of capital allocation away from people who have demonstrated great skill at capital allocation and give to the government, which has demonstrated poor skill in capital allocation.”

You can watch the entire comment here.

Elon Musk is sounding more and more like a character out of Ayn Rand’s novel “Atlas Shrugged.”

He is a major disrupter who engages in minimal compliance and civil disobedience, pushing the legal limits by ignoring mindless regulations, which often result in massive legal fees and fines.

He also pays billions in federal taxes, money that he can no longer use to advance new technologies but is now spent on federal boondoggles.

‘The Power to Destroy Capital Investment’

His criticism of taxing wealthy entrepreneurs reminds me of the statement by Chief Justice John Marshall that the “power to tax involves the power to destroy.” In this case, the power to tax is also the power to destroy capital investment and convert it to wasteful consumption when the government spends the money on foreign wars, redistribution schemes and government programs that could be more efficiently run by private enterprise.

Elon Musk’s productivity argument is one that I’ve made in my textbook “Economic Logic”: Why transfer capital via taxes from the productive sector (private enterprise and entrepreneurial capitalism) to the unproductive sector (government), never to be seen again? It just reduces economic growth and the chance to improve our standard of living by leaps and bounds through further innovations by the most productive citizens.

How much we have lost in terms of new innovations and technological advances as a result of taxing wealthy entrepreneurs via the graduated income tax and high capital gains taxes? We will never know.

Meanwhile, low-tax havens such as Hong Kong, Singapore, New Zealand and Switzerland have no capital gains tax at all, and not surprisingly, are some of the fastest-growing economies in the world because resident investors can transfer capital to its most efficient use without penalty.

Which is More Productive? Public or Private Spending?

Warren Buffett has never paid a dividend out of his Berkshire Hathaway Fund. Why not? Because he says he can put that money to better use than most investors.

The same applies to tax revenues. Buffett doesn’t voluntarily pay more than he has to because he knows he could use the money more productively than any government agent.

Who uses surplus wealth better, the unproductive government or the productive entrepreneur?

Adam Smith said it best in The Wealth of Nations (1776): “Every individual can, in his own situation, judge much better than any statesmen or lawgiver can do for him.”

Will Increased Revenues Reduce the Deficit?

Another mistake the “soak the rich” advocates make is the belief that increased revenue will somehow reduce the deficit. It won’t. Only cutting spending guarantees a reduction in the deficit and national debt. (Sadly, our Congress is unwilling to actually cut spending.)

But raising taxes does not necessarily cut the deficit. If anything, it encourages Congress to spend more.

Numerous empirical studies demonstrate that attempts to reduce fiscal deficits by raising taxes almost always fail because they lead to increased government spending by a factor that outweighs growth in revenues.

In fact, such a course of action often increases the deficit!

The answer is clear: Taxing the rich is no solution to our financial woes.

Applying the ‘Benefit Principle’ to the Rich and Famous

I do think the rich, like all Americans, benefit from a stable legal system of justice, the rule of law, local police and protection against violence and invading armies, but it shouldn’t require too much in taxes. As Benjamin Franklin said, “A virtuous and industrious may be cheaply governed.”

Taxes should be “easy” as Adam Smith advocated, so low that it finances the legitimate role of government without encouraging wealthy entrepreneurs to engage in expensive and unproductive tax shelters and tax havens. I’m thinking no more than 10% of one’s income to finance the legitimate role of the state.

Unfortunately, government spending has gone far beyond the basics of good government, and politicians are now engaged in wasting billions and even trillions on redistribution schemes, foreign wars and government programs that could be more efficiently run by private enterprise (such as education and the post office).

The Case Against Inheritance and Estate Taxes

This principle also applies to billionaire retirees, wealthy gentleman farmers and those who inherit wealth. While they themselves are not entrepreneurs and innovators, their capital is invested in companies and managers who are entrepreneurs and innovators through the stock and bond markets, banks and insurance companies and money managers.

As John Maynard Keynes himself wrote in his first bestseller in 1920, “Economic Consequences of the Peace” (his best book, in my opinion): “If the rich had spent their new wealth on their own enjoyments, the world would long ago have found such a regime intolerable. But like bees they saved and accumulated, not less to the advantage of the whole community because they themselves held narrower ends in prospect.”

For the early Keynes, savings and capital are like a cake that should never be eaten. “The virtue of the cake was that it was never to be consumed, neither by you nor by your children after you.” This statement is in sympathy with what Elon Musk is saying.

Mind you, this was before Keynes adopted his anti-saving, anti-capitalist, pro-consumption, pro-big government policies and pro-progressive taxation found in “The General Theory” of the 1930s.

The Correct Theory of Taxation is Found in ‘Economic Logic’

Only one principle of taxation makes sense, the “benefit principle.” Those who benefit should pay. It’s also known as the “user pay” principle.

I devote an entire chapter (21) to this sound principle of taxation, and the ways in which it is violated. I also demonstrate the fallacy of the “ability to pay” and other theories of tax.

Three Ways My Economics Book is Different

Based on my “real world” experience, my textbook is very different from other academic works in three significant ways:

First, instead of the traditional approach of starting with supply and demand diagrams (which can’t be drawn in real life!), I began with the profit-and-loss income statement. I’m the only economics writer to do so.

The P&L statement does so much more than supply and demand curves to demonstrate the dynamics of the economy — why new and improved goods and services are constantly being created, why some companies flourish and others go out of business, etc.

In fact, using the P&L statement, I show that there is NO equilibrium in the economy — the quantity, quality and variety of goods and services are constantly changing.

That’s not to say supply and demand diagrams aren’t useful. They are, and I introduce them in chapter 6.

Second, I reject the standard “circular flow” diagram in favor of the “structure of production” model using a general “four-stage” model of the economy, which is more realistic of how the economy actually works.

Third, I introduce gross output (GO), the new “top line” in national income accounting, and fully integrate it with GDP as the “bottom line.” Students, especially business students, love my new approach.

As Sir John Hicks (Nobel-prize-winning economist) writes, “The concept of production as a process in time… is the typical businessman’s viewpoint, nowadays the accountant’s viewpoint, in the old days the merchant’s viewpoint.”

My textbook also benefits from my living in six countries and traveling through all 50 states and 78 countries.

How to Order ‘Economic Logic’ at a Super Discount

“Economic Logic” is THE guide to sound economics, all in one book. It’s ideal for students and adults alike and is used in introductory courses in colleges around the country. It is now in its new 6th ed. published by Capital Press/Regnery.

It is a 738-page guidebook on all aspects of sound free-market economics. It is dedicated to Milton Friedman and Friedrich Hayek. Read the book and see why.

For all the details, including chapter headings, go to https://mskousen.com/

The price on Amazon is $82 plus shipping, but if you order through www.skousenbooks.com, you pay only $39. I autograph each book and mail it at no extra charge anywhere in the 50 states.

What Economists Are Saying

“Eureka! Skousen has done the impossible. Students love it! I will never use another textbook again.” —Harry Veryser, University of Detroit-Mercy

“Mark Skousen is the only economist I can understand.” —Dr. Lawrence Hayek

“An excellent balance of theory and the real world that no other text has achieved.” —Charles Baird, California State University, East Bay

“Better than any book out there! Skousen presents real business economics in a clear, provocative and logical fashion.” —Ian Mackechnie, University of Wales

“Perfect for any economics student — designed to maximize learning while minimizing monotony. Simple, direct and comprehensive.” —K. Au, Homeschool instructor

“My college econ classes, filled with perplexing theories like the paradox of thrift, GDP and Keynesian fiscal policy, were completely refuted by this excellent free-market textbook. Students, if your professors don’t use this text, get it for yourself so you can really understand the concepts of sound economics.” —Amazon review

You Nailed It!

S&P 500 Hits 5,000!

“Someone is sitting in the shade today because someone planted a tree a long time ago.” –Warren Buffett (“Maxims of Wall Street,” p. 136)

Over the weekend, newspapers and the media led with a special alert: the S&P 500 Index went over 5,000 for the first time, an all-time record. And that’s not counting dividends.

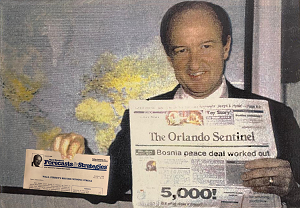

The 5,000 number reminds me of this photograph I took back in 1995, when the Dow Jones Industrial Average hit 5,000. (The S&P 500 Index was at 500 at the time.) “Wall Street’s Record Winning Streak” is the headline I used for the October issue of Forecasts & Strategies. I was bullish then and am bullish now.

The motto for my book “The Maxims of Wall Street” is “Bears make headlines, bulls make money.” But in this case, the bulls are making money and headlines!

Despite worries about interest rates, foreign wars, global warming, weak leaders and possible recession, we’ve stayed fully invested and profited from the bull market on Wall Street. “Bull markets climb a wall of worry.”

Dick Davis said it best: “The best way to put odds in your favor is to invest long term.” (Maxims, p. 137)

Want to learn more? Get a copy of the latest (10th) edition of “The Maxims of Wall Street,” which Alex Green calls the “Bible of Investing.” Only $21 for the first copy, and $11 for all additional copies. Go to http://www.skousenbooks.

Good investing, AEIOU,

![]()

Mark Skousen