The number of exchange-traded funds (ETFs) worldwide has skyrocketed in recent years, sometimes by double-digit percentages annually. As someone who has devoted his career to promoting and educating investors about the benefits of ETFs, I always am gratified when I can give my weekly readers and Successful ETF Investing subscribers insight into an ETF they may not have heard of before. Today, I am glad to be able to introduce to you the ALPS Sprott Junior Gold Miners ETF (SGDJ).

Even if you were following the rise of precious metals and mining stocks in 2016, you may not have heard of SGDJ. This largely under-the-radar gold mining fund is one of the smaller and newer mining funds in the sector, with about $39 million in total assets since its inception in early 2015. However, it has generated a powerful triple-digit-percentage return for its investors so far this year.

The ALPS Sprott Junior Gold Miners ETF tracks a factor-based index called the Sprott Zacks Junior Gold Miners Index (NYSE: ZAXSGDJ), which follows the performance of small-cap gold companies that are listed on U.S. and Canadian stock exchanges. Company weighting within the index is based on revenue growth and price momentum, and the index weighting is adjusted twice annually to account for the latest changes in a company’s performance.

SGDJ also favors “junior” and intermediate producers in the gold and silver mining industry. The fund thereby avoids more volatile, early-stage exploration companies, while still staying invested in relatively young mining companies that could gain big in the event of an important mine development.

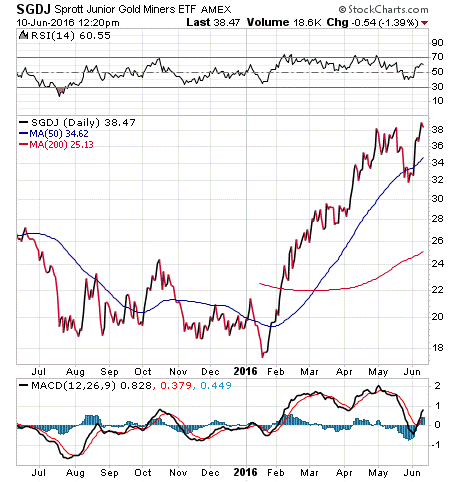

After its less-than-exciting performance in 2015, this year has taken SGDJ in an entirely different direction. The fund is currently up nearly 130% from its Jan. 19 low, a gain that is on par with some of the top-performing mining funds this year. Also, whereas some gold ETFs have cooled off slightly in the past week or two weeks, SGDJ’s chart shows no such slippage. The fund has a 0.57% expense ratio and a small dividend yield of 0.5%.

SGDJ’s top five holdings make up close to 34% of the fund. The fund’s three largest holdings and their weightings are Alamos Gold Inc., 9.04%; B2Gold Corp., 8.59%; and Endeavour Mining Corp., 6.07%.

If you believe that gold’s bullish trend still has life in it and want to invest in a potential rising star of the sector, I would recommend you check out the ALPS Sprott Junior Gold Miners ETF (SGDJ).

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)