In the past month, I attended two investment conferences whose approaches to investing are the opposite of one another.

The first one, the New Orleans Conference, occurred before the Nov. 6 election and serves as the annual gathering of gold bugs. I’ve attended and spoken there every year since 1975, so I recall its biggest turnout was right after Ronald Reagan was elected president in 1980.

There must have been over 2,000 people in attendance for that gathering. What surprised me the most was that almost every speaker there, including Jim Blanchard, the conference organizer, was critical of Reagan and didn’t think he would make any difference.

I thought “Reaganomics” would change the world and I said so. It was time to sell gold and silver and buy stocks, bonds and more traditional investments. Needless to say, my prediction was not well received. Although it took two years to be proven right, we’ve had an incredible run ever since 1982.

No matter how long the bull market will last, most speakers at the New Orleans conference predict the beginning of a financial “Armageddon.” Permabears include Doug Casey, Peter Schiff, Rick Rule and Bob Prechter. Even commodity guru Dennis Gartman believed that commodities, except for oil, are poised to do substantially better than “overvalued” stocks. He made the same prediction last year. We shall see.

The problems facing gold, mining stocks and commodities in general are the Fed’s tight money policy and a strong dollar. Under Fed chairman Jerome Powell, the growth of the money supply (M2) is slowing down and interest rates are rising. The 10-year Treasury rate is 3.14%, its highest level in four years.

Using the Austrian structure of interest rates, the yield curve is flattening, but has not turned negative. If we get an inverted yield curve, where short-term rates are higher than long-term rates, we could be facing another recession and bear market.

But this hasn’t happened. Nor has the spread between risky junk bonds and low-risk Treasury bonds widened. Instead, the spread remained stable during the October sell-off.

Baron Investment Conference in New York

The second event was the Baron Investment Conference in New York City. It was held after the Nov. 6 election. It was on Friday, Nov. 9, the anniversary of the fall of the Berlin Wall.

The Baron conference is held annually in November by Ron Baron, a member of the Forbes 400 Richest People in America and a highly successful mutual fund manager. His one-day conference is famous for providing celebrity entertainment at no charge to shareholders. While he invited all comedians (including Mel Brooks and Billy Crystal) this year, the investment part of the conference was no joke.

Are we headed for recession and a bear market? Ron Baron said he didn’t know, and his investment philosophy doesn’t depend on it. For the Baron Growth Fund (BGRFX), he buys quality companies in a growing industry at a reasonable price and holds for the long term.

In his classic book, “How to be Rich,” J. Paul Getty said the same thing: “It is possible to make money — and a great deal of money — in the stock market. But it can’t be done overnight or by haphazard buying and selling. The big profits go to the intelligent, careful and patient investors, not to the reckless and overeager speculator. The seasoned investor buys his stocks when they are priced low, holds them for the long-pull rise and takes in-between dips and slumps in stride.”

Ron Baron’s strategy has worked well, and his managed funds have outperformed the market. (BGRFX is up over 8% this year.)

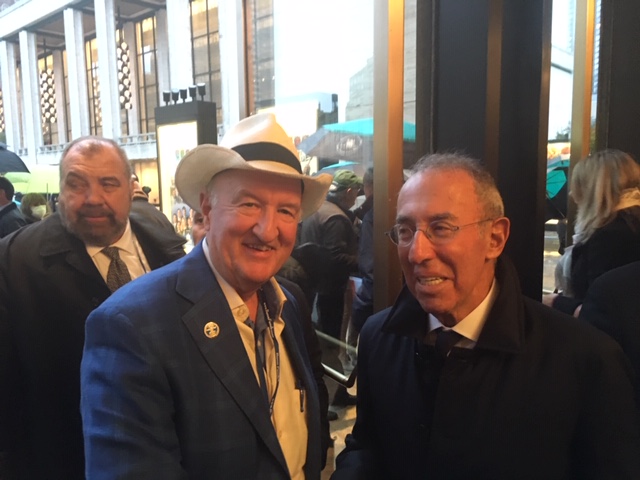

After the conference, I met up with Mr. Baron and asked him what he thought about this historic run on Wall Street. He said that the “Mother of All Bull Markets” benefited from the collapse in stocks in 2008, and that if you took the average stock market performance since 2007, the returns are about average. I looked it up, and the average annualized return since 2007 is 8.2%. Still, not bad!

Good investing, AEIOU,

![]()

Mark Skousen