Back in mid-December, European Central Bank (ECB) President Mario Draghi stated the central bank he leads would discontinue the almost $3 trillion quantitative easing, bond-buying program in January 2019.

At that time Draghi predicted Europe’s growth for 2019 to be around 1.7%, which was lower than the prior forecast, citing the persistence of uncertainties related to trade, the threat of Brexit, uncertainties in emerging markets and the impact on household wealth due to the fourth-quarter global stock market correction. Not even three months later, Mr. Draghi last week put out a revised forecast for Europe of only 1.1% gross domestic product (GDP) growth in 2019 — cutting in half its outlook from what the ECB predicted a year ago.

“Growth is below trend now and the output gap is opening up again,” one of the ECB sources said. “It is worrying because very little of this slowdown is actually temporary.”

To say this is a disturbing scenario is an understatement.

Coming out of its March 7 policy meeting, the ECB announced it would postpone the first scheduled, post-crisis rate hike until 2020. The ECB also went on to state the central bank will offer “ultra-cheap” loans to thwart the downward momentum seen in the most recent set of economic data points.

What’s most disturbing is that Draghi failed to mention the biggest threat to Europe’s GDP growth — namely, the irreversible structural long-term damage from embracing socialist economic policies that fueled a flood of non-assimilating immigrants into its borders and massive public spending on the back of sky-high income tax rates. When high tax rates increase the cost of labor, this has the effect of decreasing hours worked, which decreases the amount of production in the economy. It’s Economics 101.

The ultra-liberal European Union is located in Brussels, Belgium, which just so happens to have one of the three highest marginal tax rates in Europe at 60.2%. The other two are Slovenia (61.1%) and Portugal (61.0%). Here’s the scary part, that tax rate of 60.2% kicks in at incomes above $56,000 in Belgium. Really? A $56,000 salary being taxed at 60.2% in Belgium translates to $22,400 in annual income.

It should be of no surprise then that the youth unemployment rate in Belgium has averaged 20.04% from 1983 until 2018. So much for the democratic socialist model the elitists that run the European Union (EU) in Brussels want to apply to greater Europe. This is also the same busted model being perpetuated by Bernie Sanders, Alexandria Ocasio-Cortez and, to some extent, Elizabeth Warren — a trio of village economic idiots acting as pied pipers to a ship of utopian society fools — telling a free society that not only will “Medicare for All” be installed at any price, but that the option of private insurance and concierge health care will be outlawed and illegal.

A case in point is in Toronto, where a group of doctors were sick of seeing how much their counterparts across the border were making, so they decided to build their own hospital and receive cash only. The Canadian government shut them down. Why? The doctors actually were improving the system. For example, waiting time dropped at their hospital and saved them money because surgeries did not need to be priced to support a bloated bureaucracy that has a well-known reputation for lousy health care. It made the government-run health care system look bad, created a sense of unfairness and the government-run system couldn’t compete for top talent. We have government-sponsored health care. It’s called the Veteran’s Affairs Health System — and its poor reputation rivals that of Canada’s.

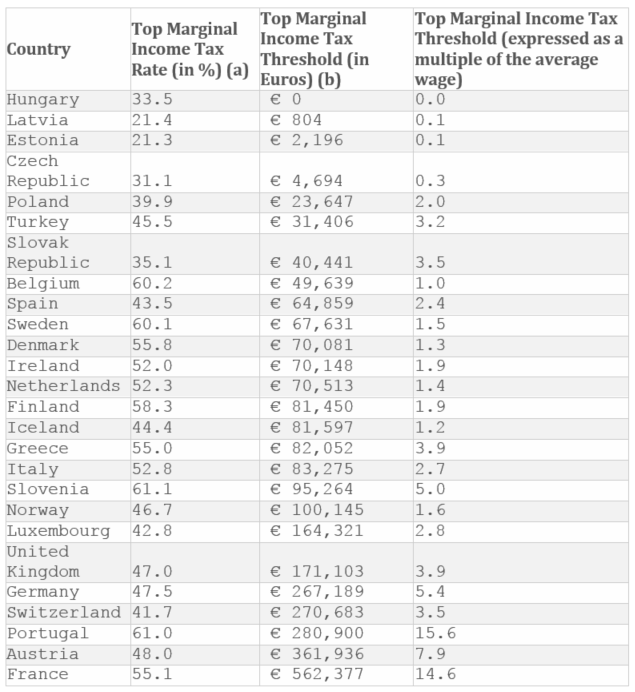

Below is a table of top marginal income tax brackets for all the countries in the European Union. No one should be surprised why the EU economy can’t get out of first gear and is now contracting fast because of the notion that governments know best how to provide for society. Socialism has never worked in any country at any time in history.

Source: www.taxfoundation.org

It should be of no surprise why the United Kingdom wants out of the EU. In terms of share of GDP for the euro zone, Germany is at the top as it contributes 21.1% with the United Kingdom coming in second as it contributes 16.0%. No wonder Brexit is such a big deal. It takes a huge chunk of revenue away from the socialist elites.

Germany closed out 2018 with GDP growth of only 1.5% compared with 2.2% in 2017. This is the weakest growth rate in five years with downward momentum implying economic contraction for Europe’s most important economic engine. Draghi is raising a red flag before the first quarter is even in the record books. Germany’s factory orders were down 2.6% for February and poor import and export data out of a key market in China shaved 4.4% off the Shanghai Index.

The hard data is mounting that the recent gains enjoyed by the Euro Stoxx 50 index on the back of the U.S. stock market rally will be at risk of being wiped out as the year progresses, led by the European banks. With no rate hikes in the forecast, loan demand in decline and trade/tariff talks hitting a stalemate, European financials are only going to suffer worsening business conditions over the intermediate term.

Additionally, it’s hard to imagine how much lower interest rates can go in Europe. Currently, the ECB held its benchmark refinancing rate at 0% and, as of last Friday, the average euro zone’s three-month interest rate is a negative 0.31%. When a bank is paying out money on loans it originates to its borrowers, there are structural issues at work in the economy.

So, when you run into a socialist at Starbucks or other hip places to spend $5 on a cup of coffee, point them to Europe to see how that decades-old experiment of social democracy is working out.

It’s not, and a vote for 50%-70% income taxes, free medical care for all, free college tuition for all, universal basic income for all and unlimited and unchecked immigration is a vote for national bankruptcy, a loss of freedom, a much lower standard of living and the end of America’s greatest asset, its ingenuity. Innovation, human capital and a willingness to take financial risk have given the United States the strongest economy in world history. To tap the opportunities and collect income from high-yield investments, I encourage you to click here to learn about my Cash Machine advisory service.