Despite a revenue decline compared to the first quarter last year, Texas Instruments, Inc. (NASDAQ:TXN) delivered adjusted earnings per share (EPS) that beat Wall Street analyst’s expectations by a double-digit-percentage margin.

In the second half of 2018, the company experienced its largest share price decline since the 2008 financial crisis. However, the share price recovered quickly and technical indicators imply a potential extension of the current share price uptrend. Furthermore, the company has rewarded its shareholder with asset appreciation over the extended time horizon as well.

The share price lost nearly 85% after the dot-com bubble burst in 2000. After doubling in just 15 months, the share price appeared to be on a steady recovery path. Unfortunately, the 2008 crisis knocked the share price back below $15 by January 2009. However, since bottoming out at the beginning of 2009, the share price has advanced more than eight-fold before the fourth-quarter 2018 pullback.

Financial Results

On April 23, 2019, Texas Instruments released financial results for its first quarter of 2019, which ended March 31, 2019. First-quarter revenue declined 5% from the same period last year to $3.59 billion. The company’s net income of $1.22 billion for the current period was nearly 11% lower than $1.37 billion figure from the same period one year earlier. However, analysts anticipated a steeper decline. Texas Instruments delivered a $1.26 adjusted EPS, which beat analyst’s expectations of $1.13 by 11.5%.

Additionally, the company continued its strategy to return all its free cash flow to owners. Over the trailing 12 months, Texas Instruments returned $8 billion to its shareholders through dividends and a stock repurchase program. The dividend distributions represented only 45% of the company’s free cash flow, which indicates that Texas Instruments should be able to sustain similar dividend income payout level going forward.

Texas Instruments also announced its outlook for the second-quarter 2019. Revenue in the $3.46 billion to $3.74 billion range should deliver adjusted earnings between $1.12 and $1.32 per share.

Texas Instruments, Inc. (NASDAQ:TXN)

Headquartered in Dallas and founded in 1930, Texas Instruments Incorporated designs, manufactures and sells semiconductors to electronics designers and manufacturers worldwide. The Analog segment offers power products to manage power requirements with battery management solutions, portable components, power supply controls, switches and interfaces, mobile lighting and display products. Additionally, this segment also offers signal chain sensors, integrated products, which primarily are incorporated into personal electronics, industrial and automotive markets. The Embedded Processing segment offers connected microcontrollers and stand-alone wireless connectivity solutions. This segment offers products for use in various markets, mainly industrial and automotive. The company also provides Digital Light Processing (DLP) products, primarily for use in projectors to create high-definition images. In 1958, Texas Instrument’s Jack Kilby invented the integrated circuit, which became the foundation for most of the technology we use today.

Dividends

Texas Instruments enhanced its quarterly dividend payout 24.2% from a $0.62 distribution amount one year ago to the current $0.77 quarterly payout. The new quarterly dividend distribution is equivalent to a $3.08 annualized payout and a 2.6% forward dividend yield. Despite a steady share price growth over the past five years, the current yield is nearly 15% higher than the company’s own 2.3% five-year average yield.

Texas Instruments’ current yield is 180% above the 0.94% average yield of the overall Technology sector. Additionally, the 2.6% current yield is nearly 35% higher than the 1.95% simple average yield of the Broad Line Semiconductor industry segment, as well as 12% higher than the 2.35% average yield of the segments only dividend-paying companies.

Since the current streak of consecutive annual dividend hikes began 16 years ago, Texas Instruments advanced its total annual dividend payout more than 36-fold. This advancement pace corresponds to an average annual growth rate of more than 25%. While the low dividend payout amounts at the beginning of the streak contributed to the high growth rate, the company managed to maintain high growth rates over recent years as well.

Over the past decade, the company advanced its annual payout nearly seven-fold for an average annual growth rate of 21.2%. Even over the past five years, the 150% dividend payout advancement translated to an average growth rate of 20%. More importantly, Texas Instruments accelerated its dividend growth rate back to almost 25% by nearly doubling its annual distribution over the past three years.

Share Price

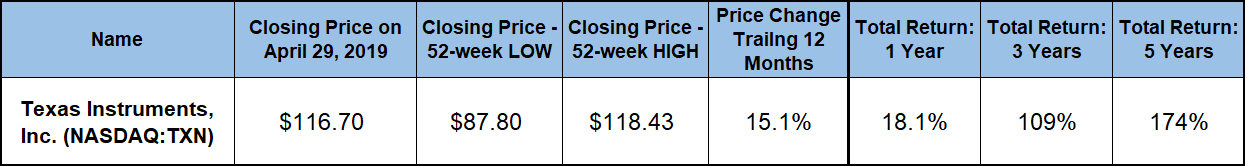

Riding the long uptrend that began in early 2009, the share price advanced nearly 17% at the beginning of the trailing 12-month period. However, after reaching $118.11 on June 6, 2018, the share price reversed direction and gave back 35% of its value by the end of the year. As with many other equities caught up in the overall market pullback, Texas Instruments’ share price reached its 52-week low on December 24, 2018. However, after bottoming out at $87.80 on Christmas Eve, the share price reversed direction again and has followed a steady uptrend since the beginning of 2019.

By April 24, 2019, the share price recovered fully from the 2018 decline and reached its new all-time high of $118.43. After pulling back 1.5%, the share price closed on April 29, 2019 at $116.70. This closing price was 15% higher than one year earlier and nearly 33% above the 52-week low from the end of December 2018. Additionally, the April 29 closing price was 155% higher than it was five years ago.

The rising dividend and the recovering share price delivered total returns of more than 18% over the past 12 months. Also, Texas Instruments’ shareholders more than doubled their investment over the past three years with a 109% total return. Furthermore, shareholders enjoyed a total return of nearly 175% over the past five years.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.