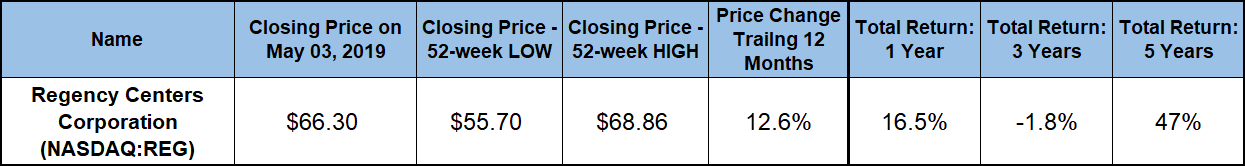

After settling its shareholders with 2% total loss over the previous three years, the Regency Centers Corporation (NASDAQ:REG) grew its share price at a double-digit-percentage rate over the trailing 12-month period for a total return in excess of 16%.

In the aftermath of the 2008 financial crisis, the Regency Centers Corporation suffered its largest share price drop since its initial public offering (IPO) in 1993. However, in addition to that decline and a smaller pullback from mid-2016 to mid-2018, the share price delivered robust asset appreciation.

The company’s dividend distributions followed a similar trend. After an initial streak of more than a decade of annual boosts, the company cut its dividend amount in 2009 and delivered six consecutive annual hikes since 2014.

Financial Results

After delivering 7% average earnings growth over the past three years and beating earnings expectations for two consecutive periods, the Regency Centers Corporation delivered positive results for the first quarter of 2019. While analysts expected a year-over-year revenue decline of 0.8%, the company delivered revenues of $286.3 million, which was 3.5% higher than the same period last year.

First-quarter funds from operations (FFO) reached $164.5 million, or $0.98 per share, which was two cents higher than analysts’ $0.96 expectations. However, the company’s earnings of $90.4 million, or $0.54 per share, outperformed analysts’ estimates of $0.35 per share by 35%

Regency Centers Corporation (NYSE:REG)

Headquartered in Jacksonville, Florida, and formed in 1963, the Regency Centers Corporation is a qualified real estate investment trust (REIT). The company is also a component of the S&P 500 Index. Regency Centers owns, develops and operates shopping centers located in affluent and densely populated trade areas. As a share of Net Operating Income (NOI), the company’s top five markets make up 43% of the company’s income. Top grocers, such as Wegman’s, Whole Foods, Kroger and Publix, anchor 80% of the company’s current properties. As of May 2019, the company owned 419 centers comprising approximately 56 million square feet of retail space nationwide, as well as 22 national offices. Additionally, based on average base rent (ABR), no more than 14% of the company’s leases expire in any given year, which minimizes income fluctuations. As of April 30, 2019, the company had approximately 9,000 tenants, with the top 10 tenants generating 20% of ABR.

Dividends

After introducing dividend distributions in 1994, the Regency Centers Corporation hiked its annual dividend distribution 13 consecutive years. The 2008 crisis forced the company to cut its quarterly dividend payout 36% for the second quarter 2009. After this dividend drop, the Regency Centers Corporation paid a flat dividend of $ 0.4625 for 19 consecutive quarters. However, since hiking its quarterly payout at the beginning of 2014, the Regency Centers Corporation has boosted its quarterly payout amount at least once every year and twice in 2017.

Even with a dividend cut of 36% in 2009 and nearly four years of flat quarterly dividend payouts, the Regency Centers Corporation increased its total annual dividend amount more than 60% over the past 25 years, which is equivalent to an average dividend growth rate of nearly 2% per year. Since embarking on the current streak of consecutive annual dividend hikes in 2014, the Regency Centers Corporation has enhanced its total annual dividend payout 26%. This advancement represents an average growth rate of 4% per year over the past six years.

The average annual growth rate over the past three years was 4.8%. Furthermore, the $0.585 quarterly payout is 5.4% higher than the $0.555 distribution from the same period last year. The current quarterly payout corresponds to a $2.34 annualized distribution and a 3.5% yield. This current yield is 11.3% higher than the company’s own 3.17% five-year average yield. Additionally, the company’s current yield is also 16.1% higher than the 3.04% simple average yield of the entire Financials sector.

Investors interested in taking advantage of the upcoming round of dividend distributions should conduct their due diligence quickly and take a position before the next ex-dividend date on May 10, 2019. All investors that can claim stock ownership before the ex-dividend date will be eligible for the next dividend distribution on the May 23, 2019, pay date.

Share Price

Coming into the trailing 12-month period on the tail end of a two-year decline, the share price fell another 5.4% over the first 10 days and reached its 52-week low of $55.70 on May 18, 2018. However, after bottoming out in mid-May 2018, the share price embarked on a relatively steady one-year uptrend. The only interruption was a 15% drop in December 2018 during the overall market pullback.

However, the share price recovered fully by the first week of February 2019 and continued to rise towards its 52-week high of $68.86 on April 5, 2019. The April peak marked a gain of nearly 24% over the May 2018 low and nearly 17% above the price from the beginning of the trailing 12 months. After peaking in early April, the share price pulled back 3.7% to close on May 6, 2019, at $66.30. This closing price was still 12.6% higher than it was one year earlier, 19% above the 52-week low from May 2018, as well as 23% higher than it was five years ago.

Despite continuously rising annual payouts, the dividend distributions were unable to offset a 15% share price decline over the past three years. However, the dividend distributions offset most of the share price’s decline and limited the total loss over the past three years to less than 2%. However, the share price and dividend performance over the trailing 12 months combined for a total return of 16.5%. Even with a 15% share price decrease in the last three years, the Regency Centers Corporation still delivered a total return on shareholders’ investment of 47% over the past five years.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.