After losing 37% over the past 12 months, the Antero Midstream Corporation (NYSE:AM) stock might be sending signals to investors that even moderate increases in natural gas market demand and pricing could send the share price higher.

In addition to losing more than one-third of its value over the trailing 12-month period, the Antero Midstream stock has also declined nearly 60% since its initial public offering (IPO) in 2014. The current asset depreciation is just a manifestation of the company’s operational and financial results, which are mostly driven by market forces in response to various economic and geopolitical events.

While the Antero Midstream Corporation exerted significant efforts into turning around the share price’s downtrend, the company’s efforts were unsuccessful in bearing fruit, so far. However, with relatively strong fundamentals and significant capital expenditures over the past few years, Antero Midstream is in a position to capitalize on these efforts and investments with some favorable market shifts.

Antero Midstream Corporation (NYSE:AM)

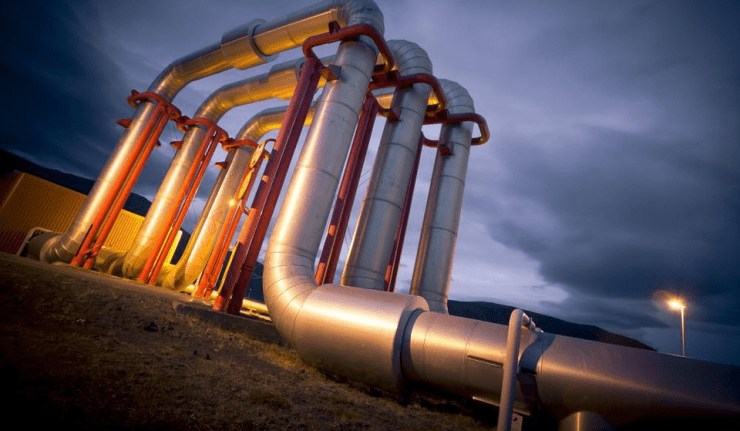

Headquartered in Denver and formed by Antero Resources in 2012, Antero Midstream Corporation (NYSE:AM) owns, operates and develops midstream energy infrastructure to service Antero Resources’ rapidly increasing natural gas and natural gas liquids (NGL) production in the Appalachian Basin. Antero Midstream focuses on developing midstream infrastructure in two of the premier North American Shale plays — the Marcellus and Utica Shales. The Marcellus Shale produced nearly 35% of total U.S. natural gas supply in 2018. Additionally, Antero Midstream provides gathering and compression services to Antero Resources under long-term fixed-fee service agreements and provides processing and fractionation services through its 50% ownership in a joint Venture with MPLX, L.P. (NYSE:MPLX).

As of July 2019, the Antero Midstream Corporation operated nearly 400 miles of low and high pressure NGL-gathering pipelines. Additionally, the company’s current compression capacity exceeds 2.7 billion cubic feet per day. The joint venture adds additional daily capacity to process through fractionation 1 billion cubic feet of natural gas into 40,000 barrels of natural gas liquids. In addition to its natural gas operations, Antero Midstream also owns and operates an integrated closed-loop system of fresh-water pipelines and storage facilities. This system includes the Antero Clearwater Facility — the largest wastewater treatment facility in the world designed for oil and gas operations.

Share Price

The share price lost nearly one-third of its value in the first year after its IPO in late 2014. However, in September 2015, the share price reversed direction and surged 85% before reaching its all-time high of more than $35 by early 2017.

After peaking in February 2017, the share price pulled back slightly and then dropped 35% in the last week of April 2017. While the share price fluctuated over the past two years with several short uptrends, the general long-term trend remained downwards.

Chart Source: Yahoo Finance

Riding this downtrend, the share price entered the trailing 12-month period at a high point and gained just 1.9% before reaching its 52-week high of $19.50 within the first two weeks, on July 26, 2018. After that marginal uptick towards the 52-week high, the share price declined for the remainder of 2018 with just one attempt at a minor gain early in the period.

By December 24, 2018, the share price had declined 46% below the July peak to close at $10.53. Since bottoming out on Christmas Eve 2018, the share price has continued fluctuating but managed to make some gains. At the end of trading on July 11, 2019, the share price closed at $12.04. While still 37% lower than it was one year ago, this closing price marked a gain of 14.3% above the 52-week low from the end of December 2018.

Distributable Cash Flow

Some of the share price gains are attributable to Antero’s shift from capital expenditures for capacity expansion towards increasing its cash returns to its unitholders. Antero Midstream has been investing heavily to expend its gas gathering, fractionation and compression capacity. However, after several years of rising capital expenditures, the company has generated enough excess capacity to support any increases in production demand over an extended time horizon.

Unfortunately, that excess capacity remains unused at the present time. Economic headwinds in international markets, especially Europe, have suppressed global demand for natural gas and its derivatives, which pushed gas prices down. Additionally, the ongoing tariff conflicts with China have also contributed to a cooling of Chinese economic expansion, thus, contributing more to the weakening global gas demand.

However, with the additional capacity in place, Antero Midstream now is lowering its capital expenditure to free up funds for increasing its distributable cash flow (DCF). DCF represents the cash available for distribution to the partnership’s unitholders after the company makes required payments to the general partners.

Depending on price movements in the oil and natural gas markets, Antero Midstream anticipates a 10% annual growth rate in its production output with oil prices hovering around the $50 per barrel mark. However, according to Antero’s current forecasts, an oil price increase to $65 per barrel would support a 15% production output annual growth rate through at least 2020. At the lower oil price level, Antero forecasts a DCF growth rate of 18% per year with the higher oil price delivering a 25% annual growth over the next three years.

This level of growth could generate an additional $ 2.5 billion to $3 billion. The company could use this additional cash to reduce its leverage and increase its DCF coverage ratio, as well as increase the return of capital to its unitholders through rising dividend distributions and potential opportunistic share repurchases.

In addition to generating additional cash flow, Antero Midstream has no debt maturing until 2022. The company had a $1.1 billion debt liability due in 2022. However, with the issuance of a $650 million senior note at 5.75% in late-June 2019, Antero plans to use a portion of those funds to reduce its debt liability in 2022 by more than 50%. The June note does not mature until 2028. Therefore, Antero Midstream has now a $460 million note payment due in three years, as well as three $650 million notes due in 2012, 2027 and 2028, respectively.

Chart Source: Antero Midstream Company Presentation July 2019

In addition to making positive changes to free up additional cash, Antero’s share price has entered oversold territory measured by the stock’s Relative Strength Index (RSI) technical indicator. Unfortunately, the stock can maintain an oversold status for a long time, and an oversold signal by itself is not a guarantee that the share price will rebound at all. However, some risk-averse investors might choose to conduct their own in-depth analysis, consider additional financial indicators and take into consideration Antero’s current 10.3% dividend yield before deciding whether the Antero Midstream stock is likely to rebound soon and benefit the investors’ portfolio.

Currently, half (8) of the 16 Wall Street analysts covering the stock have a “Strong Buy” recommendation with the other half recommending a “Buy.” Furthermore, Antero’s July 11 closing price is 34% below the analysts’ current average target price of $18.23.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.