Shopify’s stock price has shown a sustained rise with little resistance so far in 2019 and investors who have missed out on its climb still have a chance to profit, said several investment professionals who track the company.

Shopify Inc. (NYSE:SHOP), of Ottawa, Canada, is used by more than 800,000 businesses in approximately 175 countries to design, set up and manage their stores across multiple sales channels, including mobile, web, social media, marketplaces, pop-up shops and brick-and-mortar locations. Analysts who recommend Shopify tout its outlook for big growth compared to e-commerce giant Amazon (NASDAQ:AMZN), which is so large that it may face the same challenge as Walmart Inc. (NYSE:WMT) to produce more than 1-3 percent revenue gains before acquisitions within five years.

Further optimism for the Canadian company is due to the capacity of its sales platform to add new customers on an expanded scale and to serve businesses of all sizes. For example, Shopify can provide the businesses it serves with back-office operations that range from payments to shipping.

Shopify’s Stock Price Rose after Doubling Sales Growth

Unilever is among the brands that have turned to Shopify to help boost sales. Shopify, despite losing money in the pursuit of growth, produced total revenues in first-quarter 2019 that reached $320.5 million, up 50 percent from the same quarter of 2018. Investors have taken notice.

“Shopify’s stock has appreciated quite a bit in 2019, but there’s more room for growth as long as the economy stays healthy,” said Bob Carlson, who leads the Retirement Watch investment advisory service. “Shopify is in the sweet spot for growth.”

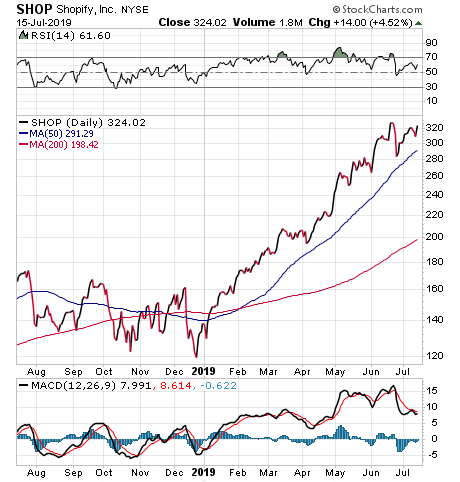

Chart courtesy of stockcharts.com

Shopify has built a scalable, popular platform that is a strong alternative to Amazon and other methods that small businesses use to generate online sales, Carlson told me. So far, Shopify has more than 820,000 merchants using its sales platform and they pay monthly fees, plus transaction fees, he added.

Shopify’s Stock Price Aided by New Product Offerings

Shopify also recently took direct aim at luring customers from Amazon by introducing a new offering. Shopify Fulfillment Network is aimed at allowing businesses to make deliveries to customers in a timely manner, at affordable rates.

“The pieces are in place for Shopify’s annual revenue growth to accelerate,” Carlson told me.

There may be significant additional growth on the horizon for Shopify that could fuel its share price further. The company’s share price has rocketed 134.03 percent between the close of trading last Dec. 31 and July 15. In comparison, Amazon has soared 34.68 percent during the same time, after my Dec. 31 investment column that described its late-2018 stock price plunge as a buying opportunity.

Shopify’s Stock Price Receives $400 Price Target from D.A. Davidson

Shopify recently held a conference for its partners and developers that included investor-related meetings. After attending that event, Tom Forte, managing director and senior research analyst at the investment firm D.A. Davidson, boosted his price target on Shopify to $400.

Forte also affirmed his buy recommendation on the stock, whose closing price on July 15 remained 23.45 percent below his target. He based his price target on an updated discounted cash flow analysis, including a 40 percent long-term adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) margin forecast, up dramatically from 3.6 percent in 2018.

In addition to Shopify’s core business activities, Forte cited new initiatives, such as fulfillment, international expansion and retail physical point-of-sale (POS) products, as ways for the company to generate a high rate of sales growth for years to come.

Shopify’s Stock Price Benefits from Taking the Road Less Traveled

At the recent conference attended by Forte, he had a chance to listen to the keynote speeches and converse with Shopify partners and developers, as well as meet company management.

Key insights from his “pilgrimage” increased his conviction that Shopify management has the right vision to serve as the first global retail operating system for entrepreneurs, Forte wrote in a recent research note. Shopify CEO Tobi Lutke received praise from Forte as the kind of executive who is capable of disrupting Amazon.

Shopify has “grown and improved” so much since its 2004 inception that the original version of the company would not be able to compete, at all, with the much more powerful business of today, Forte said. He also highlighted the company’s “impressive” first quarter, in which its sales soared.

However, Shopify’s operating loss of the first quarter of 2019 rose to $35.8 million, or 11 percent of revenue, compared with a loss of $20.3 million, or 9 percent of revenue, for the same quarter last year.

Management’s Guidance Hints Shopify’s Stock Price May Keep Rising

“The real power of Shopify is the way it empowers electronic commerce for the rest of us, all entrepreneurial retailers that grow beyond Amazon’s marketplace and want to control their own destiny,” said Hilary Kramer, a Wall Street money manager who leads the Value Authority, GameChangers, Turbo Trader, High Octane Trader and Inner Circle advisory services for individual investors.

Even though Shopify is “tiny” on Amazon’s scale and barely topped $1 billion in revenue last year, the smaller competitor has been able grow its sales faster than its huge rival has managed to achieve in more than a decade, Kramer said.

Amazon itself accounts for around 15 percent of electronic retail sales and the third-party sellers on its platform triple that share, but only $0.05 out of every retail dollar moves through the e-commerce giant, she added.

“That’s one mile in a 20-mile marathon,” Kramer said.

Investment columnist Paul Dykewicz interviews Wall Street money manager Hilary Kramer.

Amazon’s Slowing Sales Growth Could Help Shopify’s Stock Price

For today’s shareholders, the math favors the “underdog,” Kramer said. Shopify’s focus on rolling up small stores has brought $45 billion a year to its platform, so it’s about 1/7 the size of Amazon today, she added.

“Since Shopify only keeps a fraction of that gross merchandise volume, the revenue comparisons are even more constructive in absolute terms,” Kramer said. “If Amazon can capture another $1 billion in sales, it has expanded the top line by an uninspiring 0.5 percent at best. That same cash infusion doubles Shopify’s current scale. Investors who care about relative sales multiples should pay attention to that comparison.”

Meanwhile, third-party sellers are where “the action” is in retail today, but like Shopify, sellers keep most of the money and only hand the parent company a token fee, Kramer said. As a result, Amazon needs to grow gross merchandise sales even farther to generate appreciable gains as a retailer, she added.

At best, Amazon may be able to double its sales base, Kramer said. At that point, the Amazon growth story is “dead,” she added.

New Business Directions Could Lift Shopify’s Stock Price Further

“Shopify, meanwhile, is evolving in new directions,” Kramer said. “The most exciting directions for me revolve around the company’s ability to entice consumer brands to bypass traditional retail relationships and sell straight to households. Nestle, Pepsi, Kylie Kardashian… all powered by Shopify. Forget about online commerce disrupting brick-and-mortar stores. This is where all intermediaries in the consumption chain get cut out, leaving only Shopify and the products themselves to split the entire shopping cart and all the profit it represents.”

Besides, Shopify has found a niche by working with brands and retailers that can’t find partners anywhere else, Kramer said. For example, cannabis dispensaries from Toronto to Vancouver run on Shopify systems. The biggest cannabis cultivators have signed up to sell directly through the company, she added.

“Amazon can’t and won’t go there,” Kramer said. “I think that’s where a lot of the sizzle behind this company comes from.”

At some point, Kramer said, she might add Shopify to the Marijuana Millionaire portfolio in her Turbo Trader advisory service.

Shopify’s more than 100 percent return so far in 2019 may scare off some investors who could feel they missed the chance to invest in the company profitably. However, Shopify’s growth potential may prove to be more than enough to support its stock price and still produce significant double-digit-percentage gains for the next 12 months. Investors willing to accept the risk could find the ride rewarding.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz.

![[happy investor up arrows]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_124509472.jpg)