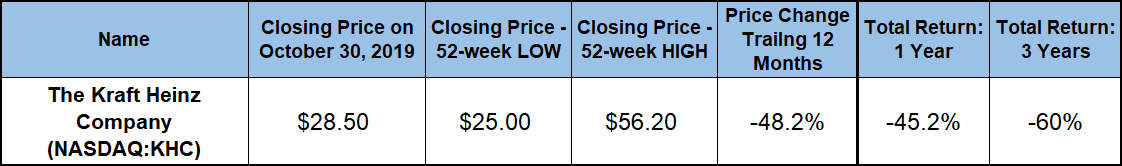

After losing more than half of its value during the last 12 months and reaching its all-time low in late August, investors should put the Kraft Heinz Company’s stock on their watch list and prepare to act quickly at any sign that the recent share price uptick might turn into a longer term uptrend.

Following the Kraft Foods and H.J. Heinz merger in 2015, the share price of the newly created business entity rose more than 25% over the first 18 months. However, after reaching its all-time high of nearly $100 in early 2017, the share price reversed direction and dropped 75% before reaching its all-time low in August 2019. Considering the company’s history, operational strengths and brand value, some investors might consider taking a long position in the Kraft Heinz stock at the currently discounted price.

After ending 2018 with two consecutive earnings misses, the company began calendar year 2019 by beating analysts’ earnings expectations in the first two quarters. The third-quarter financial results report, which was released before the opening bell on Oct. 31, revealed an increase in profits, despite weaknesses on the top end.

The third-quarter report revealed a 4.8% year-over-year net sales decline from $6.4 billion to $6.1 billion. On a regional basis, only the United States market managed to expand (1.6%). Net sales declined in all other markets. The market in Canada suffered the largest reduction of more than 11%. The Europe, Middle East and Africa (EMEA) segment contracted 3.5% and the Rest of the World segment shrank by more than 13%.

However, despite the weakening net sales, the company managed to deliver an operating income of $1.18 billion for the current period, which was nearly 10% higher than the $1.07 figure from the same period last year. Diluted earnings per share (EPS) of $0.74 advanced nearly 50% above last year’s $0.50 EPS. Adjusted EPS of $0.69 per diluted share were 9.2% below last year’s $0.76 result. However, while trailing last year’s figure, the third quarter adjusted EPS beat the $0.53 that analysts had expected by more than 30%.

In the aftermath of the early morning positive earnings news, the share price surged more than 6% immediately after the opening bell and has continued to rise at a slightly slower pace. As of 2:30 p.m., on Oct. 31, the share price has risen nearly 12% above the closing level of the previous day.

Dividends

Kraft Heinz began distributing dividends immediately after the Kraft Foods and H.J. Heinz merger in 2015. The new business entity has boosted its annual dividend payout amount every year until 2019. In the first quarter of 2019, Kraft Heinz cut its quarterly dividend payout by 36%. This meant a decline from the $0.625 value at the end of 2018 to the current distribution of $0.40. This current quarterly dividend amount corresponds to a $1.60 annualized distribution. However, the share price decline pushed the current forward dividend yield to 5.6%, which is 55% higher than the company’s own 3.6% average yield over the last five years.

Additionally, the declining share price trend has driven the company’s dividend above the average yields of its industry peers. Currently, Kraft Heinz’s yield is the highest yield among the company’s direct competitors in the Major Diversified Food industry segment. The current 5.6% yield is 143% higher than the segment’s 2.31% simple yield average. Additionally, Kraft Heinz’s yield is also outperformed by nearly 75% the 3.23% average yield of the segment’s only dividend-paying equities. Furthermore, when compared with the 2.05% yield average of the entire Consumer Goods sector, Kraft Heinz’s current yield is nearly 175% higher.

Unfortunately, the significant share price decline over the past 22 months has overpowered all of these dividend gains and delivered a total loss of 60% over the past three years. However, a continuation of the share price gains that began in mid-August could deliver robust total returns for investors who take a long position in the KHC stock soon.

Share Price

The Kraft Heinz share price has declined steadily over the past two years. Riding that downtrend, the share price passed through its 52-week high of $56.20 on the second day of the trailing 12-month period. From that peak, the share price continued descending to its all-time low of $25.00 by August 27, 2019. This 52-week low closing price was more than 55% below the peak that it achieved at the beginning of the current 12-month period. Furthermore, the share price has declined nearly 68% since Kraft Foods and Heinz merged to form a new business entity in July 2015.

However, even before the surge after the positive financial report on October 31, 2019, the share price exhibited signs of a potential trend reversal. During the 60 days between the late August low and the end of trading on Oct. 30, the share price had risen by 14%. The share price also demonstrated short upticks in the past year. However, unlike these previous instances, the current short-term uptrend pushed the 50-day moving average upward over the past 10 days.

While the 50-day average is still 14.6% below its 200-day equivalent, investors should monitor the movements of these two averages over the upcoming weeks to look for signs of a potentially sustainable uptrend before making a decision about whether to invest in the KHC stock. The company’s short term growth, the share price surge and a few additional indicators might be hinting that the Kraft Heinz stock might be a potential buying opportunity soon, mostly for risk-averse investors who are looking for high returns over the short term. However, the risks could be offset by the potential rewards for some investors.

The Kraft Heinz Company (NASDAQ:KHC)

Headquartered in Chicago, Illinois, and tracing its roots to the formation of the H.J. Heinz Company in 1869, the Kraft Heinz Company manufactures and markets food and beverage products in the United States, Canada, Europe, the Middle East and Africa. The company’s products include condiments and sauces, cheese and dairy, ready-to-eat and frozen meals, meats, refreshment beverages, coffee and other grocery products, as well as infant and nutrition products under a variety of brand names. In addition to the Kraft and Heinz brands, some of the company’s most prominent brands also include Oscar Mayer, Philadelphia, Velveeta, Planters, Maxwell House, Capri Sun, Ore-Ida, Kool-Aid, Jell-O, Cracker Barrel, Shake ‘n Bake, Ore-Ida, Miracle Whip and more. In addition to these brands, Kraft Heinz also offers products under brand names specific to each of the company’s 26 regional markets around the world. Some of these regional and local brand names include P’Tit Quebec, Tassimo, Plasmon, Pudliszki, Honig, Benedicta, Karvan Cevitam and Quero. The current business entity formed through a merger of Kraft Foods and H.J. Heinz in July 2015.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.