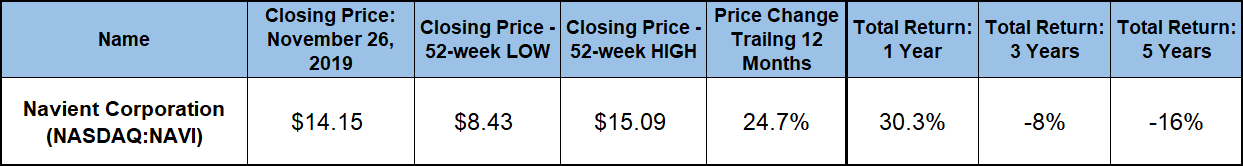

After a steep decline in 2015 and several years of trading flat with increased volatility, the Navient Corporation (NASDAQ:NAVI) stock surged more than 25% and combined with dividend income payouts to deliver a total return of more than 30% over the trailing 12-month period.

Based on the company’s 2019 performance and outlook for next year, the asset appreciation uptrend might continue into 2020 and deliver additional gains to the company’s shareholders, as well as potential new investors. Navient Corporation — the largest portfolio holder of government-insured education loans — continues to leverage its technology platform and digital marketing, which should increase loan originations and translate into strong financial results.

Even in an industry that posted average asset appreciation of more than 30% in 2019, Navient Corporation’s 62%-plus share price growth year to date was more than double the industry average. Additionally, Navient Corporation’s 17.5% Return on Equity (ROE) is currently nearly 30% higher than the 13.7% industry average, which gives the Navient Corporation considerable advantage over its industry peers. Moreover, Navient Corporation’s current share price has nearly 14% room on the upside before it reached the analysts current average price target of $16.44.

Financial Results

The company’s most recent earnings for third-quarter 2019 beat analyst’s earnings expectations by nearly 9%. This was the lowest margin by which the company beat analysts’ expectations in the last four quarters. Cumulatively, Navient’s quarterly adjusted earnings per diluted share beat analysts’ expectations by a 20% average margin over the trailing 12 months.

In addition to increased revenues and expense reduction compared to the same period last year, Navient also bolstered its share price by returning $130 million to its shareholders through a repurchase of 9.7 million shares. Furthermore, the company distributed another $133 million as dividends in the third quarter.

Dividends

The Navient Corporation initiated dividend distributions in early 2014. After hiking its quarterly payout from $0.15 to $0.16 for the first period in 2015, the company has paid the same quarterly amount over the last 19 consecutive periods. The company scheduled its next dividend distribution of $0.16 for the December 20, 2019, pay date. All investors who can claim stock ownership prior to the December 5, 2019, ex-dividend date, will receive the next round of dividend distributions in mid-December.

At the current share price level of slightly above $14, the company’s $0.64 annualized dividend payout is equivalent to a 4.5% forward dividend yield. The company’s current dividend payout ratio of 31% suggest that the Navient Corporation has earnings high enough to comfortably cover dividend distribution over the foreseeable future.

The share price surge in 2019 suppressed Navient Corporations current yield approximately 8% below the company’s own five-year yield average. Nevertheless, while trailing its own five-year average, Navient Corporation’s current yield is higher than average yields of the company’s peers in the overall Financial sector, as well as the Credit Services industry segment.

Share Price

After peaking at nearly $23 at the end of 2014, the company’s share price reversed direction and lost 60% by January 2016. By late 2016, the share price nearly doubled and recovered two-thirds of its 2015 losses. However, following another trend reversal, the share price declined over the subsequent two years on the way to its all-time low in late 2018.

Riding this two-year downtrend, the share price dropped 25% during the first 30 days of the trailing 12-month period. However, after bottoming out at $8.43 on December 24, 2018, the share price has recovered that one-month loss by the end of January 2019 and continued rising with only minimal volatility toward its current level above $14.

The share price spiked above the $15 on July 24, 2019, and reached its 52-week high of $15.09 during that one trading session. The July 24 closing price was nearly 80% higher than the 52-week low from Christmas Eve 2018. However, the one-day spike to the 52-week high was the only instance during the trailing 12 months that the share price closed at the end of trading above the current $14.45 resistance level.

After a brief pullback and a subsequent recovery during October and November, the share price rose back to within 6% of the July peak. However, the closing price of $14.15 on November 26, 2019, was nearly 25% higher than it was one year earlier, as well as 68% above the 52-week low from late-December 2018.

Despite paying steady dividends of more than 4% and distributing more than $1.1 billion to its shareholders through dividend income payout since 2014, the Navient Corporation was unable to overcome the share price decline of one-third over the past five years. The cumulative dividend payouts managed to cover half of that asset depreciation and reduced the total five-year loss to 16%. Similarly, while unable to eliminate completely the share price decline, dividend payouts offset approximately 60% of asset depreciation of 20% over the last three years and limited total losses to just 8%.

However, with the trend reversal at the end of 2018, the share price worked in unison with the dividend income payouts to deliver strong total returns. Even with the 25% pullback driven by the overall market correction in December 2018, the share price growth and dividend income combined to deliver a total return of more than 30% over the trailing 12-month period.

Navient Corporation (NASDAQ:NAVI)

Based in Wilmington, Delaware, and founded in 1973, the Navient Corporation provides asset management and business processing services to education, health care and government clients and operates in three segments — Federal Family Education Loan Program (FFELP) Loans, Private Education Loans and Business Services. The company’s portfolio contains education loans insured or guaranteed under the FFELP and private education loans. Additionally, the company holds education loans owned by the United States Department of Education (ED), financial institutions and nonprofit education lenders. The company also offers asset recovery and other business processing services for loans and receivables on behalf of guarantors of FFELP loans and higher education institutions, as well as federal, state, court and municipal clients.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.