As 2019 comes to a close, all manner of predictions regarding what to expect in 2020 are making headlines.

From interest rates, to sectors, to price targets for gold, oil, currencies and stocks, fortunes and reputations will be won and lost on such bold calls for the year ahead. In keeping with this tradition, I may as well throw my hat in the ring.

While I recognize the obvious strength in technology, multiples are now running hot, as are valuations for consumer discretionary stocks. Indeed, both are very popular market sectors. I’m also not in the mood to chase health care stocks after such a torrid rally over the past two months that coincided with waning poll numbers for Sens. Elizabeth Warren and Bernie Sanders.

What I do see that is integral to the notion of the macro argument for a U.S. and global earnings recovery theme is participation by the industrial sector, which has, for the most part, traded laterally for the past six months. The biggest and best names in the space are multi-national companies with exposure to international developed, emerging and frontier markets where I view the level of risk/reward as being very attractive.

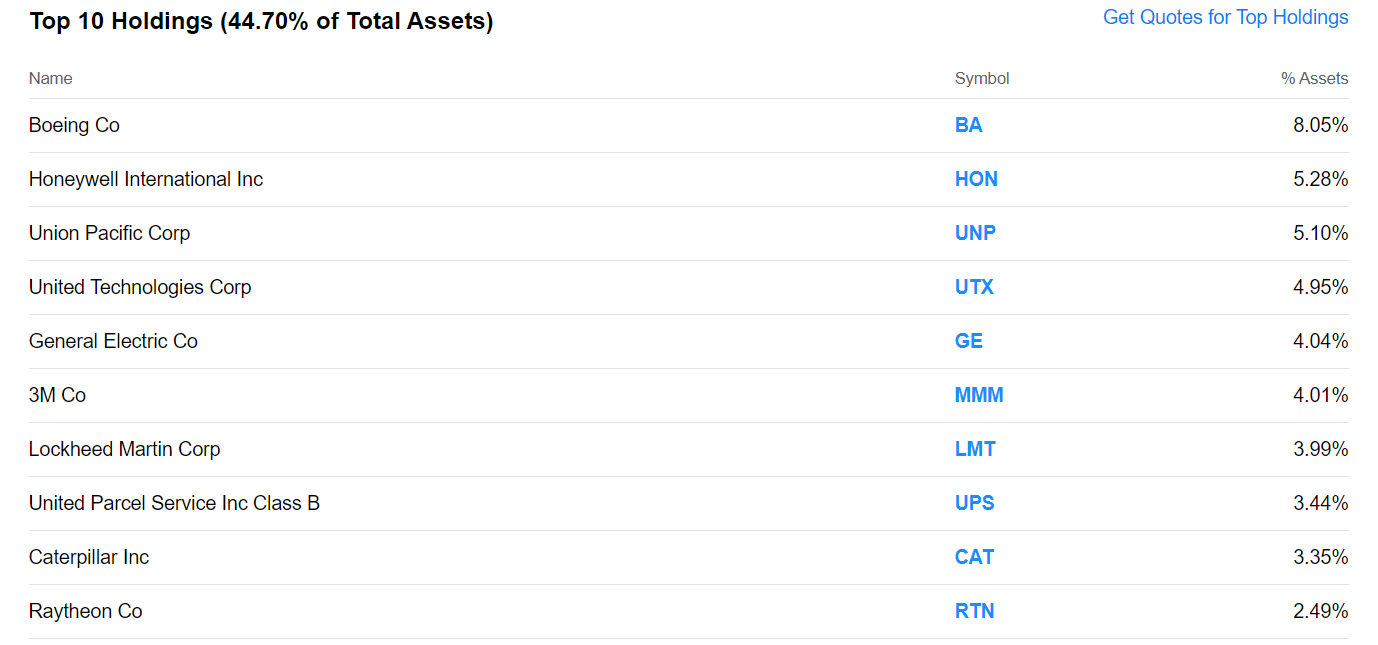

Investors can take a very straightforward approach to putting the industrial sector to work for their portfolios by simply purchasing shares in the S&P 500 Industrial Sector SPDR (XLI) that owns the crème de la crème stocks in this sector along with a couple of huge bonus situations that could really juice total returns for 2020.

Within the top 10 holdings are beaten-down shares of Boeing Co. (BA) in the #1 spot and turnaround-in-the-making story General Electric (GE) in the #5 position.

Shares of Boeing could rally huge on any breaking news surrounding the grounded 737 MAX, while GE is in the midst of aggressive asset sales and a realignment of businesses that could force the most ardent bears on the stock to capitulate. I’m also very bullish on the upside potential for Honeywell International (HON), Union Pacific Corp. (UNP), Raytheon Co. (RTN) and Lockheed Martin (LMT). All of these stocks have multi-month basing patterns that have historically led to major upside breakout moves.

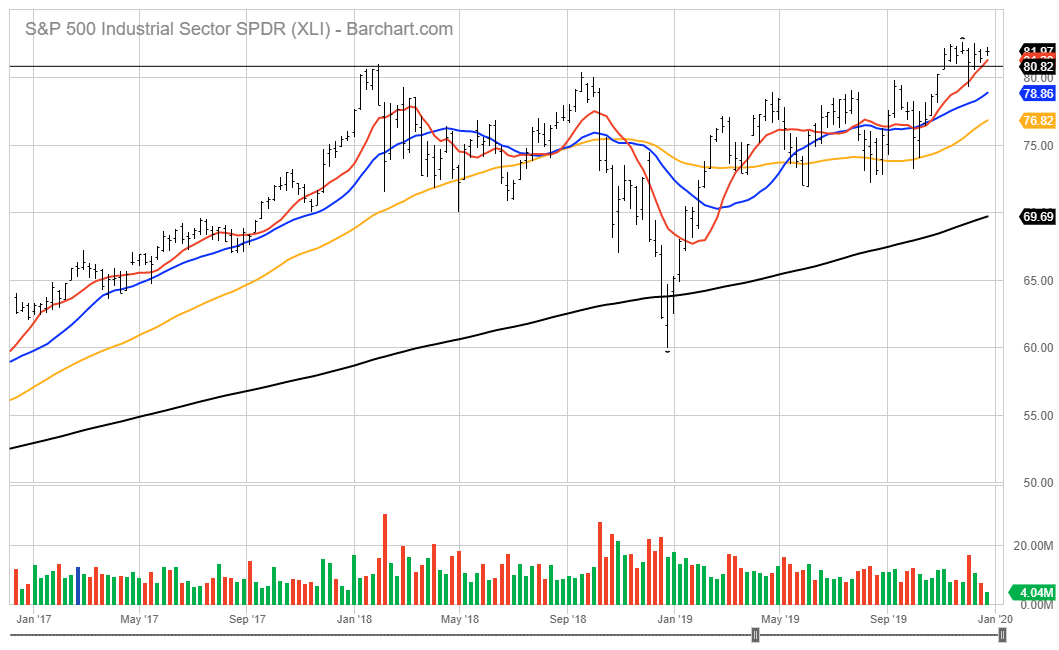

Looking at a three-year chart of XLI, the fund topped out back in January 2018 — almost two years ago — at $80.80 per share. Since that time, the chart has shown a quintessential reverse head-and-shoulders pattern with the most recent move indicating a clean upside breakout at the $81 per share level — and the very beginning of what I view as a new uptrend that has the potential for XLI shares to trade up and through $100. This pattern would represent a gain of 25% or more.

On the heels of a torrid year-end run where the major averages are arguably very overbought on a short-term basis, I believe using any bouts of profit-taking in January to initiate positions in XLI will be wise as it might prove itself to be the best-performing sector exchange-traded fund in 2020.

Join Me for the Orlando MoneyShow, February 6-8, 2020, at the Omni Orlando Resort at ChampionsGate. I will be speaking Thursday, Feb. 6, 10:30 a.m. about Double-Digit Income Investing. On Saturday, Feb. 8, I will talk at 8:00 a.m. about Extreme Profits Made Easy. Other investment experts who will be speaking include retirement and estate planning specialist Bob Carlson, Wall Street investment powerhouse Hilary Kramer and world-traveling, free-market economist Mark Skousen, who leads the Forecasts & Strategies newsletter. Register by clicking here or call 1-800-970-4355 and mention my priority code of 049265.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)