No one ever said that life was fair.

Some of the best lessons we learn come at the greatest costs.

This time… that doesn’t have to mean your hard-earned money.

The history of power brokers’ unscrupulous behavior dates back to the fabled tale of the meeting of 24 investors on May 17, 1792, under a buttonwood tree outside 68 Wall Street.

It marked the founding of the New York Stock Exchange and entrenched an elitist system structured as such.

Contrast that with 15 years earlier, when a group comprised of a swath of Americans from farmers to academics signed the Declaration of Independence.

The American government has stood strong over 200 years later, despite tests and tribulations.

Who can say the same about our stock exchange?

A place where money buys you information… a place where money buys you access… a place where money buys your way out of prison.

If it shocks you to learn the American stock market isn’t built for the retail trader, then let us tell you about this lovely island we have for sale…

Yet, we cannot survive without the system. It’s not just too big to fail. It’s too complex to reconstruct.

At this point, it may seem like your only option is to throw up your hands in frustration and relegate yourself to an index fund. We certainly wouldn’t begrudge you. It’s an excellent option to bridge the gap between pursers and the populace.

However, some of us want to do better…

Some of us want to be better…

Some of us want to perform better.

Beating the hydra of Wall Street banks should be an insurmountable task for the average individual…

…and yet, we have an advantage.

Capitalism is a beautiful thing.

Through trial and error, testing and trying, money flows where it’s needed most. Systems form to support the flows.

And that’s where our opportunity lies.

Let us explain.

By now, most of you know about the options market — a derivative contract that offers opportunity to buy or sell the right to buy or sell a set amount of stock at a given price up to an expiration date.

The price of an options contract is dictated by three components:

- The amount of time until the expiration date

- The distance between the strike execution price and the asset’s current price

- The demand (implied volatility) for that option contract

Market makers are forced to buy and sell option contracts. They don’t have a choice.

We do.

We can choose when and how we take an options trade.

Now, let’s keep things super simple here.

The time until expiration declines at a fixed, known rate. So, there’s really no edge here.

But we can find an edge on the other two components.

When we buy and sell a stock, we do it based on our expectations of where the stock will head in the future. We can do the same thing with options.

If we expect a stock to move higher, we could buy call options or sell put options.

If we expect a stock to move lower, we could buy put options or sell call options.

It’s simply a matter of translating our buying and selling stock strategies to options.

But that’s not the end.

We can also choose what to do based on the demand of an option, also known as implied volatility.

Imagine being able to sell hurricane insurance right before a storm. You’d price it through the roof just in case the storm causes damage. But most of the time, nothing happens, and you pocket the cash. And all those times add up and vastly outweigh the time when a storm does finally hit.

Stock options work the same way.

We can choose to sell options when demand is high and buy them when its low because demand is mean-reverting.

That means statistically, the further it moves away from the historical average, the more likely it is to return to that average.

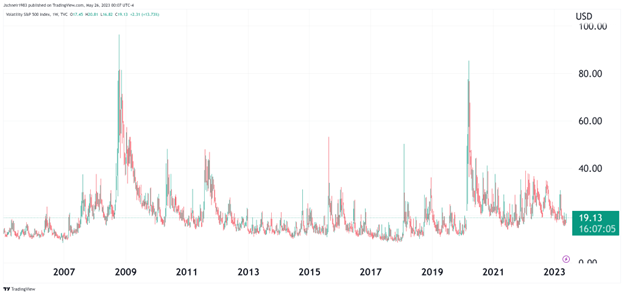

A classic example is the S&P 500 VIX Index, which measures demand for options on the S&P 500.

Source: TradingView

You see how the VIX always moves back towards 15-18?

That’s how options demand works.

When it gets super high, it snaps back like a rubber band.

The same thing happens when it gets too low.

And it’s why Bryan Perry’s Eight Month Millionaire fits perfectly into today’s quickly changing environment.

As a Wall Street insider, Bryan knows how it works, where the money is moving and how to read the tea leaves.

So, he knows how to identify the directional component of options.

But he ALSO understands when it makes sense to buy options and when to sell them.

That’s how teaches folks how to make money no matter what the market throws at you.

And it’s why eight months is all it can take to change everything.

Sure, this could be prideful boasting.

But with our 30-day guarantee, we’re confident you’ll see the value before the month is up.

Click here to learn more about Bryan Perry’s Eight-Month Millionaire Program!