Everyone should thank their lucky stars we have Chairman Jerome Powell to steer our economy.

He’s done an incredible job navigating these turbulent times, and we felt an incredible sigh of relief when he told us inflation was under control…

…Wait, didn’t he tell us that last year? No matter. In J.P. we trust.

This or something similar is playing out on every major news network. Pundits are regurgitating talking points handed down to them, not bothering to think for themselves.

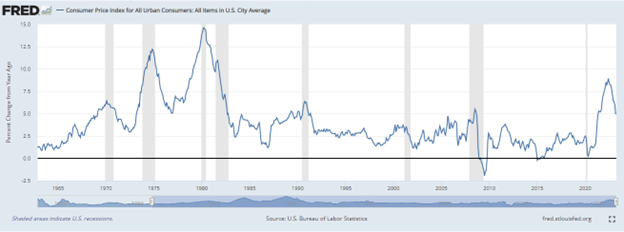

Surely, they tell us, inflation will soon be in our rear-view mirror. Just look at the data.

With the Consumer Price Index (CPI) year-over-year change falling below 5%, it’s only a matter of time before we stick that soft landing at 2%.

If you believe that load of hogwash, you can join this guy in the unemployment line…

It’s amazing what AI can do these days.

Created with MidJourney.

We all know the Fed’s propensity to ignore economic data in favor of juicing equity prices.

So, is it any wonder the recent gains come off the back of an artificial intelligence (AI) future that hasn’t materialized yet, and, coincidentally, coincides with new economic data suggesting that inflation is about to reignite?

We’re not suggesting that there isn’t money to be made in this market.

Heck, our last newsletter covered the very strategies for doing just that.

However, anyone who plans to retire in the next several decades can’t ignore the warning signs as bright and bold as a neon sign.

If you want to protect you and your family’s future, then keep reading, because we’re about to explain what everyone else is missing and how you can turn their ignorance into opportunity.

Inflation in Simple Terms

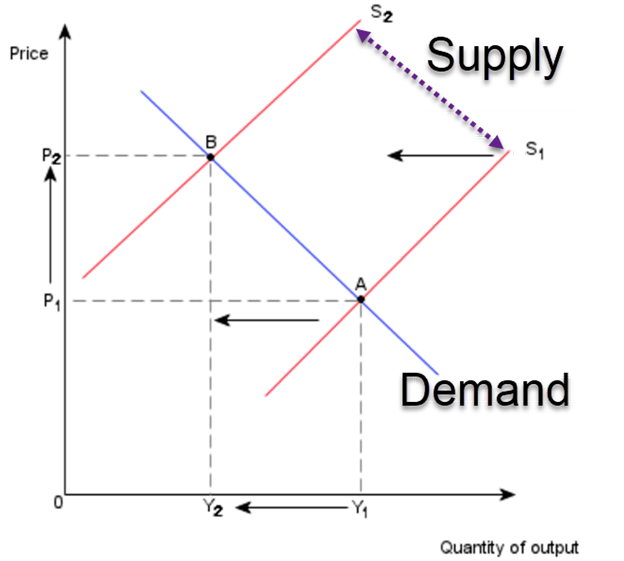

Talking heads like to over-complicate inflation. But it’s really quite simple:

Supply > Demand = Deflation

Supply < Demand = Inflation

Economics 101 classes like to show a graph similar to the following:

Without getting into the gory details, all you need to know is that supply and demand seek an equilibrium where a certain amount of a good at a given price balances.

The pandemic created two problems.

First, it buried demand for a couple of years. But the demand never went away.

Second, it shut down production, crimping global supplies of virtually everything.

Think about that in the big picture. We stopped making things for a year but didn’t stop needing them.

So yeah, inflation hit us hard. And as far as being “transitory,” that turned out to be wishful thinking since China remained closed and the global supply chain landscape completely changed.

Only now are things finally catching up… or so we’re told.

The Great Restocking

We’ve been lucky that over the last 6-to-12 months, retailers held far too much merchandise on their shelves. That kept inflation on discretionary items largely in check.

That’s changing.

Overordering, delayed shipments and quickly shifting demand left many retailers with shelves bursting with products.

So, they took action.

Inventory at Target was 16% lower at the end of the last quarter than the prior year.

Walmart slashed its levels by 9% over the past year.

The chart below from the Federal Reserve shows the dramatic drawdown post-COVID-19, the incredible rise and now, the subsequent decline.

Yes, this looks like the inflation chart from earlier. However, inventories are a leading indicator of inflation, not a reflection of it.

And the speed of the decline likely points to an overshoot on the downside.

Such gyrations are normal, as global economies search for an equilibrium.

Yet, it also implies that there won’t be enough product to meet demand. That either means we are forced to do without, or as is more likely, we will see another bout of inflation.

Like a bouncing ball, these gyrations get smaller and smaller over time. They’re not something to fear, but rather anticipate.

Unfortunately, markets expect the Fed to not only take its foot off the gas, but even provide easing sometime in 2024.

We don’t expect that until at least 2025.

While that might not sound like much of a difference, for those set to retire in the next several decades, the compound effects could be the difference between setting off on that dream cruise at 60 instead of 70.

Take Control of Your Future

Retirement is about comfort.

Retirement is about enjoying life.

Retirement isn’t about worrying whether you’ll run out of money and saddle your kids with debt.

That’s why you CANNOT WAIT to take charge of your financial future. Otherwise, you could end up like poor Chairman Jerome Powell.

What you need is an expert plan crafted by one of the best financial minds out there.

Bob Carlson started Retirement Watch as a way to protect and grow people’s financial nest eggs.

He wants to make sure that you don’t see everything you worked for get taken away.

Look, there’s a dizzying array of laws and loopholes to navigate. And one wrong move could cost you years.

That’s why he’s put together the NEW AMERICAN RETIREMENT PLAN.

It’s a report designed to help you avoid the pitfalls that hinder so many of us.

Because, let’s face it, any money you can keep from getting taxed is GUARANTEED SAVINGS.

Why wouldn’t you keep the money you earned?

Click here to learn more about Bob Carlson’s New American Retirement Plan!