Two top stocks are soaring amid the market crash recovery and merit strong consideration.

One of the two top stocks is a health care giant that is working with a German biotech company to develop a vaccine for the new coronavirus, known as COVID-19. The other of the two top stocks is a cell tower company that should boost its revenue and profits strongly from the rollout of high-speed 5G services.

The opportunity to invest in dividend-paying stocks that offer strong growth potential includes the chance to buy them at reduced prices after the stock market crashed roughly 30 percent in six weeks from Feb. 24 to March 16 as coronavirus cases spread from China and Europe to the United States. Specifically, between Feb. 24 and the close of trading on Monday, March 16, the Dow Jones Industrial Average (DJIA) tumbled 31%, the S&P 500 dove 29% and the Nasdaq tanked 30%.

There are many types of human coronaviruses but COVID-19 is a new disease, according to the U.S. Centers for Disease Control and Prevention (CDC). COVID-19 is caused by a new coronavirus that has not previously been seen in humans prior to late 2019.

Despite the Recent Market Crash, 2 Top Dividend Stocks Shine

The coronavirus crisis has caused government leaders around the world to order people to stay indoors, with relatively few exceptions as the number of cases and deaths zoomed to 2,505,443 and 172,321, respectively, as of April 21. The United States has the dubious distinction of being the country with the most COVID-19 cases, totaling 794,297, and the largest death toll of 42,564, also as of April 21.

However, President Trump announced new guidelines on April 16 to allow individual states to reopen activities in phases, using data and measures recommended by top medical experts. The guidelines set benchmarks on a reduction in new cases, testing requirements and hospital resources for states to meet before starting a phased reopening that could reopen now-closed businesses and put unemployed people back to work.

The S&P 500, a broad measure of the domestic stock market, shows that since falling to its closing low of 2,237.40 on March 23, the market has come roaring back more than 25% through the close on April 16 of 2,799.55. In a normal market, that remarkable run would signal a “raging bull” that’s trading at all-time highs, said Jim Woods, who leads the Successful Investing and Bullseye Stock Trader advisory services.

“But of course, this is no normal market,” Woods said.

2 Top Stocks Include a COVID-19 Rapid-Response, Vaccine Development Team

“Dividend stocks can be a good way to play this volatile market downturn,” said Woods, who also chooses recommendations for the Fast Money Alert advisory service that include option recommendations. “However, you must purchase the right dividend stocks. The reason why is because the likely very deep recession caused by the COVID-19 shutdown of the economy could pressure many good companies into either not raising their dividends this year or even cutting their dividends just to survive the massive loss of revenue.”

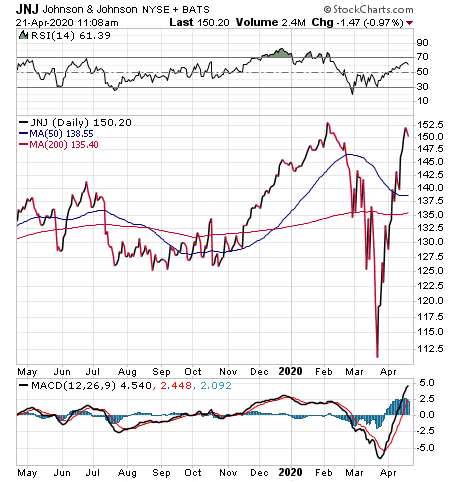

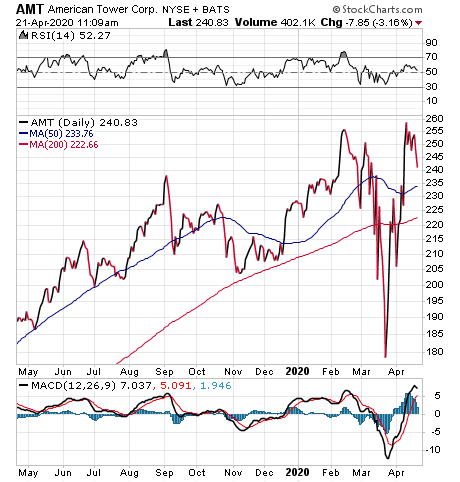

Two such stocks Woods recommends are ones he tells me are “largely immune” to the coronavirus. They feature diversified health care giant Johnson & Johnson (NYSE:JNJ), of New Brunswick, N.J., offering a new annualized dividend yield of 2.66%, and Boston-based cell phone and data tower real estate investment trust (REIT) American Tower REIT (NYSE:AMT), with a 1.74% dividend yield.

Johnson & Johnson ranks as one of 30 companies known as Dividend Kings that have boosted their annual payout for at least the past 50 years. Johnson & Johnson announced on April 14 that it raised its dividend from 95 cents a share to $1.01, up 6.3%, beating Wall Street’s earnings and revenue expectations, while scaling back its full-year 2020 financial guidance to adjusted earnings per share of $7.50-$7.90 from $8.95-$9.10.

Paul Dykewicz meets with Jim Woods to discuss the latest investment opportunities.

Johnson & Johnson Ranks as One of Investment Guru’s 2 Top Stocks

The company is among those in the pharmaceutical industry that are vying to develop a vaccine to combat COVID-19. Officials at Johnson & Johnson announced that the company already has a prospective vaccine for the coronavirus and expects to begin Phase 1 Human Clinical Studies by September 2020, possibly leading to use as soon as 2021 if testing convinces regulators at the Food and Drug Administration (FDA) to approve it as an “emergency” pandemic treatment on a not-for-profit basis.

“With Johnson & Johnson’s century-plus history of leading in times of great challenge, we are mobilizing our resources across the company in the fight against the COVID-19 pandemic,” said Alex Gorsky, its chairman and chief executive officer. “Johnson & Johnson is built for times like this, and we are leveraging our scientific expertise, operational scale and financial strength in the effort to advance the work on our lead COVID-19 vaccine candidate.”

Despite the company’s stock receiving a lowered price target of $150 from $165 from Wells Fargo on April 2 and of $153 from $161 from Raymond James on April 9, those pre-earnings downgrades did not stop the share price from rising $6.48, or 4.48%, to $146.03 on April 14 after it reported first-quarter 2020 net earnings of $5.8 billion, jumping 54.6%, and revenues of $20.7 billion, up 3.3%, from the same quarter a year ago.

Chart courtesy of www.StockCharts.com

Cell Tower Company Gains Expert’s Nod as One of 2 Top Stocks

American Tower has been a stalwart performer for years, yet in mid-March, AMT saw its share price tumble — and it wasn’t just the wider market selloff that prompted the decline, Woods told me. Instead, traders negatively reacted to the rather abrupt resignation by its Chief Executive Officer Jim Taiclet on March 16, 2020. He made the move to take the CEO position at Lockheed Martin (NYSE:LMT), and that created understandable angst on the part of AMT shareholders, Woods opined.

“The reason why is because in addition to having a business model perfectly positioned for future growth — cell phone companies enter into long-term leases with real estate companies that include rent escalators — along with ever-increasing demand for mobile data, AMT also was considered the best-run company in the business,” Woods said.

Yet AMT’s board is filled with “very smart people,” Woods continued. They knew continuity was key to calm investor fears and to continue to run the company in the same winning manner as Taiclet led it.

“So, AMT’s board immediately named longtime CFO Tom Bartlett as new permanent CEO,” Woods said. “That decisive move calmed investors, and along with the wider risk-on bid in stocks, allowed AMT shares to recoup all of its post-Taiclet losses.”

JNJ and AMT have been two long-time top stocks in the Intelligence Report advisory service’s Income Multipliers portfolio that Woods heads.

Chart courtesy of www.StockCharts.com

Negative Crude Oil Price Futures Should Not Hurt Two Top Stocks

The historic negative pricing of oil in the form of May West Texas Crude (WTI) for near-term delivery on April 20 should have no effect on either of these two top stocks. The negative prices affected crude oil deliverable in May, but the value of oil futures contracts further out stayed positive.

“It’s a day that will live in infamy for oil,” said Woods, in response to oil contracts trading in negative territory for the first time ever.

“The main reason the May crude oil contract turned negative was demand for oil has been decimated by the global coronavirus economic lockdown,” Woods said.

Causes for the negative prices included sharply reduced demand for oil in a very weak global economy that has been exacerbated by drastically lower levels of consumer motor vehicle driving, as many countries are in lockdown due to the coronavirus, said Hilary Kramer, host of a national radio program called “Millionaire Maker” and head of the GameChangers advisory service. This situation has caused inventories to grow significantly to the point where oil storage facilities in the United States are now full, she added.

“Since it costs money to store oil, and since buyers finance the purchase with debt that requires interest payments, it actually is logical for oil to be delivered in the near term to have a negative value, said Kramer, who also looks for bargain-priced stocks and funds to recommend in her Value Authority advisory service. The reality is that oil cannot be sold with storage full and it costs money to hold it.

Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include 2-Day Trader, Turbo Trader, High Octane Trader and Inner Circle.

The market crash recovery is drawing attention to two top stocks that are worth weighing for possible purchase by investors who want both income and share-price appreciation. At a time of sacrificial service from health care providers caring for coronavirus patients, Johnson & Johnson and American Tower offer investors a chance to buy shares of two top stocks that not only pay dividends but are vital to helping people, particularly amid the current public health crisis.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Endorsements for the book come from Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Dick Vitale and others. Follow Paul on Twitter @PaulDykewicz.