Six stocks to buy for profiting amid 2022 challenges should be fueled by key investment themes.

The six stocks to buy for profiting amid 2022 challenges share characteristics of high quality, inflation-protected dividend yield, value rather than growth, free cash flow (FCF) generation and more, according to BofA Global Research. Other factors that led to their recommendation include fund positioning, the investment firm’s analysts’ 2022 earnings outlook versus consensus forecasts, as well as other catalysts.

In addition, these six stocks are mostly neglected by active funds and benefit more from inflation, rising interest rates, heightened gross domestic product (GDP), increased oil prices and wage growth, compared to an equal-weighted 11 sector portfolio. The following six stocks to buy for profiting amid 2022 challenges were picked by BoA, which provided analysis for each of its choices.

The Fed’s Jan. 5 release of the minutes from its December Federal Open Market Committee (FOMC) meeting indicated an increasingly aggressive plan to wind down quantitative easing (QE), raise the Fed Funds Rate and reduce the $9 trillion in debt on the Fed’s balance sheet, Bryan Perry wrote to his Cash Machine newsletter readers. The news impaired short-term investor sentiment and triggered heavy selling in the market’s favorite and dominant growth stocks in subsequent days, he added.

The only sectors holding up under the stress of broad market downside pressure are energy, financials, consumer staples and utilities, Perry opined.

Paul Dykewicz interviews Bryan Perry, who heads the Cash Machine newsletter, as well as the Premium Income, Quick Income Trader, Breakout Profits Alert and Hi-Tech Trader trading services.

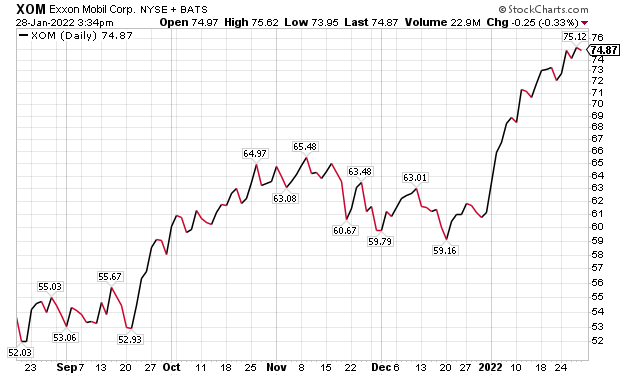

Exxon Mobil Is One of Six Stocks to Buy for Profiting Amid 2022 Challenges

Exxon Mobil Corp. (NYSE: XOM) shares traded above $70 on Tuesday, Jan. 11, to reach a new 52-week high. The stock also pays a 5% dividend yield at that breakout level, said Perry, who has been watching the stock rise as an existing recommendation in his Cash Machine newsletter.

Exxon Mobil will stand as the only oil major to emerge from the last five years with capacity for growth in free cash flow, according to BofA Global Research. But while claiming a rich opportunity slate, its chosen pace of investment is perceived as having underestimated cyclical risks, the investment firm wrote.

XOM proved capable of navigating COVID volatility but at a price, adding $20 billion to its balance sheet, and overshadowing prudent management of prior cycles, in contrast to some peers that cut their dividends, BofA wrote. As BofA’s top Energy sector stock for 2022, Exxon Mobil is estimated to have the capacity to resume dividend growth on both an absolute and per-share basis, while restoring its balance sheet to pre-COVID levels.

Bob Carlson, who heads the Retirement Watch investment newsletter, said his top pick for conservative to moderate investors is Energy Select SPDR (XLE), featuring Exxon Mobil as the fund’s top holding among 21 stocks. Carlson, who serves as chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, said energy stocks finished 2021 strongly, and most of the factors that propelled those gains will continue in 2022.

“Inflation is likely to remain high for much of 2022 and perhaps longer,” Carlson said. “Energy stocks traditionally are a good inflation hedge.”

Pension fund and Retirement Watch chief Bob Carlson answers questions from columnist Paul Dykewicz.

From discussions with certain investors, the preponderance of views suggests a big issue that gained support from enough shareholders to win 3 of 12 Exxon Mobil board seats was less about climate and more about capital discipline and continuing a sustainable and growing dividend for the stock, BofA wrote. There is little doubt dividend sustainability came under scrutiny through the cyclical trough of 2020 and the company’s payout may increase in 2022 for the first time since 2019, BofA added.

Chart courtesy of www.stockcharts.com

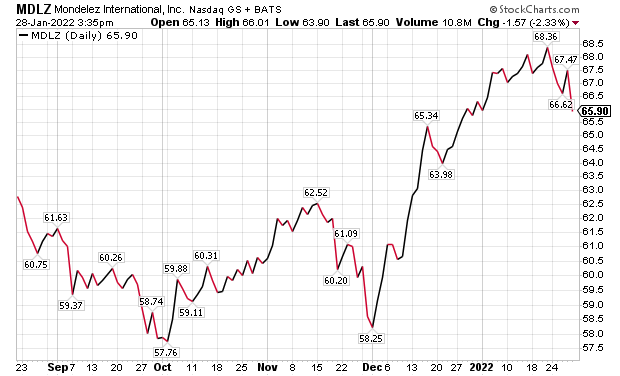

Mondelez Joins Six Stocks to Buy for Profiting Amid 2022 Challenges

Mondelez International, Inc. (NASDAQ: MDLZ), a multinational confectionery, food, holding and beverage and snack food company based in Chicago, Illinois, is BofA’s top pick in the Consumer Staples sector. BoA described Mondelez as a high-quality stock that has positive gross domestic product (GDP) and interest rate betas.

Based on analysts offering 12-month price targets for Mondelez International in the last three months. The average price target is $72 with estimates ranging from a high of $76 to a low of $67, according to NASDAQ.

However, Mondelez’s share price has soared recently, so the potential profit by investing in the stock now is not as large as it would have been a little more than a month ago. Nonetheless, Mondelez International gained a nod from BofA analysts.

Chart courtesy of www.stockcharts.com

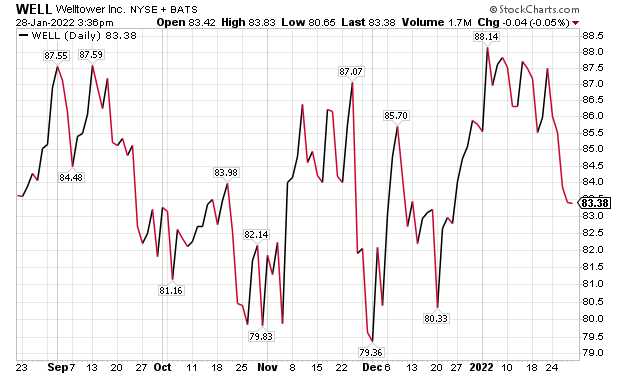

Welltower Gains Spot With Six Stocks to Buy for Profiting Amid 2022 Challenges

Welltower Inc. (NYSE: WELL), a Toledo, Ohio, real estate investment trust (REIT) that invests in health care infrastructure, is BofA’s preferred choice in the real estate sector. BofA cited the REIT’s “attractive dividend yield” of 2.9% as a reason to own its shares.

The $94 price objective for WELL set by BofA accounts for depressed earnings due to the COVID pandemic, as well as expectations of a multi-year period of above-average earnings growth due to a rebound in senior housing as the pandemic wanes. The stock’s price may outperform that estimate amid better-than-expected senior housing or medical office building performance, higher-than-forecast dividend growth and reduced interest rates.

But risks remain. They include public-pay reimbursement cuts, a more competitive acquisitions environment, weaker-than-expected senior housing fundamentals, increased tenant credit risk and rising interest rates, BofA noted.

Welltower has been one of the top holdings of one of Carlson’s recommended funds, Cohen & Steers Realty Shares (CSRSX). Cell tower firms and data storage companies have benefited from increased use of mobile technology and will do so, he added.

Chart courtesy of www.stockcharts.com

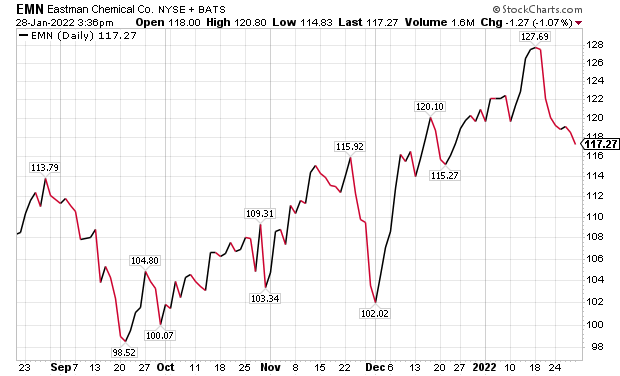

Six Stocks to Buy for Profiting Amid 2022 Challenges Include Eastman Chemical

Kingsport, Tennessee-based Eastman Chemical (NYSE: EMN), an independent global specialty materials company that produces a broad range of advanced materials, chemicals and fibers for everyday purposes, received an upgraded rating to a buy from neutral by BofA in August 2021. The investment firm boosted its earnings per share (EPS) and earnings before interest, taxes, depreciation and amortization (EBITDA) estimates, as well as its price objective on Eastman Chemical to $140, up from $130.

The company, BofA’s favorite choice in the Materials sector, offers an attractive dividend yield of 2.6%. Once a subsidiary of Kodak, EMN’s businesses today offer a highly diversified set of chemical products delivering exposure to various markets. This is accomplished through an expertise in four primary chemical chains: coal gasification and acetyls, para-xylene and polyesters, olefins, and methanol and alkyamines. EMN then markets these products to customers across the product chain, starting at upstream commodities and moving down to highly differentiated chemical derivatives, BofA wrote.

Chart courtesy of www.stockcharts.com

Eastman Chemical Should Not Be Overlooked, BofA Wrote

Eastman Chemical has executed well both through and in the wake of the COVID recession, building on innovation-led initiatives while adding additional avenues for growth, BofA wrote. Supplementing the revenue story is a transition in cash deployment from debt pay down to more direct shareholder value creation. With its shares trading below its highs, BofA sees an attractive value and entry point for investors.

BofA’s $140 price objective is based on the average of its enterprise value to 2022 estimated earnings before interest, taxes, depreciation and amortization (EBITDA) valuation of $147 and its price to 2022 estimated earnings per share (EPS) valuation of $134. The price target is based on 10.5x and 13.5x multiples for BofA’s 2022 EBITDA and EPS estimates, respectively, near the high-end of historical five-year peak valuations of 11.0x forward EBITDA and 14.5x forward P/E. BofA described that level as appropriate due to Eastman Chemical’s expected return to normal profit level, consistent free cash flow generation and positive earnings momentum.

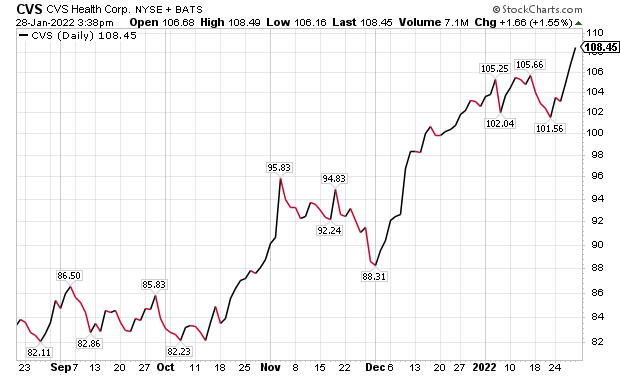

CVS Captures Place Among Six Stocks to Buy for Profiting Amid 2022 Challenges

CVS Health (NYSE: CVS), of Woonsocket, Rhode Island, is one of the largest health care companies in the United States, providing retail, mail and specialty pharmacy dispensing services and pharmacy benefits. CVS is one of the most vertically integrated publicly traded healthcare companies and ranks as BofA’s favorite health care stock.

CVS Health has been taking share across its three businesses and continues to generate a significant amount of cash flow to support the ongoing growth strategy, BofA wrote. Thus, BoA affirmed its buy rating on CVS and boosted its price objective from $112 to $115.

BofA increased its fiscal year 2021 EPS from $8.00 to $8.04, maintained its fiscal year 2022 E0PS at $8.23 and cut its fiscal year 2023 EPS from $9.08 to $8.98. The latter change stemmed from incremental investments tied to different service buildouts, which are not expected to aid profit materially until at least fiscal year 2024. Share buybacks are expected, with potential mergers and acquisition (M&A) action tied to the company’s growth initiatives to offer near-term catalysts aside from sustaining ongoing operational strength.

Chart courtesy of www.stockcharts.com

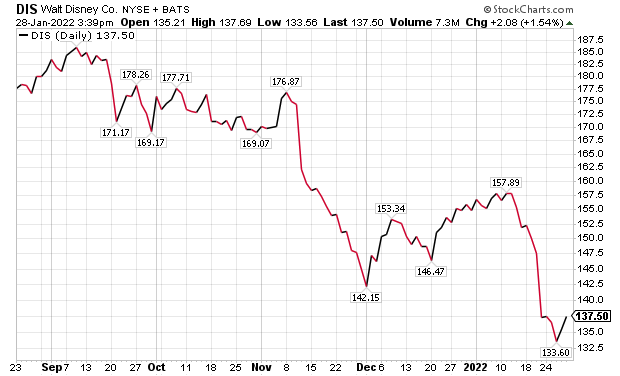

Walt Disney Snares Spot in Six Stocks to Buy for Profiting Amid 2022 Challenges

Despite near term COVID pressures and higher direct-to-consumer (DTC) expenses, BofA expect Disney to grow stronger due to robust Disney+/Hulu/ESPN+ subscriber growth and long-term theme park margin potential, among other reasons. Key catalysts incl Disney+ video price increases and more widespread launch in Japan, theme park re-openings and capacity increases and resumption of feature film/TV releases.

BofA wrote on that it maintains a Buy rating and a $192 price objective on the stock. The investment firm also trimmed its earnings outlook for Disney to reflect slower vaccine rollout leading to more gradual theme park and hotel re-openings, causing temporary delays in production due to a resurgence in COVID cases, theatrical film delays and increased investment in DTC initiatives.

Disney also has been slowed by closures of Disneyland in California and Disneyland in Paris on Oct. 30, along with Disneyland in Hong Kong on Dec. 1, BofA wrote. Those shutdowns led to employee furloughs and other cost-saving measures.

Chart courtesy of www.stockcharts.com

Single-Day Hospitalizations in America Hit New High

U.S. hospitalizations due to COVID-19 surpassed last winter’s peak, proving the virus is becoming increasingly prevalent as the highly contagious Omicron variant spreads across the country. The U.S. Department of Health and Human Services reported that 142,388 people were hospitalized nationwide with the virus as of Sunday, Jan. 9, exceeding the previous single-day record of 142,315 reported on January 14, 2021.

As an indicator of how the virus is spreading, the seven-day average of daily hospitalizations hit 132,086, up 83% from two weeks ago. In addition, the Biden administration called for U.S. insurers to cover eight at-home tests each month.

The holiday season of 2021 marked the second straight year that COVID-19 has interfered with the travel plans of families and friends hoping to gather. Canceled flights keep growing by the thousands due to rising COVID cases, as workers at airlines, airports and related retailers call in sick.

Scientists have confirmed the new Omicron variant of COVID-19 is spreading much faster than the Delta version. However, the severity of the Omicron variant seems weaker than Delta, according to early reports.

Omicron recently has become the dominant variant of COVID-19 in the United States by a wide margin. That version of the coronavirus is blamed for causing the Mid-Atlantic region of Washington, D.C., Maryland and Virginia to set records for daily cases. Many other regions are reporting new peaks for COVID-19 cases, too.

COVID-19 Concerns Mount Along With Cases and Deaths

The Omicron variant of COVID-19 is combining with the Delta version to trigger renewed calls for people in high-risk locales to obtain vaccinations, wear masks indoors and even stay home. Government and public health leaders in the United States also are urging people to receive booster shots, if they are eligible.

The Centers for Disease Control and Prevention (CDC) reported that the variants are spurring people to obtain COVID-19 boosters. However, nearly 62 million people in the United States remain eligible to be vaccinated but have not done so, said Dr. Anthony Fauci, the chief White House medical adviser on COVID-19.

As of Jan 11, 247,321,023 people, or 74.5% of the U.S. population, have received at least one dose of a COVID-19 vaccine, the CDC reported. Those who are fully vaccinated total 207,954,605, or 62.6% of the U.S. population, according to the CDC.

COVID-19 deaths worldwide, as of Jan. 11, topped the 5.5 million mark to hit 5,503,857, according to Johns Hopkins University. Worldwide COVID-19 cases have zoomed past 313 million, reaching 313,353,216 on that date.

U.S. COVID-19 cases, as of Jan. 11, jumped more than 5 million in the past week to total 62,308,132 and caused 842,141 deaths. America has the dreaded distinction as the country with the most COVID-19 cases and deaths.

The six stocks to buy for profiting amid 2022 challenges are recommended by BofA to purchase and hold for the full year. Investors open to accepting that commitment may be rewarded for their patience in what could be a volatile year for the markets.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for multiple-book pricing.