Seven cybersecurity investments to purchase for growth feature household names such as Cisco Systems Inc. (NASDAQ:CSCO) and lesser known but highly promising competitors that are excelling in important niches.

The seven cybersecurity investments to purchase serve as vital protectors for intellectual property and a reminder of their value occurred on July 21, when the U.S. Department of Justice announced a federal grand jury returned an 11-count indictment charging two hackers who work for the People’s Republic of China with invading the computer systems of hundreds of organizations. Companies, governments, non-governmental organizations, dissidents, clergy and democratic and human rights activists in the United States and abroad were among the victims of this alleged state-sponsored espionage.

The indictment indicated the hackers stole terabytes of data that comprised a “sophisticated and prolific threat” to U.S. networks. The alleged cyber thieves also targeted Western medical researchers who are seeking to develop a vaccine to help fend off the devastating human toll of COVID-19, a virus that originated in Wuhan, China.

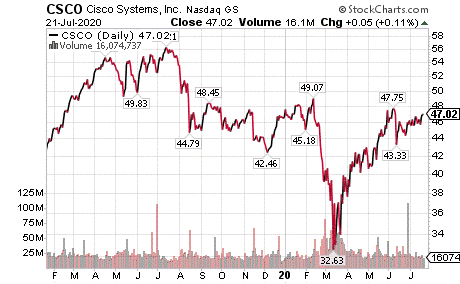

Cisco Systems Ranks as 1 of the 7 Cybersecurity Stocks to Purchase in Pursuit of Growth

Cisco Systems’ stock and its dividend yield offer appeal for investors who want to buy shares in a technology company that will pay them to stay patient amid any further market plunges.

Cisco Systems, a developer, manufacturer and seller of networking hardware, telecommunications equipment and other high-technology services and products based in San Jose, California, overcame the challenge of U.S.-China trade disputes in the past couple of years when its top leaders mitigated almost the entire effect of 25% tariffs by improving its supply chain position and by selectively boosting its prices, Goldman Sachs (NYSE:GS) concluded.

Chart Courtesy of www.StockCharts.com

Mark Skousen, PhD, an economist who is a Presidential Fellow at Chapman University, recommends Cisco as one of the Flying Five stocks in his flagship investment newsletter, Forecasts & Strategies, offering dividend-paying companies that feature a handful of the five lowest-priced stocks among the 10 highest-yielding ones in the Dow Jones 30. Those stocks are updated each August and tend to outperform the market annually, but not always since he began using the strategy in 1994.

Mark Skousen, a descendant of Benjamin Franklin, meets with Paul Dykewicz in Philadelphia. Skousen’s premium investment services consist of Home Run Trader, Five Star Trader, TNT Trader and Fast Money Alert.

Dividend-Paying Technology Giant Shines Among 7 Cybersecurity Investments to Purchase

The Flying Five did not keep up with the high-tech boom of the late 1990s and the strategy further faltered in 2008, when three of the Flying Five stocks stopped paying dividends. Since then, the Flying Five strategy typically has beaten the market each year.

Skousen’s recommendation of Cisco on March 9 to replace another stock resulted in the new position soaring 25.0% from $38.20 to $47.02, aided by a 3.07% dividend yield that has included 72 cents per share in payments.

Cisco, a high-end industry leader in technical performance, has been locked in a global competitive struggle against China’s Huawei for years. It costs plenty of money to keep packing more ports and connections in Cisco’s devices every year to keep up with network load, so Cisco passes that research and development (R&D) cost onto customers who need the premium speed, said Hilary Kramer, host of a national radio program called “Millionaire Maker.”

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include 2-Day Trader, IPO Edge, Turbo Trader, High Octane Trader and Inner Circle.

On the other side, there is China’s Huawei, which treats networking as a commodity business where simply throwing enough routers and switches at the problem is the right solution, provided of course that the equipment is built cheaply enough and replaced in large volumes when it breaks, Kramer continued. These are not meant to be “disposable devices,” but the lowest-cost approach appeals to small, price-sensitive enterprise customers with limited budgets, she added.

Cisco Systems remains a technology leader and has impressed Goldman Sachs and others with its resilience. If the company’s management can stay on course, its shareholders could be rewarded with further strong returns. The company received a downgrade to neutral from overweight on July 16 from JPMorgan due to a lack of visibility about the company’s return to revenue growth. However, the investment firm maintained its price target of $50, which now is less than $3 away.

The company received mixed reviews in June from Bank of America, which upgraded the stock to “buy” from “neutral” and boosted its target price to $55 from $48. RW Baird reduced its rating on Cisco to “neutral” from “outperform” but kept its target price at $48.

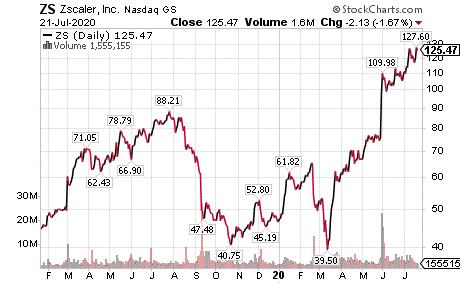

Zscaler Is 1 of 7 Cybersecurity Investments to Purchase for Growth

There have been fears of a collapse in cybersecurity growth for years now, but it has not happened. The recent pandemic spurred a working-from-home trend that could sustain growth for a while.

Zscaler (NASDAQ:ZS), also of San Jose, California, stands out partly because its technology could make its rivals obsolete. ZS software is specifically built for cloud computing, and is user- and application-centric, as opposed to network-centric.

Zscaler is a global cloud-based information security company that provides Internet security, web security, firewalls, sandboxing, SSL inspection, antivirus, vulnerability management and granular control of user activity in cloud computing, mobile and Internet of things environments. However, Zscaler is among the technology companies that do not pay a dividend to keep the research-and-development pump primed.

ZS is security as a service, with all software off-premise, which allows for easy deployment with no need to change existing hardware infrastructure. It is less costly to manage than traditional proof points and network gateways, while also reducing cost of total ownership.

Chart Courtesy of www.StockCharts.com

Zscaler is one of the top picks of Andrew Nowinski, a cybersecurity analyst with D.A. Davidson, an investment firm headquartered in Great Falls, Montana, that covers technology closely. Nowinski told me Zscaler is “well-positioned” for the upcoming digital transformation, which has been accelerated in response to the COVID-19 outbreak.

“Zscaler’s entire platform was specifically designed to more efficiently and securely connect remote workers to applications,” Nowinski said. “While the adoption of ZPA has accelerated following the outbreak, we believe adoption of ZIA will also start to accelerate as companies begin the journey of the digital transformation. As such, we expect revenue growth to remain strong for the next three-plus years, as no other vendors have a comparable solution.”

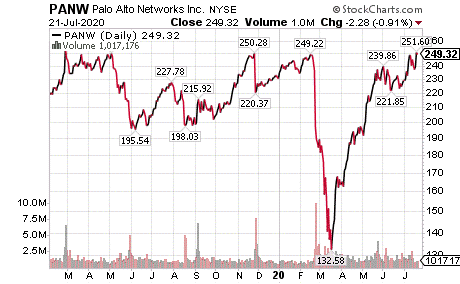

Palo Alto Networks Gains Spot Among 7 Cybersecurity Investments to Purchase

Palo Alto Networks (NYSE: PANW), headquartered in Santa Clara, California, views Zscaler as a threat, which is why it now has its own cloud-based product. Proofpoint (NASDAQ:PFPT) may be the only large-cap software stock that has declined in price this year due to the threat ZS brings.

The stock’s current valuation makes it risky, but that is true for most of the technology stocks.

“While the sizzle on cybersecurity is always moving to the next big thing, the bread-and-butter business tends to become a zero-sum game as the threat shifts across the enterprise network,” said Kramer, who also leads the Value Authority and GameChangers advisory services. “This makes investing in this space extremely challenging. Some people love the challenge and their enthusiasm pushes stocks to the stratosphere, but when a new hot competitor emerges, they come back to earth fast.”

Zscaler is a “hot name” right now and may be the one to finally end the cycle and become a long-term winner, Kramer said. It has depressed other security stocks like PANW since it went public. Until the next hot thing hits the market, Zscaler remains a growth stock, she added.

Cybersecurity Stock Recovers Strongly Since March’s Market Drop

Palo Alto Networks provides next-generation firewalls, critical components in the cutting-edge zero trust security model, as well as cybersecurity intelligence to enterprise customers.

The company’s stock price has seen a substantial recovery after dropping precipitously in early March from $249 to $133. Since then, the stock price has climbed to $250 territory. Based on strong fundamentals, the share price looks undervalued and should keep rising in the months ahead.

Chart Courtesy of www.StockCharts.com

On May 21, Palo Alto Networks posted strong fiscal third-quarter revenue and reached $869.4 million for growth of 20%, compared to the same quarter the previous year. The company also notched non-GAAP earnings per share of $1.17, compared with $1.31 for the fiscal third quarter of 2019. Palo Alto Networks increased billings 24% year over year to top $1 billion.

PANW also is growing through acquisition by buying more than a dozen security startups in the last few years to beef up its enterprise cybersecurity capabilities. The company’s most recent acquisition became CloudGenix, a cloud-delivered SD-WAN provider, for $420 million.

Palo Alto further indicated that working at home will be a tailwind for next year to 18 months, Kramer said.

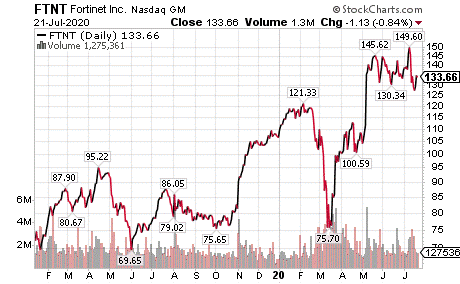

Fortinet Earns Position with 7 Cybersecurity Investments to Purchase for Growth

Fortinet (NASDAQ: FTNT), based in Sunnyvale, California, provides firewalls, antivirus, intrusion prevention and endpoint security that help secure in-house and remote workers.

Fortinet reported first-quarter 2020 revenue of $577 million, a 22% jump year over year. Billings jumped 21% year over year, reaching $667.8 million. Earnings per share rose 30% to 60 cents per share.

“The world is going to keep getting more and more cyber, and that means opportunists of all sorts are going to try to exploit the weaknesses in cyber systems,” said Jim Woods, who leads the Intelligence Report, Successful Investing and Bullseye Stock Trader advisory services.

Paul Dykewicz meets with Jim Woods before COVID-19 to discuss new investment opportunities.

“My favorite stock in the cybersecurity space is Fortinet Inc. (FTNT),” Woods told me. “The company’s software helps customers build a virtual ‘fortress’ around their data, and it does this chiefly through its firewall software.

“Fortinet also has targeted the latest trend in the cybersecurity markets, the so-called software-defined wide area networks. This is a relatively new computer networking technology, and experts say this is the next frontier in the cloud computing and cybersecurity technologies.”

Woods also teams up with Skousen on the Fast Money Alert trading service and recently notched a 93%-plus gain for those who follow their recommendations, fueled by the runaway rise in electric vehicle manufacturer Tesla, Inc. (NASDAQ:TSLA).

Chart Courtesy of www.StockCharts.com

Fortinet beat expectations on revenue, billings and earnings per share, William Blair analyst Jonathan Ho wrote recently.

“Increased work from home activity drove demand for its FortiGate, FortiClient, FortiToken, and FortiAuthentication solutions,” Ho added.

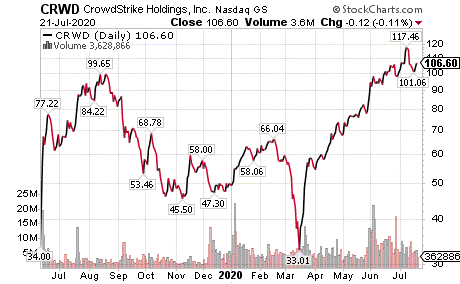

Crowdstrike Attains Spot Among 7 Cybersecurity Investments to Purchase for Growth

CrowdStrike Holdings Inc. (NASDAQ:CRWD), of Sunnyvale, California, has more than tripled since the market’s crash in March. The stock is the favorite right now of D.A. Davidson’s Nowinski, who told me he rated it as his “top pick.”

“The company is leading the endpoint security market with a best-in-class cloud-native solution, capable of stopping the most sophisticated breaches,” Nowinski said. “The competitive gap between CrowdStrike and other vendors continues to widen, even with next-gen vendors such as Carbon Black.

“Moreover, CrowdStrike is also starting to penetrate the virtual server market, which could be larger than the traditional endpoint market, as more applications move to the cloud. As such, we believe CrowdStrike is well-positioned to deliver exceptionally high average annual return growth over the next three-plus years.

Chart Courtesy of www.StockCharts.com

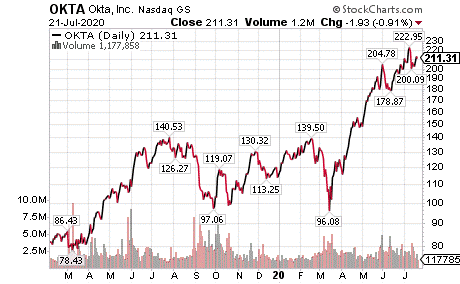

Okta Joins the 7 Cybersecurity Stocks to Purchase for Growth

“Okta is another one of our top three picks for the next 18 months,” Nowinski told me. “Okta provides a best-in-class identity security platform, which is a foundational element of the digital transformation. Moreover, Okta’s competitive advantage over Microsoft continues to widen, as the company now integrates with over 6,500 applications.”

Those total applications of San-Francisco-based Okta (NASDAQ:OKTA), which has more than doubled in share price since the market’s drop in March, are more than three times what Microsoft (NASDAQ:MSFT) currently offers, Nowinski said.

“We believe this extensive application integration will enable Okta to maintain an exceptionally high growth rate over the next three-plus years,” Nowinski said.

Chart Courtesy of www.StockCharts.com

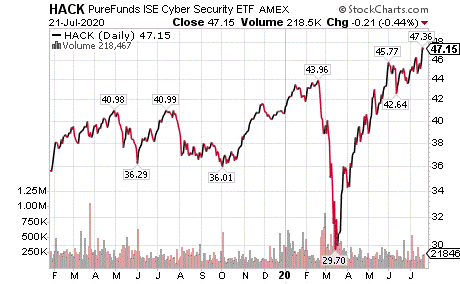

HACK Climbs More than 15% So Far in 2010 as 1 of 7 Cybersecurity Investments to Purchase

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz during an interview before social distancing became the norm after the outbreak of COVID-19.

Bob Carlson, leader of the Retirement Watch advisory service and chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, told me a conservative but profitable way to invest in cybersecurity is through ETFMG Prime Cyber Security (NYSEARCA:HACK).

The exchange-traded fund (ETF), launched in 2014, holds technology stocks but has trailed broad technology indexes during bull markets, Carlson said. On the other hand, the ETF so far has had good defensive characteristics, he added.

The fund achieved a positive return in 2018 of 6.72%, when most stocks and especially technology stocks were down for the year. It also is up 15.82% since Carlson recommended it to me for a column on December 31, 2019, aided by its 1.14% dividend yield.

Pension Fund Chairman Likes Spreading the Risk of Cybersecurity Investing in an ETF

Top holdings in the fund include Sophos Group PLC (NASDAQ:SPHHF), Carbonite (NASDAQ:CARB), Splunk (NASDAQ:SPLK), Fortinet (NASDAQ:FTNT) and Avast (NASDAQ:AVST). The ETF seeks to limit each holding to no more than 3% of its overall portfolio.

Since the ETF is thinly traded, take care when investing in it, Carlson counseled. Use a purchase price limit instead of a market order, he added.

“You don’t want a short-term surge in buying to push your purchase price artificially higher,” Carlson continued.

Chart Courtesy of www.StockCharts.com

The scourge of COVID-19 has caused 14,898,145 cases and 615,462 deaths globally, along with 3,899,072 cases and 141,992 lives lost in the United States, as of July 21. America has more cases and deaths of any other nation, including China, where COVID-19 first arose.

Nevada, Oregon and Tennessee became the latest states to report their highest single-day death figures on July 21, as a variety of reasons from reopening so-called non-essential businesses to public protests without social distancing and universal masking keep COVID-19 infections spreading. These seven cybersecurity investments to purchase offer opportunities to profit despite the continuing plague of the ongoing public health crisis.