Cyberattacks spur U.S. military to mitigate threats as investors buy stocks that offer protection from such incursions.

Recent multi-month cyberattacks against a number of federal agencies are causing U.S. military members to engage in efforts to thwart such threats, but so far there is no evidence of any compromise to the U.S. Department of Defense Information Networks (DODIN), an agency spokesman said. The risk of potential damage from any successful attacks is leading to targeted actions by the DOD to protect its systems beyond the standard measures used each day, he added.

“We will continue to work with the whole-of-government effort to mitigate cyberthreats to the nation,” the spokesman said.

Cyberattacks Spur U.S. Military to Mitigate Threats and ‘Grave Risk’

The U.S. Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency (CISA) found the threat poses a “grave risk” to the federal government, state, local, tribal and territorial governments, as well as critical infrastructure entities and other private sector organizations. The compromised cybersecurity began at least as far back as March 2020 without resulting in detection until the CISA this month issued an emergency bulletin that warned, among other things, that the adversary used virtual private servers (VPSs), often with IP addresses in the home country of the victim, for most communications to hide the activity among legitimate user traffic.

The attackers also frequently rotate their “last mile” IP addresses to different endpoints to obscure their activity and avoid detection, the CISA continued. The agency expects that the compromised cyber environments will be highly complex and challenging to remedy, since the adversary showed it can exploit software supply chains and use significant knowledge of Windows networks.

Russia is the suspected home of the perpetrators, but knowing their origin does not eliminate any damage that already has been done. The cyberattack targeted Austin, Texas-based SolarWinds Corporation (NYSE:SWI), a developer of software that helps businesses manage their networks, systems and information technology infrastructure.

Cyberattacks Spur U.S. Military to Mitigate Threats as SolarWinds’ Products Compromised

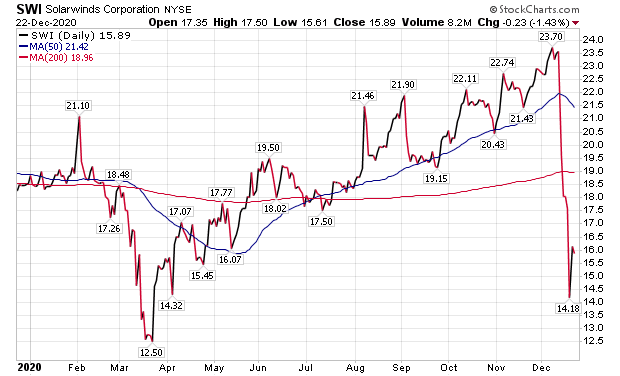

The shares of SolarWinds Corporation rose 13.68%, or $1.94, to close at $16.12 on Monday, Dec. 21, as it rebounded after announcing in a Dec. 14 8-K document filed with the Securities and Exchange Commission (SEC) that a cyberattack inserted a vulnerability within its Orion monitoring products may have caused the compromise of servers. The stock’s recovery stalled on Tuesday, Dec. 22, when it slid 23 cents a share, or 1.43%, to $15.89.

Chart courtesy of www.stockcharts.com

The company reported the “incident” likely was the result of a highly sophisticated, targeted and manual supply chain attack by an outside nation-state, but SolarWinds indicated it had not been able to independently verify the identity of the attacker. SolarWinds reported in its SEC filing that it has retained third-party cybersecurity experts to assist in an investigation of these matters, including whether a vulnerability in its Orion monitoring products was exploited as a point of infiltration of any customer systems. The experts also will assist SolarWinds in the development of appropriate mitigation and remediation plans.

SolarWinds confirmed it is cooperating with the Federal Bureau of Investigation (FBI), the U.S. intelligence community and other government agencies in probes related to this incident. Based on its investigation to date, SolarWinds found that the vulnerability was inserted within its Orion products and existed in updates released between the relevant period of March and June 2020. But the vulnerability was not present in the source code repository of the Orion products.

SolarWinds has taken steps to remediate the compromise of the Orion software and is investigating what additional steps, if any, are needed. The company announced it is not aware that the vulnerability exists in any of its other products.

However, the fallout could hurt the company and many of its clients in the months ahead. The hackers reportedly obtained sensitive information and communications of SolarWinds’ clients such as the U.S. Departments of Treasury, Commerce and Energy, as well as the Los Alamos National Laboratory, which oversees the U.S. government’s nuclear weapons.

Recovery of SolarWinds’ Shares Does Not Remove Risk to Investors, Money Manager Says

Hilary Kramer, host of a national radio program, “Millionaire Maker,” and head of the GameChangers and Value Authority advisory services, said she would not buy the dip in SolarWinds’ shares because contracts within the industry are so competitive that whenever one vendor shows any sign of weakness, the others pounce to “devour the remaining contracts.” It is a “real shark tank” and there’s blood in the water now, she added.

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader, High Octane Trader and Inner Circle.

Whether SolarWinds did anything wrong remains to be proven but from Wall Street’s perspective it does not matter, Kramer counseled. It was a $24 stock two weeks ago but bouncing from $14 to $16 may be the only recovery shareholders will see for years to come while the company’s reputation recovers, she cautioned.

“Cybersecurity becomes more urgent every year and also more crowded,” Kramer said. “A lot of money is packed into these stocks and they aren’t all going to get a good spot at the table… there’s only a finite number of important contracts available and when all the big enterprises have gotten serious about protecting their networks, that’s it.”

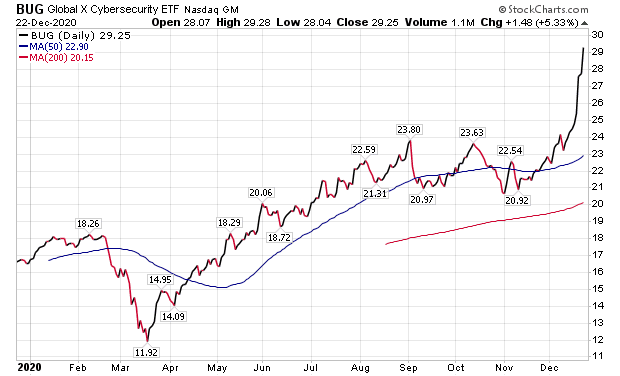

Chart courtesy of www.stockcharts.com

“I love the theme, but rather than recommend a concentrated all-or-nothing position on one or two security stocks, a diversified approach has worked a whole lot better here over time to ensure that you’re invested in all the ultimate winners,” Kramer said. “An exchange-traded fund like Global X Cybersecurity (NYSE:BUG) contains all the major players around the world, weighted by current market footprint. It has done extremely well this year. And a look at BUG’s holdings reveals that while SolarWinds made a lot of headlines, it wasn’t really a force in the overall industry.”

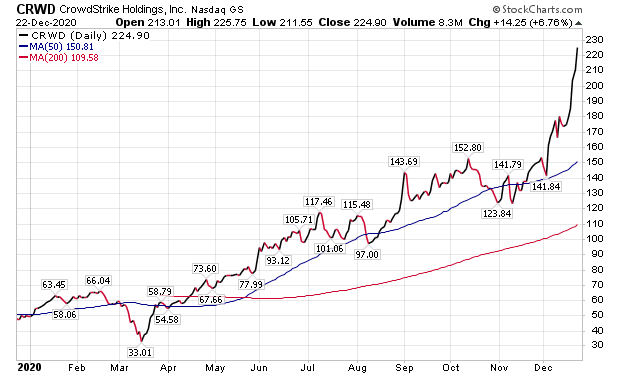

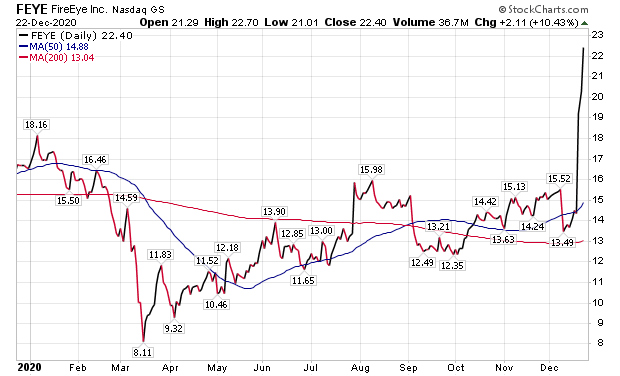

For investors seeking to purchase individual cybersecurity stocks, CrowdStrike Holdings Inc. (NASDAQ:CRWD) or FireEye (NASDAQ:FEYE) would be the “purest plays” but they are expensive, Kramer added.

Chart courtesy of www.stockcharts.com

Chart courtesy of www.stockcharts.com

Cyberattacks Spur U.S. Military to Mitigate Threats but Give Pension Chairman Investing Ideas

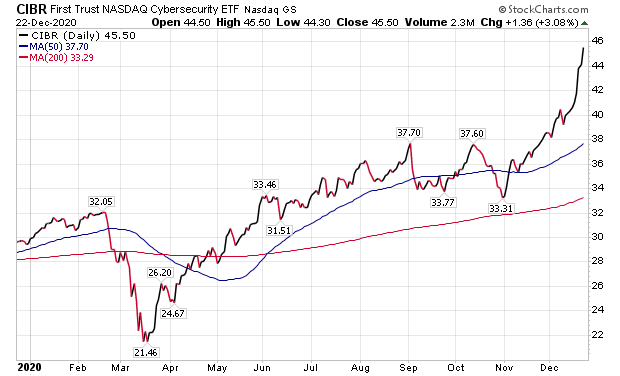

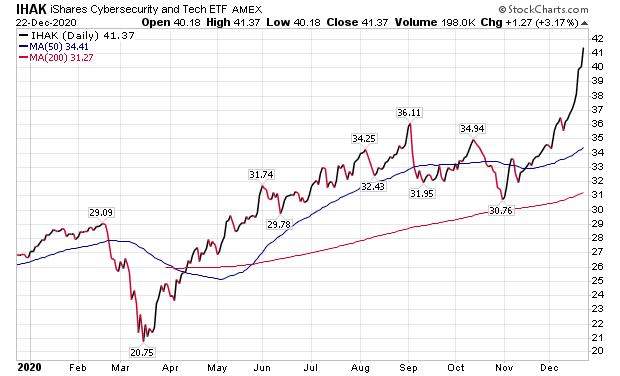

Investors interested in a diversified portfolio of cybersecurity stocks can choose between either of two exchange-traded funds (ETFs), First Trust NASDAQ Cybersecurity (NASDAQ:CIBR) or iShares Cybersecurity & Tech (AMEX:IHAK), said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. Carlson, who also heads the Retirement Watch investment newsletter, mentioned both exchange-traded funds are “closely correlated” with each other, though IHAK has slightly higher returns over the last 12 months.

Chart courtesy of www.stockcharts.com

Chart courtesy of www.stockcharts.com

“The SolarWinds hack will generate additional revenue for cybersecurity companies over the next 12 months and increase investor enthusiasm for the stocks,” Carlson said. “Rather than trying to pick one or two stocks that would benefit the most and become dominant providers, most investors are better off with a diversified portfolio of quality companies in the sector.”

However, investors should be cautious, Carlson counseled. The cybersecurity stocks have soared during the last two months. Their stock prices could be well ahead of their fundamentals, he warned.

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz in an interview before social distancing became routine after the COVID-19 outbreak.

Cyberattacks Spur U.S. Military to Mitigate Threats and Raise Interest in Zscaler

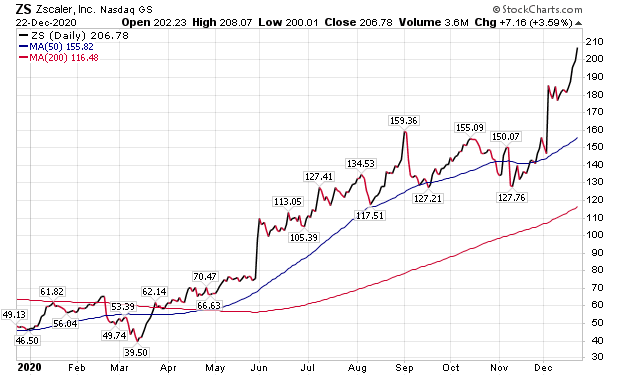

“The massive data breach and likely Russian cyber-attack just highlights the need for security architecture in place for any major company or organization,” said Jim Woods, editor of Successful Investing, Intelligence Report and Bullseye Stock Trader. “My favorite stock in this space is global cloud security firm Zscaler (NASDAQ:ZS).”

Chart courtesy of www.stockcharts.com

Woods praised San Jose, California-based Zscaler for its combination of strong earnings growth and relative price strength. As the biggest provider of cloud-based web security gateways that inspect customers’ data traffic for malware, ZS security software may have plugged the Russian malware attack before it could take root in some of America’s most-sensitive networks, said Woods, who also is the co-head of the Fast Money Alert trading service.

FireEye has rebounded nicely from the breach, too, Woods added.

Cyberattacks Spur U.S. Military to Mitigate Threats as a Key Safeguard, Says DOD Cyber Leader

An analogy to cyber defense in depth exists in securing a building through the use of the brick and steel of the structure, silent alarms, guards, a vault and tags on the money to identify it as stolen if ultimately recovered later, said Col. Patrick Ryan, a reserve advisor to the commander of the Joint Force Headquarters — DODIN.

In cyber defense, we have a perimeter boundary, rout them out and harden the terrain, Col. Ryan said. The boundary, mid-point and end-point protections work together to harden terrain, but the duty is to secure, operate and defend the cyber warfare domain, he added.

“Our role is to defend, operate, secure against adversary action and reduce risk and threats that undermine mission assurance,” Col. Ryan said.

Cyberattacks Spur U.S. Military to Mitigate Threats to Ensure Operations Continue

The U.S. military’s cyber services need to ensure planes can take off, Navy ships can navigate and satellites can operate safely in space. Basically, in today’s digital world, all military missions operate in, through and from the cyber domain.

One strategy of U.S. military cyber defenses is to increase the cost to adversaries that seek to harm U.S. interests and interfere with its operations, Col. Ryan said.

“The harder we make the job of the adversaries, the realization for them could become not to engage with the DODIN, specifically,” Col. Ryan said.

Cyber security is important for ground, air and space missions.

Cyberattacks Spur U.S. Military to Mitigate Threats Just as Businesses Do

Lt. Col. Stacey Shade, a National Guardsman who is part of the intelligence directorate at the Joint Force Headquarters — DODIN, is a 28-year military man who works in information technology (IT) and cyber security.

“We face the same issues in the military and civilian world,” Lt. Col. Shade said.

What we do is use a threat-informing methodology and prioritize vulnerabilities, Lt. Col. Shade continued. A sheer volume of 146,000 vulnerabilities exist in the database that is compiled, cataloged and tracked by the National Institute of Standards and Technology (NIST).

Cyberattacks Spur U.S. Military to Mitigate Threats Amid COVID-19 Crisis

Despite the COVID-19 pandemic not stopping the rise of most cybersecurity stocks, the virus has caused severe economic fallout and huge job cuts. A recent surge in cases even ensnared President Trump, who was hospitalized between Friday, Oct. 2, and Monday, Oct. 5. The overall weekly hospitalization rate is at its highest point in the pandemic, with steep jumps in individuals aged 65 years and older, according to the Centers for Disease Control and Prevention (CDC).

COVID-19 cases have totaled 18,236,615 and led to 322,832 deaths in the United States, along with 78,028,353 cases and 1,717,124 deaths worldwide, as of Dec. 23, according to Johns Hopkins University. America has the dubious distinction of enduring the most cases and deaths of any country.

The United States added 195,033 new coronavirus cases and 3,401 deaths on Tuesday, Dec. 22, Johns Hopkins University reported. The death toll was the second-highest daily number in the United States, trailing only the 3,682 who succumbed on Dec. 16, marking the fifth time during the pandemic that the country has suffered more than 3,000 Covid-19 fatalities in a day.

The cybersecurity stocks and funds to buy mostly come at comparatively high prices, so bargain hunters may choose to stay patient in hopes of a pullback. But the sophisticated cyberattack that has alarmed U.S. officials and business leaders alike shows a great need for cybersecurity and could keep a floor under these stocks and funds, despite any short-term pullbacks.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a holiday gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.