Five food stocks to buy for fueling portfolios feature a frozen potato provider, a chocolate maker, the owner of Frito-Lay and Quaker Oats, a cheese and ketchup conglomerate, and a provider of premium sauces.

The ongoing war in Ukraine is not stopping any of the food stocks from floating above the market mayhem. People still need to eat, so cutbacks typically come from other products and services.

BofA Global Research follows the industry closely and the five food stocks to buy for fortifying portfolios are on its list of recommendations. Here are the highlights.

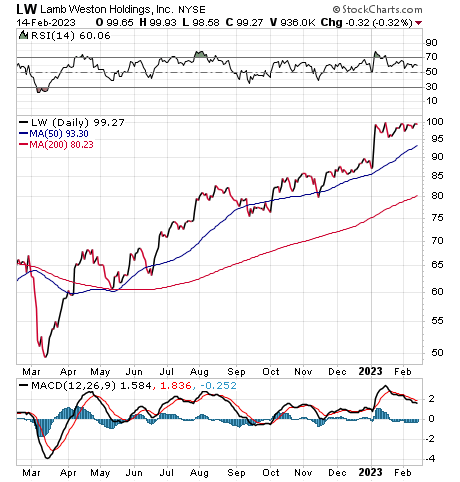

Five Food Stocks to Buy for Fortifying Portfolios: Lamb Weston

Lamb Weston Holdings, Inc. (NYSE: LW), of Eagle, Idaho, supplies frozen potato, sweet potato, appetizer and vegetable products to restaurants and retailers worldwide. For more than 60 years, Lamb Weston has sought to introduce uniquely presented products distributed to more than 100 countries.

The company has manufacturing operations in the Pacific Northwest, primarily in the Columbia River Basin, arguably the world’s best potato-growing region. Lamb Weston employs more than 7,000 people worldwide in sales offices, manufacturing plants and corporate offices.

BofA gave Lamb Weston Holdings a price objective of $115, a premium to the packaged food index. The investment firm wrote that the higher valuation compared to peer companies is warranted, since Lamb Weston is poised to approach pre-COVID levels with favorable demand trends and margin potential in fiscal year 2023 and 2024.

Chart courtesy of www.stockcharts.com

Can Lamb Weston End up Roaring Like a Lion?

Reasons why Lamb Weston could surpass its $115 price target include demand rebounding faster than expected and category growth staying above 3% with tight industry supply expected to continue in the medium- to long-term. Tight supply permits providers to hike prices to both global and food service customers, BofA wrote.

Risks to reaching the $115 price target include higher-than-expected potato costs, unforeseen problems propelling price increases to cover inflation and restore margins, any influx of new industry capacity and a slowdown in on-premise sales activity if consumers face reduced spending power.

Bryan Perry, the leader of the Cash Machine investment newsletter and the Breakout Options Alert trading service, recommended Lamb Weston call options in the latter service. The stock is up 11.76% so far this year, as of the close on Feb. 14.

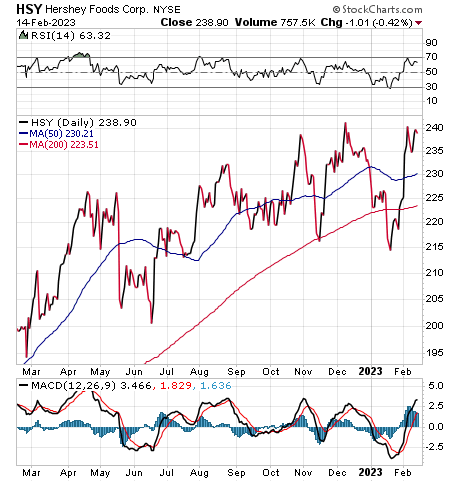

Five Food Stocks to Buy for Fortifying Portfolios Include Hershey

BofA also recommended The Hershey Co. (NYSE: HSY), setting a $270 price target. With some slack in capacity, Hershey is better positioned now than in recent years to service demand upside if it occurs, BofA wrote in a research note.

For fiscal year 2023 guidance, HSY provided perspective on sales, pricing and inflation, causing BofA to write that it did not expect much surprise one way or another about the company’s earnings. Hershey is executing on its pricing actions and has seen lower-than-expected elasticities across its portfolio as consumers continue to spend on sweet treats and snacking occasions in an inflationary environment, BofA wrote.

“In addition, HSY has been able to maintain share in its categories with the lowest private label exposure in its peer set,” BofA continued.

Potential outperformance could come from continued market share gains in a low private label exposure environment, faster moderation of inflation, low elasticity of demand persisting and volume gains offsetting any pricing decelerations, BofA opined. Possible risks to reaching the price target include elevated inflation taking longer than expected to taper off, competitors grabbing market share from HSY and negative surprises on packaging, logistics or special ingredient costs that aren’t traditionally hedged by Hershey.

Chart courtesy of www.stockcharts.com

Jim Woods, who leads the Bullseye Stock Trader advisory service and the Intelligence Report investment newsletter, is not currently recommending Hershey but has done so in the past. Woods features an Income Multipliers portfolio in his newsletter that seeks to identify stocks on the ascent that also pay dividends just like Hershey.

Paul Dykewicz meets with Jim Woods, head of Bullseye Stock Trader.

Woods, who openly acknowledges his fondness for quality food and drinks, likes to use his personal preferences in choosing the stocks he recommends. As Hershey is a stock Woods has recommended in the past, he may do so again.

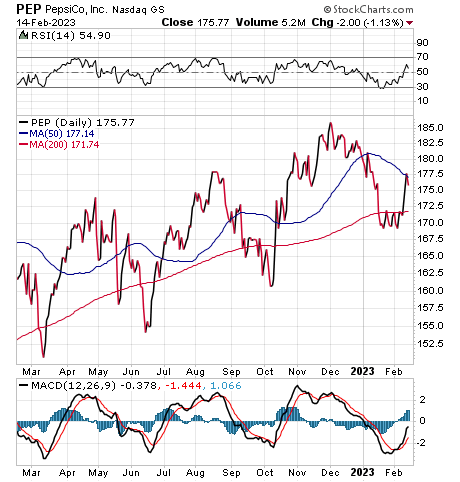

PepsiCo Fits With Five Food Stocks to Buy for Fortifying Portfolios

PepsiCo is a major beverage company that also owns the Frito-Lay brand of snack foods and Quaker Oats. BoA put a $205 price target on PepsiCo, along with a buy recommendation.

“We expect PEP is set up for another quarter of strong organic sales growth, modeling 4Q22 organic sales growth of +8%,” BofA wrote.

PepsiCo is valued at a premium to its non-alcoholic-beverage peers that is “justified” based on the view that the stock is positioned to deliver against its long-term algorithm and return cash to shareholders via dividends and share repurchases, the investment firm wrote.

Advantages for PepsiCo include low-to-moderate foreign exchange headwinds, growth opportunities and improving volume/price/mix in soft drinks.

Risks to reaching the price target come from foreign exchange becoming a drag on results and Frito-Lay North America incurring a decline in volumes due to price hikes.

Chart courtesy of www.stockcharts.com

Connell Cites Growing Food Revenue in Recommending Pepsi

Michelle Connell leads Dallas-based Portia Capital Management.

Pepsi is a world-class competitor in the snack and convenience food category, Connell said. The U.S. snack market is valued at $115 billion and Pepsi currently has 20% share, she added.

With 55% of sales coming from snack and convenience foods, Pepsi’s leaders know that food is one of the keys to the company’s success, Connell said.

To make sure that it continues to hold its ranking in this segment, Pepsi is investing in the innovation of its snacks, Connell said. In 2020, Pepsi created a growth office for its snack products.

Pepsi is researching different ingredients, packaging formats and flavors to enhance its presence in the category, said Parth Raval, chief growth officer for PepsiCo Foods North America, comprising Frito-Lay North America, Quaker Foods North America and PepsiCo Foods Canada. The company has found that consumers increasingly are turning to snacks instead of full meals.

“Families are frequently so busy that a traditional sit-down meal is not an option,” Connell said. “Pepsi is trying to appeal to this behavioral change.”

For example, consumers now turn to Quaker granola bars outside of breakfast. Also, a line of “Tostitos Toppers” was created to take advantage of this behavior, Connell counseled.

Pepsi further created two direct-to-consumer websites for its snacks. One of these is Snacks.com. These online options allow a consumer to find flavors or brands that may not be easily found on store shelves.

An example of an unusual new flavor is Southern Biscuit & Gravy Lays Potato Chips, Connell said. They can be found in most Southern gas stations, she added.

Pepsi Propels Dividend Payout 10%

Pepsi announced a 10% boost in its dividend payout when it released its fourth-quarter financial results on Feb. 9. The quarterly dividend rose to $1.265, marking the 51st year in a row that Pepsi has raised its payout.

Pepsi continued its streak of consistently beating Wall Street expectations with its latest financial results. Organic revenue grew 14% in North America and 16% in international markets, Connell said.

Price hikes to consumers drove Pepsi’s revenue growth, not an increase in sales volume, Connell continued. The company’s chief executive officer said there is no near-term intention of further price increases, but recent price hikes will not be cut in the future.

All segments of Pepsi’s businesses continued to experience strong demand for its products, but the Gatorade, Pepsi and Mountain Dew beverage brands showed high demand.

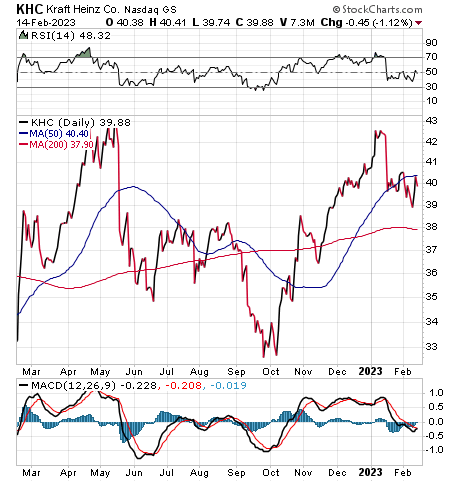

Five Food Stocks to Buy for Fortifying Portfolios: Kraft Heinz

BofA gave Chicago-based Kraft Heinz Company (NASDAQ: KHC) a buy recommendation and a $48 price objective. The valuation is below the packaged food group average but the investment firm wrote at-home food consumption remains elevated as consumers show sensitivity to the higher cost of eating out.

KHC could outperform expectations with continued improvement in market share trends and services levels, topline strength driving organic sales growth and pricing strength protecting margins. Another plus could come from quicker than expected tapering in inflation.

Risks that could hurt the stock price performance include high inflation persisting longer than expected and pressuring margins and consumers trading down to buy private label products, BofA wrote. If demand elasticities worsen while pricing simultaneously tapers off, organic sales growth could be “sandbagged,” BofA wrote.

Chart courtesy of www.stockcharts.com

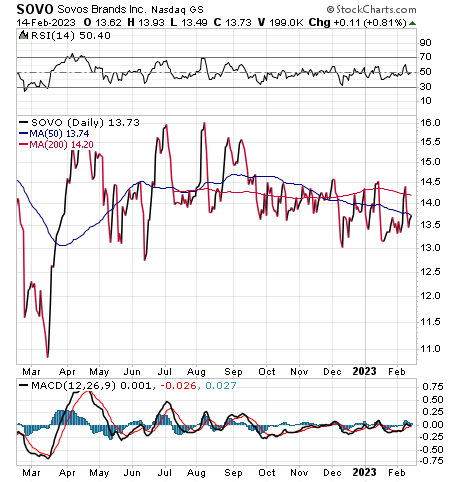

Five Food Stocks to Buy for Fortifying Portfolios: Sovos Brands

Sovos Brands Inc. (NASDAQ: SOVO), of Louisville, Colorado, is another buy recommendation of BofA. The investment firm predicts potential upside for fourth-quarter sales at Sovos Brands due to scanner data showing double-digit-percentage growth in sauce, frozen, soup and pasta.

BofA recently reduced its 2023-2024 sales and adjusted earnings before interest, taxes and depreciation (EBITDA) estimates to reflect the Birch Benders divestiture. The company distributes Rao’s sauce, as well as Rao’s brand extensions into areas such as frozen pizzas.

BofA placed a $17 price objective on SOVO, valuing it comparably with its closest small- to mid-cap food peers that share similar sales growth and EBITDA margin profiles. BofA predicts SOVO’s value gap will close as the company delivers on Rao’s distribution expansion goals.

Risks to Sovos reaching the $17 price objective include inflation rising higher than forecast and an inability to offset with pricing. Other risks include consumers switching to lower-priced brands due to inflation across the food sector and potentially worse elasticity of demand than the company currently expects. Another challenge could come from growing its Noosa business, with further risk posed by supply chain related to its La Regina co-packing based in Italy.

Chart courtesy of www.stockcharts.com

Russia’s Invasion of Ukraine Intensifies

The five food stocks to buy for fortifying portfolios mostly have been spared from effects of the ferocious fighting taking place in Bakhmut, Ukraine, where Russian forces are seeking to seize control of a key highway and capture a key transportation route. Russian airborne units have joined Wagner mercenary fighters in the battle for the city.

Russia’s troops have been “leveling Bakhmut to the ground, killing everyone they can reach,” Pavlo Kyrylenko, a Ukrainian prosecutor and politician who also is the current Governor of Donetsk Oblast, wrote on Telegram. Russia claimed to have captured a village just to north of Bakhmut as it tries to surround the city and seize control.

The U.S. State Department accused Russia of violating a key nuclear arms agreement by refusing to allow inspections of its nuclear facilities. The only agreement left to regulate the nuclear arsenals of the United States and Russia is the New START treaty, but inspections have been on hold since 2020 due to the COVID-19 pandemic.

Diabetes Increases Risk of Severe COVID, Report Indicates

Diabetics who have elevated blood sugar levels face a significantly higher risk of being hospitalized with severe illness from COVID-19, according to the International Diabetes Federation (IDF). Headquartered in Brussels, Belgium. the Federation reported “poor glycemic control was a risk factor for adverse COVID-19 endpoints.”

Worldwide COVID-19 deaths rose to 6,856,252 people, with total cases of 673,213,963, Johns Hopkins reported on Feb. 14. COVID-19 cases in the United States totaled 102,904,309, while deaths reached 1,114,990 as of Feb. 14, according to Johns Hopkins University. Until recent reports that China had more than 248 million cases of COVID-19, America had ranked as the nation with the most coronavirus cases and deaths.

The U.S. Centers for Disease Control and Prevention reported that 269,208,743 people, or 81.1% of the U.S. population, have received at least one dose of a COVID-19 vaccine, as of Feb. 8. People who have completed the primary COVID-19 doses totaled 229,820,324 of the U.S. population, or 69.2%, according to the CDC. The United States has given a bivalent COVID-19 booster to 49,078,211 people who are age 18 and up, equaling 19.2% as of Feb. 8, 19% on Feb. 1 and 18.8% on Jan. 26.

The five food stocks to buy for fortifying portfolios are enticing investments at a time when industries such as technology have been struggling to recoup 2022 share price plunges. Even though technology tends to outperform for the long term, food stocks most recently have been satisfying consumer tastes in the equities markets.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and

DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Special Holiday Offer: Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases.

![[woman shopping at grocery store]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_133181729.jpg)