Nissan’s stock price slid after Japanese prosecutors ordered the re-arrest of visionary auto industry leader Carlos Ghosn on suspicion of “aggravated breach of trust” in the wake of a Japanese court refusing to extend his detention that began on Nov. 19 because he allegedly under reported his pay between 2011 and 2015 by $44.3 million.

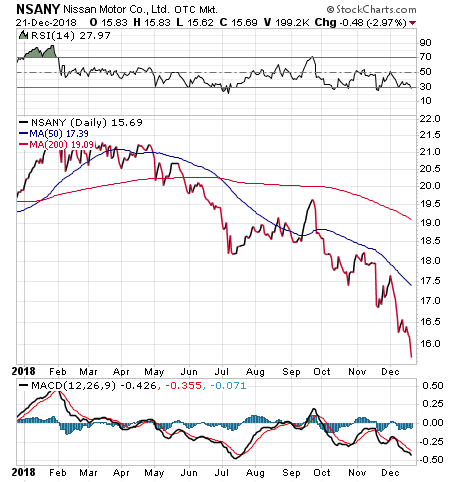

Nissan Motor Co Ltd. (OTC: NSANY) shares fell 2.04 percent on the Tokyo Stock Exchange and 2.97 percent on the Over the Counter market in the United States on Friday, Dec. 21, after the new accusations were made. The stock is down more than 12.59 percent since Nov. 16, the last trading day before Nissan’s former chairman Ghosn, 64, was taken into custody.

The board of directors at Nissan removed Ghosn as chairman in a unanimous vote on Nov. 22 that some news reports now indicate may have stemmed, in part, from a power struggle with Nissan Chief Executive Officer Hiroto Saikawa. Ghosn, who orchestrated the Renault-Nissan-Mitsubishi alliance and led it to become the world’s second-largest auto manufacturing group, based on units sold in 2017, was voted out as chairman of Mitsubishi on Nov. 26.

However, Ghosn has not been stripped of his roles as chairman and chief executive officer at France-based Renault SA (OTC:RNSDF), which is seeking evidence about the executive’s alleged wrongdoing. Renault may have benefitted the most from the alliance due to its 43 percent ownership of bigger and more profitable Nissan. Renault’s relative strength in the alliance may be slipping, with Nissan now selling one-third more cars annually than its partner and the Japanese company’s management reportedly seeking increased decision-making clout.

But Renault’s stake in Nissan almost triples the latter company’s 15 percent share of its France-based alliance member. Renault, on the other hand, does not have an equity stake in Mitsubishi. However, the French government owns 15 percent of Renault and may influence the company’s future course.

Nissan’s Stock Price Keeps Falling Since Ghosn’s Detention

Nissan’s share price fell about 5.5 percent on Nov. 19 when Ghosn, then the chairman of the Japanese auto maker and its two alliance partners Mitsubishi and Renault, was locked up after landing in Japan for a business trip. Ghosn has indicated through representatives that he wants to clear his name and reputation rather than agree to a plea deal.

Chart Courtesy of stockcharts.com

Nissan’s board of directors on Dec. 17 approved the creation of the Special Committee for Improving Governance at the company. The board acknowledged ongoing discussions about the nomination of a new chairman and reaffirmed its ongoing efforts to inform its alliance partners, Renault and Mitsubishi Motors Corporation, about its activities.

Nissan’s Stock Price Plunges after Japanese Prosecutors Pounce

The aggressive Japanese prosecutors effectively doubled down on their pursuit of Ghosn by introducing new claims of wrongdoing to keep him locked up, despite not charging him with any illegal activities for most of his time in detention.

Ghosn’s legal team has indicated some of the compensation in question has not been paid to him and thereby would not require declaration as income for tax purposes. In contrast with the United States, Japan’s legal system allows people to be arrested and held for weeks without the filing of any charges.

The move of adding new accusations against Ghosn allowed prosecutors to begin a new clock to keep him detained for additional time in austere conditions. Japanese broadcaster NHK reported prosecutors now claim Ghosn shifted a private investment loss of more than $16 million to Nissan in the wake of the 2008 financial crisis.

If Ghosn is found guilty of financial misconduct charges, the potential penalties include up to 10 years in prison and a fine of as much as $6.2 million, or £4.9 million. In contrast to the accusations of malfeasance, Ghosn led the Renault-Nissan-Mitsubishi Alliance in achieving huge cost savings, while sharing parts and suppliers, among other assorted advantages.

Nissan’s Stock Price Drop Shows No Signs of Abating

Ghosn championed the successful three-way alliance between Mitsubishi (MMTOF), Nissan (NSANY) and France’s Renault (RNSDF), but reportedly had been considering an outright Renault-Nissan merger.

The Renault-Nissan-Mitsubishi Alliance is powerful, since it combines to build one of every nine cars sold globally. The three companies employ 470,000-plus people in almost 200 countries. Mitsubishi Motors Corp., the smallest alliance member, aligned with the others in 2016 when Nissan acquired 33 percent of its fellow Japanese automaker. Both Nissan, one of Japan’s largest auto makers, and Mitsubishi are among the car manufacturers worldwide that have admitted to falsifying diesel emissions tests.

Bob Carlson, who heads the Retirement Watch advisory service, recommended against buying Nissan amid the fallout from the arrest of Ghosn and fellow executive Greg Kelly. Japanese prosecutors accused the two executives of violating Japan’s Financial Instruments and Exchange Act, according to Automotive News. Nissan itself also has been accused of allowing Ghosn to under report his earnings.

Nissan’s Stock Price Slide Adds Risk for Shareholders

“The best principle in this case is ‘don’t try to catch a falling knife,’” Carlson said. “At some point, Nissan is likely to be a good value. But we can’t know what additional bad news might come out. It’s best to watch the stock and wait until the company can put all this behind it and focus on its business.”

The Ghosn jailing is just adding “more and more uncertainty” for Nissan shareholders, said Jim Woods, editor of Successful Investing and Intelligence Report investment newsletters.

“Although I admire any man willing to fight for his freedom, values and justice, especially if he feels unjustly accused, that fight comes at a price,” Woods said. “Unfortunately, Nissan shareholders also are paying that price.”

Hilary Kramer, who advised the sale of Ford Motor Company (NYSE:F) to subscribers of her Turbo Trader and Inner Circle advisory services several months ago, currently is not recommending any auto makers, but she said Ghosn’s troubles will be a cloud over Nissan and its stock price for a while. At some point next year, the situation likely will fade into the background and Nissan will trade on its fundamentals, she added.

Nissan is down by double-digit percentages since the announcement of Ghosn’s arrest, compared to a modest decline in the Nikkei, said Kramer, whose Value Authority investment advisory service has achieved double-digit-percentage profits in its past six closed positions. Interestingly, the share price of rival Japanese automaker Toyota Motor Co. (NYSE:TM) is up a little bit since the announcement of Ghosn’s detention, she added.

Japanese prosecutors have hurt investors by pursuing their accusations against a key auto industry leader and keeping him incarcerated for more than a month without bail. It demonstrates the political risk that comes from investing in foreign companies that operate under legal systems that limit the rights of the accused to defend themselves. Investors need to weigh such risks when deciding which auto companies may be worthy of investment.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz.