Amazon’s 25th anniversary highlights rewarding strategies for investors that helped the company’s management to grow its e-commerce business into one of the world’s most valuable enterprises.

Investors may find Amazon’s strategies useful in identifying them in other companies whose shares may be worth buying. Amazon (NASDAQ:AMZN) began humbly in the garage of founder and CEO Jeff Bezos on July 5, 1994, producing weekly sales of $20,000 within just two weeks to begin an ascent that reached a market capitalization of $1 trillion in 2018 before dipping to $961.19 billion at the close of trading on Monday, July 8.

Amazon has soared 29.18 percent since I wrote my last investment column about it on Dec. 31, when I described its stock price plunge as a buying opportunity.

Amazon has become a case study in providing business lessons to modern-day startups. The company’s continued growth has been aided by more than 40 acquisitions, including its $13.7 billion purchase of Whole Foods Market in August 2017 to disrupt the grocery industry by making home deliveries more commonplace around the United States than ever before.

Chart courtesy of StockCharts.com

Amazon’s 25th Anniversary Highlights Include Its Focus on Customers

The company’s key to success stemmed from Bezos learning that internet usage was growing by 2,300 percent a year in 1994. He soon thereafter chose to leave a job on Wall Street to launch Amazon and initially decided to focus on selling books, since the customer base was too big for direct mail catalog providers to serve as efficiently as his new e-commerce business.

Investors who want to buy shares in the kinds of companies that have the potential to disrupt existing industries that way Amazon did may be wise to look at the e-commerce behemoth’s success formula. Amazon employs key strategies that transformed it into a “great” company that other businesses can emulate, said Tom Forte, a managing director and a senior research analyst at D.A. Davidson & Co.

Forte, who has developed a specialty in covering e-commerce companies, wrote in a July 5 research note that he viewed a key Amazon strategy as focusing on the customers first and then working backwards to consider the competition when creating a new product or service. Start with what a customer wants and create the product or service that best suits his or her needs, Forte said.

“If we could only pick one business lesson from Amazon, this would be the one,” Forte advised. “Because of all the business lessons from Amazon, we consider this one the most useful for another company interested in employing Amazon’s best practices to disrupt an industry.”

Tom Forte

Amazon’s 25th Anniversary Highlights Its Goal of Continuous Improvement

Another characteristic Forte said he admires about Amazon is its “iterative process” to make continual refinements to improve its activities. Amazon does not always succeed the first time it ventures into something new, but by iterating, it seeks to improve the second time, do even better the third time and adapt as needed in the future, he added.

“We consider this the Amazon version of the adage — if, at first, you don’t succeed, try, try again,” Forte opined.

Amazon management accepted losing money during its early years as a strategy to gain market share. Decisions aimed at growing sales sometimes failed to produce the desired results but were used as learning experiences to operate successfully and profitably in the future.

Amazon’s 25th Anniversary Highlights its Fast-Delivery ‘Flywheel’

Amazon also has created a “flywheel” that consists of offering low prices, large selection and fast delivery, which Forte described as the “most frequently mentioned strategy” used by the company. The concept of a flywheel is that once it begins spinning, it quickly can gain momentum.

The concept is like a “snowball effect,” in which the size of a snowball grows bigger as it rolls down a hill. However, a flywheel never has to stop.

Amazon has been able to develop specific areas of its business that its leaders envision as integral to supporting its flywheel strategy. The intent is to create happy customers who stay loyal to the company by aiming to provide products and services that people really want and need.

Amazon’s 25th Anniversary Highlights Embracing and Driving Change

A willingness to embrace and drive change is another reason why Amazon has grown into one of the world’s largest companies, Forte continued. That characteristic is one of the core values of Zappos, an online shoe and clothing retailer that Amazon acquired in July 2009 for $928 million.

At the time of its acquisition, Zappos had built a reputation for its customer-friendly service, free shipping and free returns policy that enticed shoppers to buy shoes from the e-commerce website. Upon purchasing Zappos, Amazon allowed its new business to continue operating as it had in the past.

“What makes Amazon so remarkable, in our view, is how it has changed during its first 25 years,” Forte wrote in his research note.

Amazon’s 25th Anniversary Highlights Losing Money to Grow Sales

Amazon ultimately became an unquestioned success by losing money as a strategy long before the advent of Uber Technologies Inc. (NYSE:UBER), Pinterest, Inc. (NYSE:PINS), and, seemingly, every other newly minted initial public offering (IPO) company, Forte indicated. Also, other growth-oriented companies that chose to accept early financial losses include Roku, Inc. (NASDAQ:ROKU), Shopify Inc. (NYSE:SHOP) and Wayfair Inc. (NYSE:W), he added.

“The company either was the first or, at least, the best at losing money in its first-party retail efforts to take market share,” Forte continued. “Its ability to develop other, more profitable ventures, such as third-party retail, cloud computing and, more recently, advertising, have further enhanced its ability to run its first-party retail efforts at break-even, if not worse. And this is one main reason it has been so disruptive in the retail sector.”

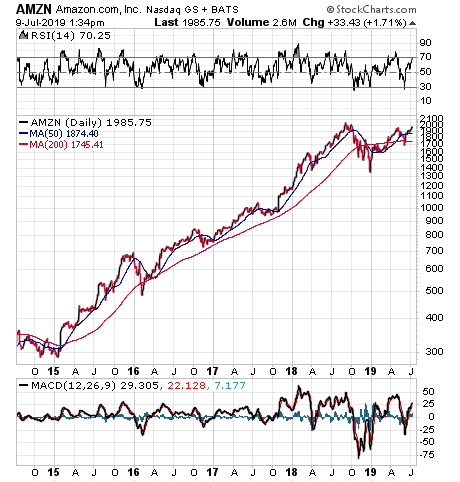

A glimpse of Amazon’s stock price for the past five years shows how it has been rewarded by investors.

Chart courtesy of stockcharts.com

Amazon’s 25th Anniversary Highlights Potential Areas of Improvement

Just like any company, Amazon is not perfect. The company’s management often is among the first to admit its shortcomings and to stay open to change.

“While we appreciate the company’s strategy of, often, quickly exiting initiatives that are not successful rather than investing the time and effort — and capital — to get them right, over time, we believe this can be a weakness and not a strength,” Forte wrote in his July 5 research note.

For example, Amazon should have made multiple attempts to develop a proprietary smartphone, Forte said. Its failure in this area leaves it vulnerable to Apple, Inc. (NASDAQ:AAPL) and Alphabet Inc.’s Google (NASDAQ:GOOGL), he added.

“We believe its inability to exploit the Chinese e-commerce market — the world’s largest — is its greatest failure and it must continue to find a strategy to succeed in China, no matter how many times it fails,” Forte opined.

Amazon’s 25th Anniversary Highlights the Challenge of Sustaining Growth

The challenge Amazon faces in sustaining its growth comes up again and again on the company’s earnings calls each quarter, said Hilary Kramer, a Wall Street money manager who leads the Value Authority, GameChangers, Turbo Trader, High Octane Trader and Inner Circle advisory services for individual investors.

“It’s the law of large numbers, which boils down to growth becoming harder and harder to sustain the bigger a company gets,” Kramer continued. “Amazon is enormous. We’re looking for at least $300 billion in revenue here next year. On that scale, it takes $50 billion a year in organic sales just to maintain 16 percent growth. That’s an extraordinary amount of money, roughly 11 percent of all the growth in the entire U.S. economy.”

For one company to achieve that level of performance in a single year would be “spectacular,” Kramer said. To do it again and again each year ultimately will push the odds to sustain its pace of growth too far, she added.

“Management started to surrender to this mathematical fact with the 3Q18 earnings call on Oct. 25 alongside similar guidance cuts at Apple and Alphabet,” Kramer said.

Amazon’s 25th Anniversary Highlights Flattening Growth Curves

Amazon’s growth curves are flattening as its revenue and earnings numbers increase, Kramer continued. It goes beyond the weaker-than-hoped 2018 holiday quarter or whether Amazon’s many massive operations have hit any walls, she added.

“The real disruptive years are already receding in the rear view and reflected in the stock price,” Kramer said. “Look at Walmart Inc. (NYSE:WMT), where $15 billion in new sales come in every year but it only moves the growth needle at a 1-3 percent crawl. It is nothing to get excited about. Even if Amazon keeps expanding, it’s going to hit that point in the next 4-5 years. Where it goes from there is the question Walmart is facing today.”

Now that its growth curves are flattening, all Amazon management has been able to do is acquire new businesses and adjust its accounting accordingly, Kramer said. Half of U.S. households subscribe to the Amazon Prime delivery service, the company’s $119 annual free-shipping program, so a day is coming when global subscription revenue will hit a limit, she added.

Amazon’s 25th Anniversary Highlights Retail Growth Limits

Amazon also faces a steep climb to grow its retail business through its marketplace of third-party vendors, Kramer said. The company also is seeking to fully tap its new advertising business and even its cloud computing operation, which is still growing above 40 percent a year, but the percentage gains are shrinking, she added.

“These are aging businesses, closer to maturity than the dynamic category-killing startup Jeff Bezos built decades ago,” Kramer said. “I’m focusing exclusively on revenue with Amazon because year-over-year earnings comparisons are still largely a whim of Bezos’ strategy, by the way. When he wants to boost revenue, he sacrifices margins. When he wants to boost the earnings trend, he forgoes new ventures that drive revenue.”

Kramer said she suspects Bezos will remain focused on earnings for the foreseeable future. She reasons that after his divorce, he’ll want to pivot into a place where Amazon pays dividends to provide current income and to relieve the pressure on him and his now ex-wife MacKenzie Bezos to sell twice as much stock a year to fund separate households.

“But in that scenario, Amazon isn’t ever going to be cheap here around $2,000,” Kramer said. “Earnings just won’t go that far. It’s growth or nothing.”

Amazon’s 25th Anniversary Highlights Rise of E-Commerce Rivals

Kramer said she’d rather recommend a growth stock that has room to post big percentage sales gains.

“Shopify is still tiny on Amazon’s scale, barely booking $1 billion in revenue last year,” Kramer said. “That’s what Amazon did way back in 1999 when it was a lowly $76 stock but, unlike Amazon in 1999, Shopify is already profitable and growing the top line faster than Amazon has been able to achieve in over a decade.”

Since 1999, Amazon has expanded its revenue a “stunning 300-fold” and given shareholders an end-to-end 2,500 percent return, Kramer said.

“I’m not holding out a lot of hope that Jeff Bezos can repeat that feat between now and 2039,” Kramer said. “Doing that would create a company nearly five times as big as the entire U.S. economy and a stock worth a lofty $50,000 per share. The odds of Shopify consolidating its retail platform into a $300 billion business are much higher.”

The latter scenario is where the real rewards of the future will be, Kramer said.

Paul Dykewicz and Hilary Kramer

Amazon’s 25th Anniversary Highlights Investors’ Need for Caution

“Amazon finally is seeing strong competition in key business segments,” said Bob Carlson, who leads the Retirement Watch investment advisory service. “Microsoft (NASDAQ:MSFT) and others are making steady inroads in the cloud services Amazon once dominated. Shopify is providing online storefronts to small businesses, providing many advantages that Amazon can’t.”

Amazon also is venturing beyond its traditional e-commerce niche and Whole Foods acquisition into health care, Carlson said.

“That’s very different from the lightly regulated, nascent businesses that fueled its growth to date,” Carlson said. “It’s difficult to count Amazon out, because it’s managed to innovate and change during its 25-year history. But the low-hanging fruit has been picked, and Amazon faces more challenges than in the past.”

Amazon’s 25th anniversary highlights how the company has achieved astounding growth and become the world’s e-commerce leader. If the U.S.-China trade talks ultimately result in an agreement that helps to open the Chinese market to Amazon, the company may find the huge new market it needs to drive growth. However, investors cannot count on any such progress in opening China’s market with the Asian country’s own e-commerce business Alibaba Group Holding Ltd. (NYSE:BABA) already reaching $50 billion in annual sales and its management certainly wanting to avoid competition with Amazon and its Prime service.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz.